Shares of Hycroft Mining Holding Corp. rallied in very active trading Tuesday, as the gold and silver miner enjoyed its new meme-like status, with help from new investor AMC Entertainment Holdings Inc.

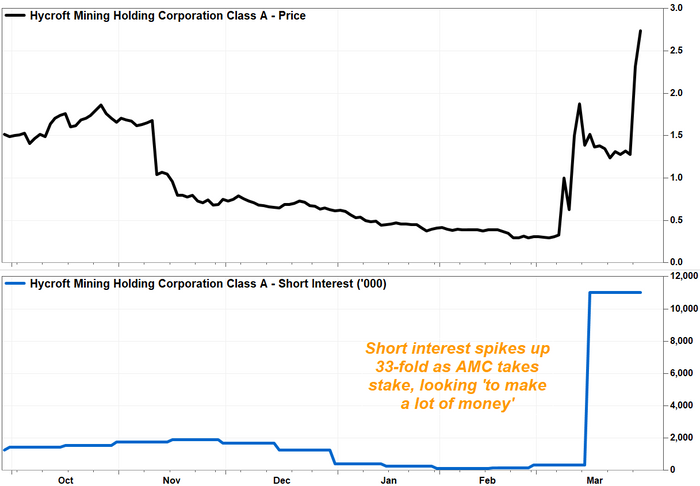

The stock HYMC, +11.20% shot up as much as 33.6% intraday before paring gains to be up 13.3% in midday trading, which puts it on track for an eight-month closing high. Trading volume swelled to 263.9 million shares, compared with the full-day average over the past 30 days of 71.7 million shares, and enough to make the stock the most actively traded on major U.S. exchanges.

That follows an 81.3% blast off on Monday on record volume of 385.3 million shares, after AMC Chief Executive Adam Aron appeared on CNBC to explain the decision to invest in the company.

The movie theater operator AMC, -1.86% and metals investor Eric Sprott had announced before the March 15 open that they were each making a $27.9 million investment in Hycroft, in a move that stunned many on Wall Street given that the Hycroft operated in a business that was well outside AMC’s core competency. Read more about AMC’s investment in Hycroft.

Aron explained that one of things AMC wanted to do with the $1.8 billion war chest it accumulated by cashing in on the meme-stock frenzy that had boosted its stock price was to find “transformational” acquisition opportunities. In Hycroft, Aron said, AMC found a company with great assets in the ground (gold and silver) that was suffering from a cash squeeze, just like AMC was before it was saved by its shareholders.

“We knew we were going to take some flak when we did it,” Aron said on CNBC’s “Squawk on the Street” segment. “There was one thing we were certain of — we were going to make a lot of money.”

That they did, as the value of the 46.82 million shares of Hycroft that AMC owned has increased by $62.7 million in two days. That’s more well more than double AMC’s initial investment of $27.9 million.

CNBC’s David Faber then asked Aron, if AMC’s new core competency was “to use the memesters that you have to help turn around the fortunes of a company because they’re willing to put money behind it,” and Aron answered:

“I think I have to say the answer to your question is, ‘yes.’”

Hycroft Mining followed by tweeting late Monday, that it certainly liked the attention it was getting, and Aron’s comments.

Prior to AMC’s investment, Hycroft was a so-called “penny stock,” as it had closed below the $1 mark every day since Nov. 15, 2021. It had closed at its record low of 29 cents as recently as March 3. The company has been warning since March 2019 that its auditors have expressed “substantial doubt” about its ability to continue as a going concern.

What may have helped make the penny stock of such a troubled company, on top of AMC’s investment, was that short interest, or bearish bets in the stock had spiked up 3,214% during the first half of March, to a record 11.02 million shares as of March 15 from 332,661 shares at the end of February. Read more about the mechanics of short selling.

That boosted short interest as a percent of the public float of shares to 23.5%, which compared with fellow meme stocks AMC of 20.3% and GameStop Corp. GME, -5.80% of 19.6%.

Hycroft’s stock has climbed 747.9% month to date, while fellow meme-stocks AMC has rallied 58.2% and GameStop has run up 43.9%. Meanwhile, the S&P 500 index SPX, +0.44% has gained 5.0% so far in March.