The market has climbed by 4.1% over the past week, with every sector up and the Information Technology sector leading the way. In the last year, the market has climbed 25%, and earnings are expected to grow by 15% per annum over the next few years. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United States

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Sarepta Therapeutics |

24.22% |

44.94% |

★★★★★★ |

|

TG Therapeutics |

28.62% |

43.05% |

★★★★★★ |

|

Super Micro Computer |

20.84% |

35.00% |

★★★★★★ |

|

Invivyd |

42.85% |

71.50% |

★★★★★★ |

|

Ardelyx |

27.44% |

65.50% |

★★★★★★ |

|

Iris Energy |

70.63% |

125.09% |

★★★★★★ |

|

G1 Therapeutics |

24.26% |

51.62% |

★★★★★★ |

|

Amicus Therapeutics |

20.45% |

61.85% |

★★★★★★ |

|

Seagen |

22.57% |

71.80% |

★★★★★★ |

|

ImmunoGen |

26.00% |

45.85% |

★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adobe Inc., together with its subsidiaries, operates as a diversified software company worldwide with a market cap of $245.40 billion.

Operations: The company generates revenue primarily through three segments: Digital Media ($15.03 billion), Digital Experience ($5.11 billion), and Publishing and Advertising ($284 million). The majority of its income is derived from the Digital Media segment, which significantly outpaces the other two revenue streams.

Adobe’s recent innovations, such as the Adobe Journey Optimizer B2B Edition and AI enhancements in Acrobat, showcase its commitment to leveraging generative AI for business growth. The company’s R&D expenses have seen a significant increase, reaching $1.29 billion in 2024, reflecting a robust focus on innovation. With forecasted revenue growth of 10.2% per year and earnings expected to rise by 17.2% annually, Adobe is well-positioned within the tech sector despite not outpacing industry averages entirely. Additionally, Adobe repurchased $2.35 billion worth of shares this year, indicating strong financial health and confidence in its future prospects.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Netflix, Inc. is a leading provider of streaming entertainment services with a market cap of $289.29 billion.

Operations: The company generates revenue primarily from its streaming entertainment service, which accounts for $36.30 billion. Netflix’s cost structure and profitability metrics are not detailed here, but the focus on a single revenue stream highlights its core business model.

Netflix’s earnings are forecast to grow at 16% per year, outpacing the US market’s 15.1%. The company’s R&D expenses have increased significantly, reaching $2.35 billion in 2024, reflecting a strong commitment to innovation. Recent strategic moves include a $996 million fixed-income offering and repurchasing shares worth $1.60 billion this year, showcasing financial robustness and confidence in future prospects. Revenue is expected to grow at 10.1% annually, driven by high-profile productions like “The Royals.”

Simply Wall St Growth Rating: ★★★★☆☆

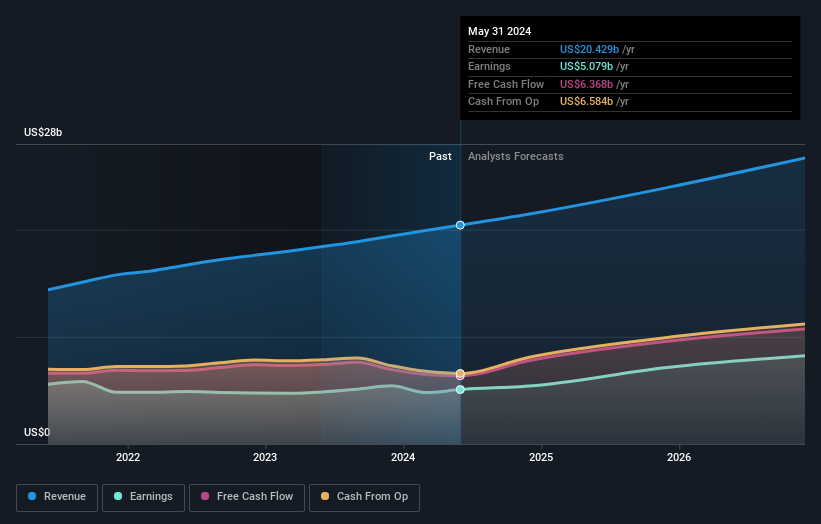

Overview: Oracle Corporation provides a wide range of products and services to support enterprise information technology environments globally, with a market cap of $378.85 billion.

Operations: Oracle generates revenue primarily from three segments: Hardware ($3.07 billion), Services ($5.43 billion), and Cloud and License ($44.46 billion). The company’s offerings cater to various aspects of enterprise IT environments on a global scale.

Oracle’s commitment to innovation is evident with R&D expenses reaching $7.2 billion in 2024, reflecting a robust strategy towards enhancing its cloud and AI capabilities. Revenue growth is projected at 9.5% annually, bolstered by strategic client partnerships like Alfred Health and Syniverse. Oracle’s earnings are forecasted to grow at 15.9% per year, outpacing the US market’s average of 15.1%. Recent enhancements in Oracle Fusion Cloud SCM and new user experience features demonstrate their focus on improving productivity and customer satisfaction across various industries.

Summing It All Up

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ADBE NasdaqGS:NFLX and NYSE:ORCL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]