The Federal Reserve building in Washington in 2017.

AFP/Getty Images

The Federal Reserve this summer vowed not to run “like an elephant” through the U.S. corporate bond market, roughly a month after making its historic leap into buying corporate debt for the first time ever.

The Fed’s latest holdings, pegged at $3.6 billion worth of corporate debt at the end of July, indicate that it has been been tiptoeing through the booming corner of finance instead, using only a smidge of its total $750 billion corporate debt-buying capacity and recently tapering its purchases down to a nub.

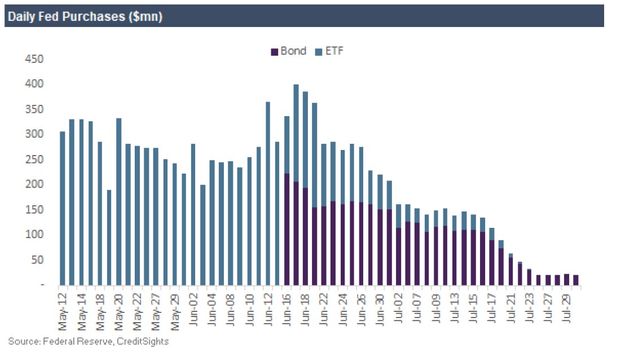

CreditSights analysts combed through the Fed’s latest portfolio data for trends and found the central bank’s daily puchases dwindled to about $21 million on average through July 30, down from about $180 million of daily buying when the program kicked off in May.

The below chart traces the Fed’s buying volume over the past three months, including how it started out buying only exchange-traded funds (ETFs) of corporate debt, but shifted exclusively to individual corporate bonds in recent weeks.

“As expected, Fed purchases of both corporate bond ETFs and direct purchases of bonds slowed in July as the market has generally functioned well,” wrote the CreditSights team led by Jeff Khasin.

“As of the end of July, daily ETF purchases were halted completely, with bond-buying comprising 100% of Fed purchases.”

For context, Google GOOG, +0.10% parent Alphabet GOOGL, -0.10% GOOG, +0.10% issued $10 billion of debt last week in the investment-grade bond market, at its lowest cost of financing on record, both Reuters and Bloomberg reported.

The Fed’s top corporate debt holdings, though July, include AT&T Inc. T, +0.60%, Comcast Corp. CMCSA, +0.49%, Toyota Motor Corp. TM, +0.46%, Ford Motor Co. F, +3.35% and Apple Inc. AAPL, +1.45%, with the central bank holding $60 million to $50 million of debt by each company, according to CreditSights.

Of note, about 54% of the Fed’s corporate debt portfolio was rated on the cusp of “junk bond” territory in the bulging BBB-ratings bracket, a category that had been a source of alarm for regulators, at least until the Fed stepped in as a backstop during the pandemic to keep credit flowing.

Investment-grade companies issued a record $1.3 trillion of U.S.-denominated debt this year through last week, nearly an 80% increase from last year’s pace, according to BofA Global Research.

Much of the corporate borrowing has been viewed as a way for companies to build up a cash buffers during the COVID-19-induced U.S. economic crisis, which included gross domestic product plunging a record 32.9% in second quarter.

But with corporate earnings coming in surprisingly better for the second quarter, BofA’s credit team now thinks cash raised in the first half by investment-grade companies is enough to cover “perhaps four times baseline COVID-19 crisis related needs for 2H20.”

Researchers at the New York Fed on Monday said they remain concerned about the cash-flow shock of the pandemic at public U.S. companies in relation to their leverage levels, but looked at data only through April.