(Bloomberg) —

Huawei Technologies Co. reported a healthy bump in revenue and earnings for 2019, in spite of a sustained effort from the U.S. to curtail its business on the global stage.

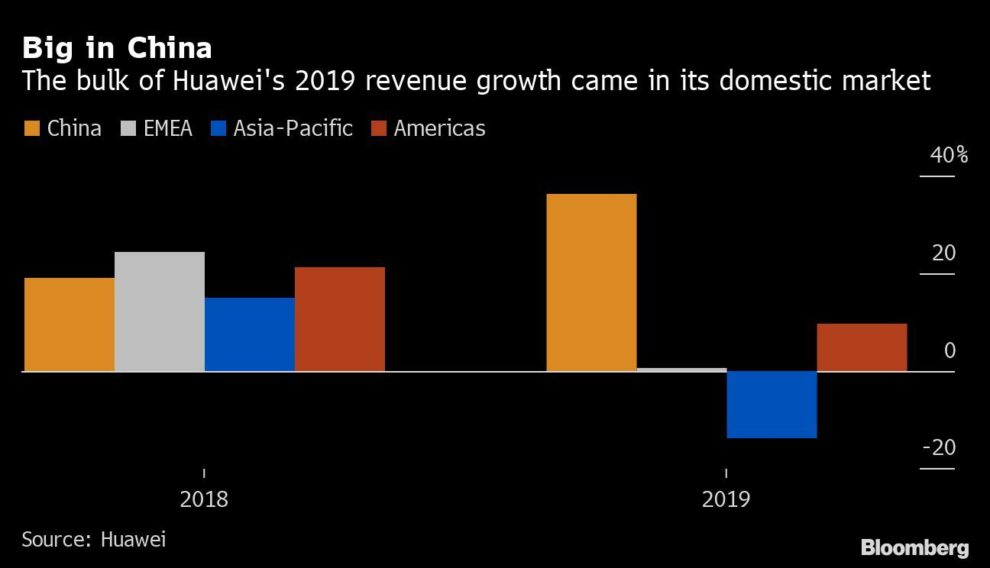

China’s biggest tech company grew profit 5.6% after revenue expanded by almost a fifth to 859 billion yuan ($123 billion) in 2019. The rate of growth was roughly the same as the previous year’s, indicating that the prolonged scrutiny and sanctions from Washington failed to reverse the company’s upward momentum. Still, Huawei’s business has been transformed by the tumultuous year, as its previously global growth narrowed sharply to a focus on the domestic market.

The Shenzhen-based company’s profit improved to 62.7 billion yuan, off sharply from 2018’s pace. The Trump administration’s campaign to get allies such as Japan and Australia to shut out Huawei gear and phones helped drive sales in the Asia-Pacific down 13.9%, though that was more than offset by a surge at home in China.

In the fourth quarter alone, which was most impacted by the U.S. prohibition on Huawei selling Android phones with Google’s mobile services, the company shipped roughly 55 million devices, calculated from the difference between its September shipments update and the year’s total. Of the 240 million shipments of Huawei and Honor phones, 6.9 million had fifth-generation wireless networking, an area where the company remains a tech leader.

Pelosi Joins Trump in Warning Europe of Huawei’s 5G Threat

Contrary to warnings from American lawmakers and diplomats, numerous European countries like the U.K. and Switzerland have opted to use Huawei’s technology in building out their 5G networks. The U.K. and Germany have both echoed U.S. concerns about how far Huawei can be trusted with key infrastructure of the future, but those have not extended to the severity of an outright ban.

Huawei faces tremendous pressure in overseas smartphone markets, where the U.S. ban on its use of Google Mobile Services severely undercuts the appeal of its devices. Without the Google Play Store and third-party app ecosystem, Huawei phones simply can’t compete with similarly capable alternatives from the likes of Samsung Electronics Co. and OnePlus. The company reported flat revenue in Europe, the Middle East and Africa alongside the drop in the Asia-Pacific. Those regions were two of its major growth engines in 2018, whereas now 59% of its sales are at home in China.

China’s ambitious 5G network construction projects, which started in the second half of last year, helped Huawei weather the international storm and sustain its core businesses.

Huawei Makes End-Run Around U.S. Ban by Using Its Own Chips

Founder Ren Zhengfei initially estimated that Huawei’s May 2019 blacklisting by the U.S. could wipe $30 billion off annual revenues and threaten his company’s very survival, though he has tempered that outlook more recently. Huawei mobilized a massive effort to develop in-house alternatives to American software and circuitry, while U.S. suppliers like Intel Corp. and Microsoft Corp. found ways to continue supplying Huawei vital components it needed to make its products. Huawei is also selling base stations free of American technology in another effort to bypass the U.S. ban.

With no relief from U.S. sanctions in sight and the coronavirus pandemic stifling business across all industries, the year ahead looks to be more challenging for Huawei. Chinese smartphone sales, which the company is now particularly sensitive to, are already hurting. And its global 5G installations, for which Huawei has secured more than 90 contracts worldwide, are hitting the brakes with many countries implementing lockdowns and the global economy at a standstill.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”57″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”58″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.