A risky investment in a video game chip designer has turned into anything but.

Long-term investors tend to think in terms of years or decades, rather than weeks or months because history shows that buying ownership in quality businesses to hold them forever is the best path to wealth generation.

Five years ago, Nvidia (NVDA -1.18%) was a very different company than it is today. Sure, management was seeking to capitalize on the same opportunities it is today, but the results then were very different. While some investors saw the stock as risky, others saw an opportunity.

In the second quarter of fiscal 2020 (ended July 28, 2019), Nvidia reported revenue that declined 17% year over year to $2.6 billion. The biggest drag on the results was falling demand for graphics cards used by gamers, as sales slumped to a 20-year low, thanks to macroeconomic headwinds. At the same time, Nvidia’s data center segment — which represented just 25% of revenue — tumbled 14% due to withering demand from cloud infrastructure providers.

Investors who purchased shares five years ago were already facing a decline of 17% heading into the dismal financial report. By the time 2019 ended, Nvidia stock was essentially flat, and some investors feared the worst. However, a lot can happen in five years, and investors who held the line have been richly rewarded.

Jumping ahead to 2024, Nvidia’s gaming segment is recovering from another slump brought on by macroeconomic headwinds. However, the data center segment has been the beneficiary of accelerating demand for generative artificial intelligence (AI), resulting in four consecutive quarters of triple-digit growth. Furthermore, Nvidia recently announced a 10-for-1 stock split, thanks to the stock’s robust gains.

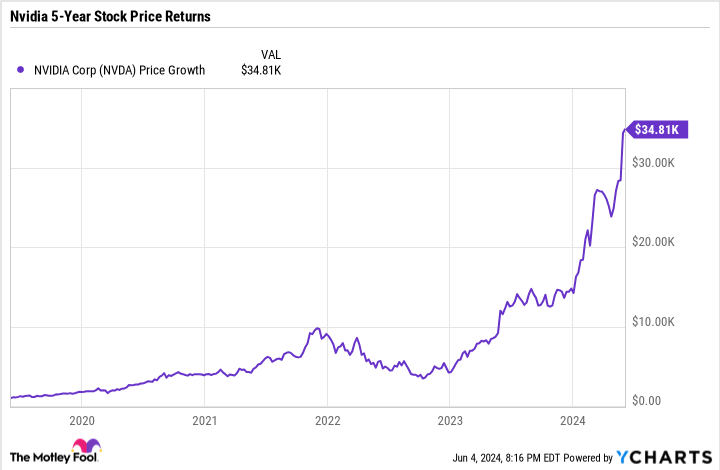

Data by YCharts.

If you’d invested $1,000 in Nvidia stock five years ago and held on through the headwinds, you’d have nearly $35,000 today. To be clear, no one could have foretold the soaring demand for AI. However, it helps to illustrate the value of ignoring the daily and monthly machinations of the market. Doing so can lead to big long-term gains for investors.