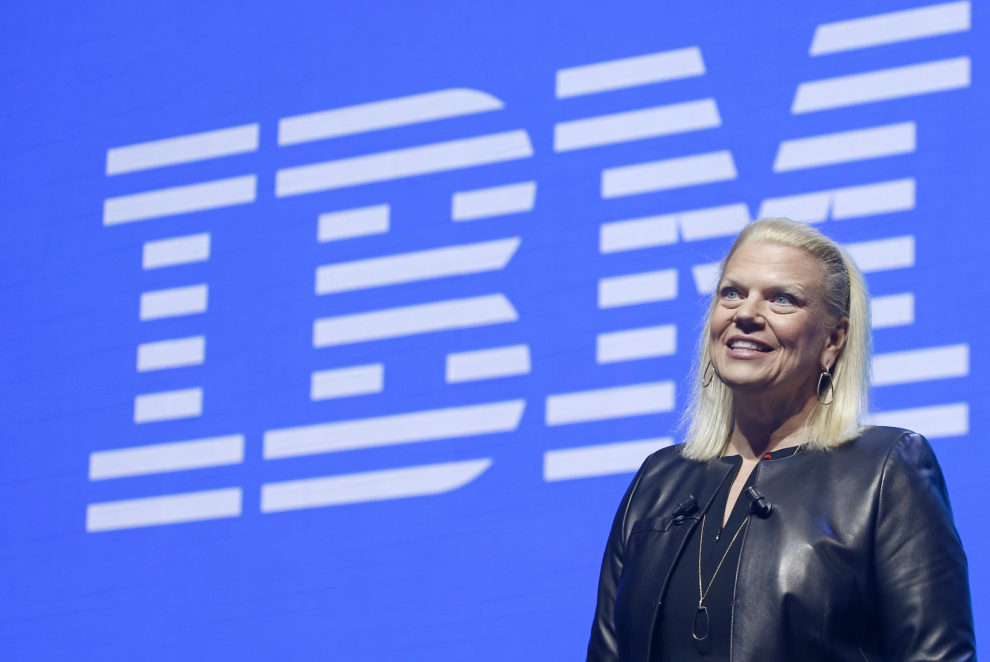

IBM President and CEO Virginia Rometty delivers a speech to participants during the 4th edition of the Viva Technology show at Parc des Expositions Porte de Versailles in Paris on May 16, 2019.

Chesnot | Getty Images

IBM stock moved as much as 5% higher on Tuesday after the company reported fourth-quarter results that beat analysts’ estimates and forecast earnings growth in 2020.

Here’s how the company did:

- Earnings: Excluding certain items, $4.71 per share, vs. $4.69 per share as expected by analysts, according to Refinitiv.

- Revenue: $21.77 billion, vs. $21.64 billion as expected by analysts, according to Refinitiv.

Revenue grew slightly on an annualized basis, IBM said in a statement, after it had fallen five quarters in a row, after the conclusion of an upgrade cycle for its z14 mainframe computer. The company has been shipping a new model, the z15, for more than one quarter now.

In terms of guidance, IBM said that for 2020 it expects $13.35 in earnings per share, excluding certain items. That’s above the $13.29 consensus from analysts surveyed by Refinitiv, and it implies a 4% increase from the prior year.

The Cloud and Cognitive Software segment, which encompasses transaction processing platforms, cognitive applications and cloud and data platforms like Red Hat, came up with $7.24 billion in revenue. That’s above the $7.12 billion consensus among analysts polled by FactSet. Revenue from Red Hat, a $34 billion acquisition that closed in July, was up 24% in the quarter. In the prior quarter, Red Hat revenue grew 19%.

IBM’s Global Technology Services segment produced $6.95 billion in revenue, less than the $6.99 billion FactSet consensus estimate. The segment contains infrastructure and cloud services, as well as technology support services.

The company’s generated $4.24 billion from its Global Business Services business, including application management, consulting and global process services. That’s just lower than the FactSet consensus estimate of $4.26 billion.

IBM’s Systems revenue was $3.04 billion, up 16% and exceeding the $2.84 billion FactSet consensus.

In the fourth quarter IBM announced a “financial services-ready public cloud” offering that is expected to use the company’s existing cloud infrastructure, and it appointed Thomas Buberl, CEO of insurance company AXA, to its board.

Morgan Stanley analysts led by Katy Huberty cut their rating on IBM to equal-weight from overweight on Friday. “Even assuming modest Red Hat synergies, we now see long-term revenue growth at IBM as less likely without a more meaningful shift in the portfolio,” the analysts wrote. “We see IT budget growth deteriorating in 2020 with risk of further cuts to core IBM profit pools including on-premise infrastructure, consulting, and outsourcing.”

IBM shares are up 3% since the beginning of 2020.

Executives will discuss the results with analysts on a conference call scheduled for 5 p.m. Eastern time.

This is breaking news. Please check back for updates.

WATCH: Trade should not be based on protectionism, IBM China CEO says