This stock could be the next dividend stalwart.

Earlier this year, Alphabet (GOOG -1.33%) (GOOGL -1.33%) joined fellow tech giants like Apple, Meta Platforms, and Microsoft in becoming a dividend stock. The move may have been a signal to calm investors’ fears that generative artificial intelligence threatens its most valuable property, Google Search, which has an estimated 90% market share for Internet searches.

So, let’s examine Alphabet’s dividend, its growth potential, and how it rewards shareholders in another way.

Here is Alphabet’s dividend information

In August, Alphabet announced its first-ever quarterly dividend of $0.20 per share, totaling $0.80 per share annually, with a dividend yield of 0.47%.

When a company issues a dividend, investors typically want to ensure it can support these payments without straining its cash reserves. Alphabet’s strong financial position — boasting $82.4 billion in net cash — indicates it can comfortably cover dividend payouts, which are projected to cost the company nearly $10 billion annually.

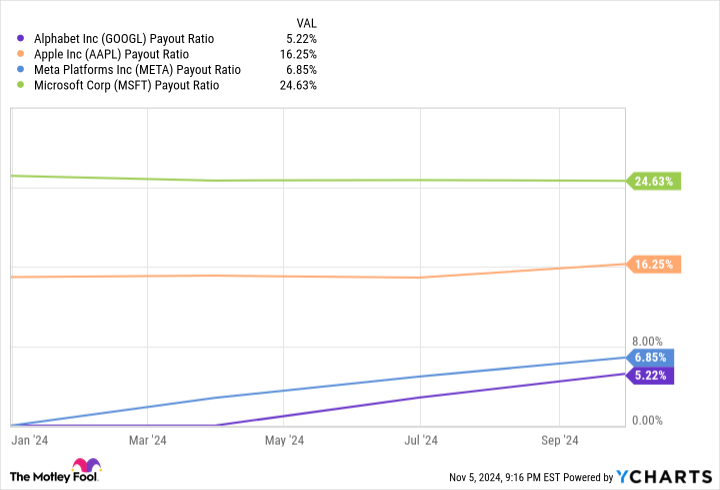

For any dividend-paying stock, a key metric to monitor is its payout ratio, which shows what portion of earnings is paid out as dividends. Alphabet’s payout ratio is a modest 5.2%, notably lower than other tech giants like Apple, Meta Platforms, and Microsoft.

Given Alphabet’s healthy balance sheet and low payout ratio, investors can reasonably anticipate potential increases in its dividend over time. However, management has not signaled how much of a dividend increase is due.

GOOGL Payout Ratio data by YCharts.

Here’s what else Alphabet is doing for shareholders

Alongside its steady dividend, Alphabet is aggressively repurchasing its own shares, which effectively returns capital by increasing each shareholder’s ownership stake. Over the past five years, management has reduced the company’s outstanding shares by 11% and recently committed to a $70 billion share repurchase program. In the most recent quarter alone, Alphabet invested $15.3 billion in buybacks, bringing the total to $46.7 billion in buybacks for the first three quarters of 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Collin Brantmeyer has positions in Alphabet, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.