Tilray and the rest of the cannabis industry have not delivered on the hype.

The cannabis industry experienced significant regulatory progress toward the end of the last decade, arguably none more important than Canada’s legalization of recreational uses of the substance in 2018. This move attracted the attention of investors who rushed to purchase shares of notable cannabis companies, including Tilray Brands (TLRY -7.46%). The company quickly established itself as a leader in the industry, a position it has maintained since.

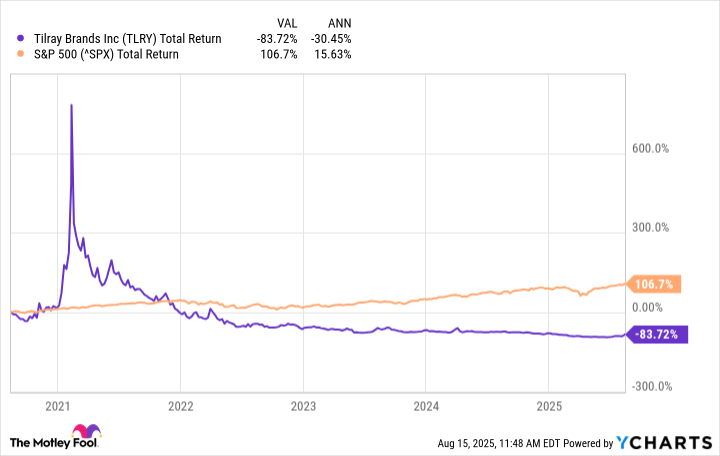

However, this hasn’t exactly translated to strong stock market performances. Read on to find out how you would have fared if you had put $1,000 in Tilray five years ago.

Image source: Getty Images.

You wouldn’t have much money left

Let’s go through some of the issues Tilray and its peers have faced over the past five years. First, seeing a massive opportunity to dominate a newly legalized market in Canada, cannabis companies started popping up like weeds. That created significant competition for market share. Second, even though recreational uses of marijuana were now legal in Canada, there were still stringent regulations regarding the production, sale, and distribution of the substance.

For instance, retailers needed to obtain the appropriate license to stay on the right side of the law, among other things. However, different provinces in Canada had slightly different rules. In the most populous province, Ontario, which accounts for almost 40% of the Canadian population, a complex lottery system was initially used to grant licenses to retailers.

As the former CEO of Canopy, Mark Zekulin, famously said in 2019, “The market opportunity today is simply not living up to expectations and … the inability of the Ontario government to license retail stores right off the bat has resulted in half of the expected market in Canada simply not existing.”

Third, illegal routes to obtain cannabis haven’t disappeared in Canada despite legalization. According to some reports, as of 2022, 33% of the marijuana market in Canada was from illicit channels. Tilray had to contend with oversupply and competition from illegal retailers, which helped push down prices, while also facing a smaller overall market due to complex licensing requirements. The company’s financial results have been inconsistent at best over the past five years, and the stock has been on a downward spiral.

So, if you had invested $1,000 in Tilray five years ago, you’d have about $163 left as of this writing. By comparison, $1,000 invested in the S&P 500 five years ago would be worth $2,067 today.

TLRY Total Return Level data by YCharts

Cut your losses while there is still time

Those who are bullish on the stock would point to several developments that could allow Tilray to bounce back. First, the company has diversified its operations across cannabis, wellness (including hemp-based food products), the purchase and resale of certain pharmaceuticals, and a craft brewing business.

Second, Tilray is still counting on legalization in the U.S. The recent news that President Donald Trump might consider rescheduling cannabis from a Schedule I to a Schedule III substance jolted the stock. However, none of these are compelling enough arguments to justify sticking with Tilray.

The company’s diversified operations have not enabled it to generate consistent financial results over the past few years. Tilray remains unprofitable. Moreover, even assuming Tilray gets something better than rescheduling and cannabis is legalized in the U.S. at the federal level, that’s no guarantee of success. It will depend on a range of factors that are beyond the company’s control.

For instance, what will the rules regarding the sale and distribution of cannabis-based products look like? Besides the Canadian experience, it’s worth noting that Germany legalized recreational cannabis for adults last year, which has not led to a market opportunity. Among other reasons, there are no cannabis stores and no one is allowed to sell the substance. Instead, people have to grow marijuana at home (limited amounts of it) or join a cannabis club to obtain it. No one can join more than one club, and clubs are restricted to 500 members.

Will legalization in the U.S. look like that? It’s hard to say, but without knowing the specifics — which no one does, since we aren’t even sure it will happen — there is no telling how Tilray will fare. Even if the rules create a significant market opportunity, larger companies with deeper pockets and extensive experience in dealing with highly regulated substances may enter and dominate the market. What’s the verdict? Tilray’s performance over the next five years will look much like the past five, in my view. The stock still isn’t worth investing in.