Yahoo Finance tech reporter Allie Garfinkle joins the Live show to grade how tech sector leaders performed this past earnings season amid labor trends, A.I. adoption, and TikTok facing legislative headwinds.

Video Transcript

[AUDIO LOGO]

SEANA SMITH: Meta planning another round of layoffs this week, that’s according to reports from Bloomberg. Now, the move would add thousands more to the 11,000 workers that were cut from the social media giant last November. It is the latest in a tech industry that has certainly seen a massive contraction over the last several months.

Here to break down how the major players are navigating this and who’s coming out on top, Yahoo Finance’s tech reporter Allie Garfinkle has that for us. Hey, Allie.

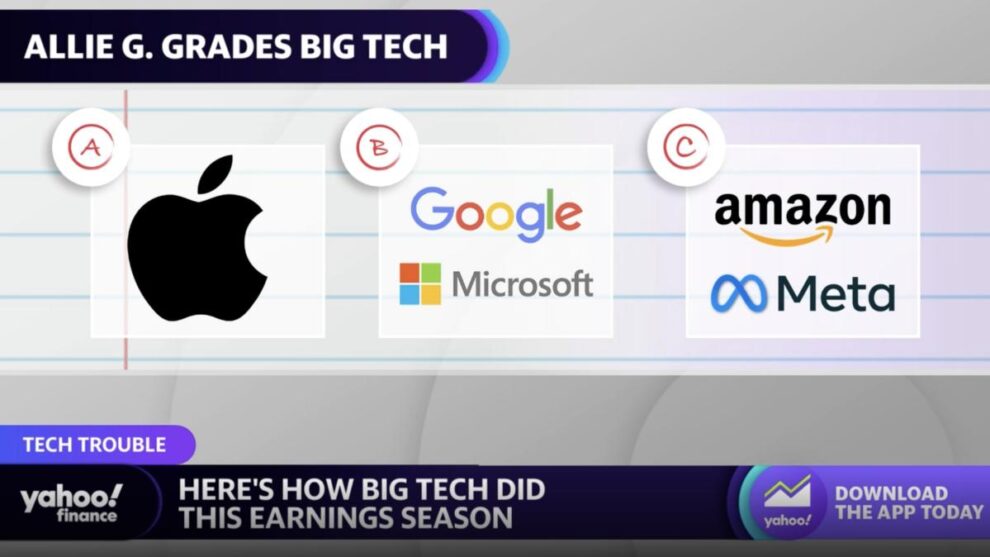

ALLIE GARFINKLE: Hi, Seana. So while I’m not a teacher, I want to break this down report card style because these companies are all in incredibly different positions. I want to start with Apple, who is at the top of the pack with an A. Now, Apple’s earnings were actually not standard Apple. We actually saw a rare miss out of them this last cycle.

However, there’s a key number that’s really important here for how things are looking, and it’s 2 billion devices. That is how big their install base is. I believe that’s more than 20% of the world’s population. So the iPhone install base is at an all-time high, and it’s sending the company’s services revenue to a record of $20.8 billion.

What does this– what does this all amount to? It says that analysts say that this bodes extremely well for Apple’s future as they increase how much individual users spend. So not a standard quarter for Apple, but there is a lot of good news there. So we’ll give them an A. Maybe we’ll fudge it to an A-minus.

Now, next is Microsoft. So Microsoft will get a B, slight top line B, slight bottom line miss, but they won the ChatGPT lottery. Now, while their cloud growth is slowing, it slowed to about 31%, just barely beating analysts’ expectations, that $10 billion investment in ChatGPT came at exactly the right moment. So we’re going to give them a B for foresight.

Next, Amazon. Revenue beat, earned EPS miss. Amazon has a lot to prove here. They’re really doubling down on cost cutting, and I’m giving them a C because of that cloud number. Amazon Web Services net sales came in missing. It was a $21.3 billion actual versus $21.76 billion expected.

Now, that doesn’t seem like a big miss. And to be fair, it is not. However, that has been a stalwart– AWS has been a stalwart of Apple– of Apple– of Amazon’s business for so long, that it is very important that they keep that growth up or come up with a new plan.

And last, we have Meta, which is going to get a C. Yes, they beat key revenue expectations, and there are growing losses on the Reality Labs operation, hence the C. However, they are investing in a $40 billion stock buyback plan, and they’re betting that this year of efficiency, this cost-cutting plan, is going to work. I’m withholding judgment for now, but they are certainly ready to bet on themselves.

Of course, now Meta being in the news because they’re reportedly set to do another round of layoffs that could affect thousands and could come as early as this week. That said, Meta is the only one we know is doing layoffs for the time being. However, given Jerome Powell’s testimony earlier today that rates will continue rising, the macroeconomic climate that has been so difficult for so many of these companies will continue to be difficult, so we’ll have to see how they navigate it moving forward.

DAVID BRIGGS: Very good. So, Allie, you mentioned the ChatGPT lottery being won by Microsoft. Let’s shift to the other one, which is the TikTok ban boost, if you will. Who stands to benefit the most? Because you’re young and I’m old and because you’re our tech reporter, is it YouTube Shorts, therefore Google? Is it Meta with their Reels? Or is it even Snap, who’s seen a really solid pop to start the year? Who’s the closest to emulating it in terms of social media style?

ALLIE GARFINKLE: That is a really good question, Dave, and I’ll be candid. I think there are a couple of different answers, and we would have to have that whole scenario play out to really know who the winner is. That said, I’m going to actually throw my hat in on Snap here. Every analyst I’ve ever spoken to who’s bullish on Snap has one key argument, and it’s that it is essential for teenagers. And if that’s like something TikTok has become known for, it’s certainly something Snap is known for, definitely on Wall Street and, to be fair, among the teenagers I’ve talked to.

So I’d say if there’s anyone who’s set to really benefit, I would put money on Snap. That said, YouTube Shorts is something Google has massively invested in. Meta has been preparing for the moment where, hopefully, TikTok is less of a competitor for a long time. I think we could see a massive shift in the competitive landscape. But I would say the biggest beneficiary could be Snap, and the market certainly seems to think so.

DAVID BRIGGS: That’s an interesting take because I sat at a Celtics game with a 15-year-old the other day, and he was on Snap the entire time, not TikTok.

ALLIE GARFINKLE: The kids love it.

DAVID BRIGGS: So, yeah–

ALLIE GARFINKLE: The kids love it.

DAVID BRIGGS: –they really do. I’m curious–

ALLIE GARFINKLE: They love it.

DAVID BRIGGS: –to see where they go from here. Allie Garfinkle, thanks so much. Good stuff.