It’s still the core business by far.

Over the past two decades, Amazon (AMZN -0.17%) has built up an unmatched e-commerce business. At the same time, it’s constantly experimenting with new business ideas. One of those ideas, Amazon Web Services (AWS), has grown to become the largest cloud computing company in the world by sales. Along with AWS, Amazon is developing several other concepts already successful or in the baking stage.

Given this diverse business model, is e-commerce still important to Amazon’s total business?

The key to Amazon’s growth

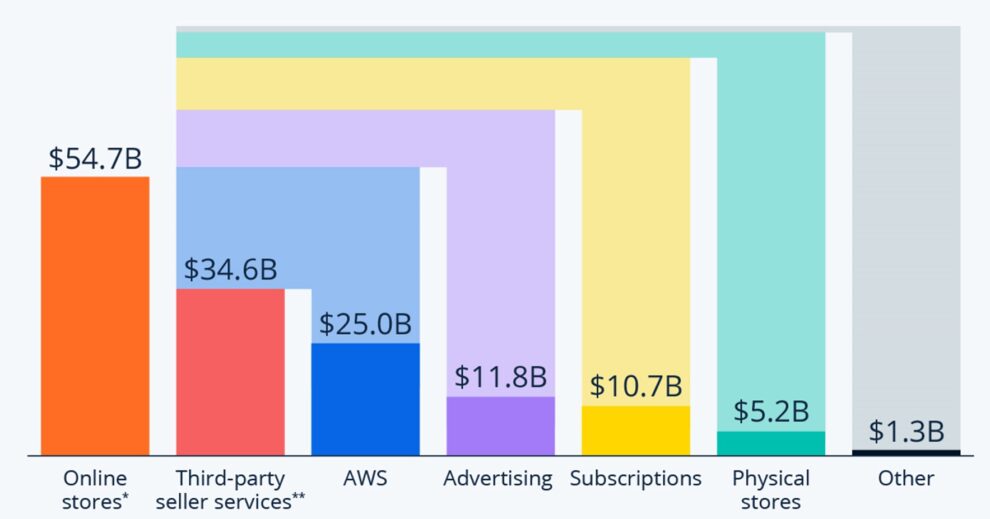

Amazon’s online stores plus third-party sales together make up its e-commerce segment. That segment accounted for $89.3 billion, or 62% of the breathtaking $143.3 billion in total sales in 2024’s first quarter. Ancillary e-commerce services like subscriptions (including Prime memberships, e-books, and digital music) could be considered part of e-commerce, raising the share of overall sales to 70%.

Amazon sales by segment in the 2024 first quarter. Image source: Statista.

Even though AWS and other businesses are becoming more important, e-commerce remains the main business by a wide margin. But it isn’t the main source of profits nor the fastest growing.

AWS was responsible for more than 60% of Amazon’s operating income in Q1 2024, even though it only accounted for 17% of total revenue. Advertising is Amazon’s fastest-growing segment. It only represented 8% of sales in Q1, but the segment grew 24% year over year.

That’s Amazon’s growth model. It brings money in through e-commerce and invests in making it more efficient and profitable. It moved from a national to a regional fulfillment network last year, and it’s getting more products to more customers faster and at lower costs. Shoppers who get their orders faster become more loyal and shop more, creating an upward, positive cycle.

Amazon uses the proceeds to fund the next growth segment. In the past, that was AWS. Now AWS is its profit-making machine, and advertising has moved into the growth seat. Amazon’s “other” category includes its newer and smaller businesses. Today it’s mostly healthcare, and this is the breeding area for its next big thing.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.