In its 38 years of trading, Microsoft is one of the most profitable investments in history.

When it comes to a stock’s long-term returns, few have outperformed Microsoft (MSFT -0.68%). Since the company launched its initial public offering (IPO) in 1986, its stock has risen more than 434,000%! Interestingly, that included the (former CEO) Steve Ballmer era, a 14-year period when the stock fell by over 30%.

From 1975 to 2000, under co-founder Bill Gates, Microsoft thrived due to its dominance in PC operating systems and productivity software. However, since Satya Nadella took over as CEO in 2014, Microsoft has driven most of its returns from its leadership in the cloud, a foundation for its presence in the artificial intelligence (AI) field. Not surprisingly, such successes have driven the stock’s massive returns.

The share growth of Microsoft

The company launched its shares at an IPO price of $21 per share on March 13, 1986. That original investment earned considerable returns and grew to 288 shares through nine stock splits. Microsoft initiated 2-for-1 stock splits in 1987 and 1990. It followed with two 3-for-2 stock splits in the early 1990s and five 2-for-1 splits between 1994 and 2003.

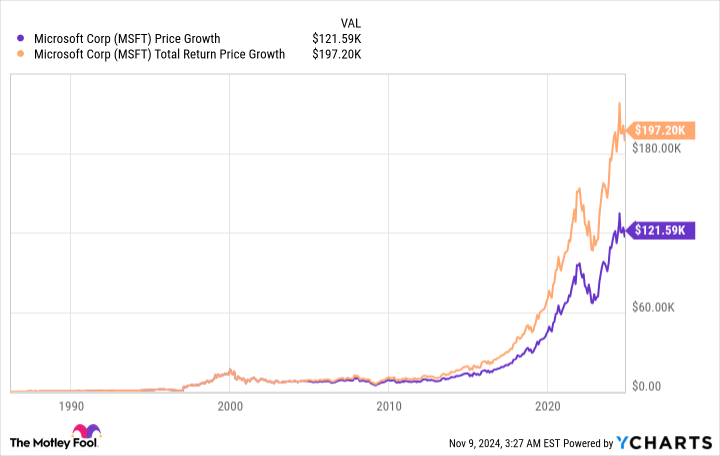

Assuming an investor bought one share on the first day of trading, the total investment value of the resulting 288 shares has risen to a value of over $121,500 as of the time of this writing! If one includes dividend income, the total return rises to over $197,000.

Making sense of Microsoft’s growth

Admittedly, no IPO investor probably expected one share of stock they own to become 288 shares. Moreover, nobody could have predicted Microsoft’s level of PC-driven success or rebirth in the cloud industry decades later.

Obviously, a new investor in Microsoft is unlikely to earn comparable returns given the state of the company today. Nonetheless, Microsoft teaches us that massive growth can occur when a company leads or dominates an emerging industry. Such lessons can guide investors in future purchases, helping them prosper even if they missed this specific opportunity.

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.