Banks and money-market funds using the Federal Reserve’s overnight reverse repo program parked a record $755.80 billion in cash with the central bank on Thursday, a day after policy makers tweaked the facility’s payout.

High demand for the facility since April underscores how awash financial markets have become with cash during the pandemic, as trillions worth of fiscal and monetary stimulus slosh through the economy.

With interest rates low globally, banks and money-market investors have been eager to avoid negative yields and have been parking cash in the Fed facility, which as of Thursday pays 0.05% instead of 0%.

It “isn’t a lot, but it’s better than zero,” said Jim Vogel, interest rate strategist at FHN Financial, about the Fed’s bump up in its reverse repo rate.

“When the Fed opened up this new avenue, $250 billion of fresh demand came in overnight,” Vogel said. The Fed’s decision Wednesday to boost the rate it pays on excess reserves and on the overnight reverse repo facility comes as part of a broader strategy to keep a grip on short-term rates, while helping to stoke the U.S. economic recovery.

Fed Chair Jerome Powell on Wednesday also reiterated that it still was too early for the central bank to raise short-term rates above its current 0%-0.25% target range or trim its near $120 billion-a-month bond buying program.

But in a surprise for markets, Powell said the Fed now has penciled in two potential interest rate increases in 2023, while stressing that central bank officials were attuned to the risk of inflation rising faster than expected.

The Fed’s update on its inflation outlook and forecast for raising interest rates, sparked an “oops” reaction across markets, Vogel said, and volatility jumped in bonds TMUBMUSD10Y, 1.509%, currencies DXY, +0.86%, commodities CL00, -1.51% and even the Dow Jones Industrial Average DJIA, -0.62%.

Even so, the scramble for safe places to park cash isn’t only about Fed policy, which is why Vogel and other strategists think demand for the facility could easily top $1 trillion this quarter.

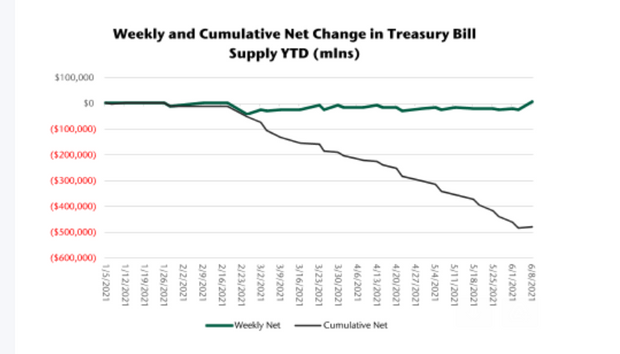

Increasing use of the central bank’s reverse repo facility also has coincided with a $478.1 billion “freefall” in net Treasury bill supply since the start of the year, with the pace of maturing bills exceeding new bill issuance, according to Jefferies economists Thomas Simons and Aneta Markowska.

Sinking T-bill supply

Jefferies

“Worse still, the potential for supply to increase materially over the next year or so is quite low,” the team wrote in a recent client note.

Recent guidance from the U.S. Treasury Department shows it intends to run cash balances down to $450 billion by July 31 from $776.7 billion as of late May, to “satisfy the requirements of the law that suspended the debt ceiling back in 2019,” they wrote. “So Treasury’s borrowing needs are going to be very light in the interim.”

“The question is not how high it goes,” Vogel said of reverse repo demand. “But where does it land after the debt ceiling agreement is reached.”

Read: U.S. Treasury officials urge Congress to raise debt-limit