Amazon’s AMZN, +0.12% Jeff Bezos, the world’s richest man — $143 billion. Berkshire Hathaway’s BRK.A, +0.02% Warren Buffett, the Oracle of Omaha — $67 billion. Microsoft MSFT, -1.29% co-founder Bill Gates, philanthropist — $104 billion.

Obviously, net worth tends to be the measurement of choice when comparing wealth. And in this age of extreme wealth inequality, the median net worth for U.S. households — straight up assets minus liabilities — comes in at a $97,290, according to the Survey of Consumer Finances.

But Ritholtz Wealth Management data scientist Nick Maggiulli explained in an Of Dollars and Data blog post on Thursday that there are “some serious limitations” in using it as a benchmark for your financial progress. Instead, he said the focus should be elsewhere.

“Liquid net worth is a far better measure of your ability to react to financial shocks and financial opportunities than net worth,” he wrote. “Why? Because liquid net worth is based on what you have available right now. It’s not what you would have if you took drastic action and liquidated everything, but what you could reasonably expect to have in a short period of time.”

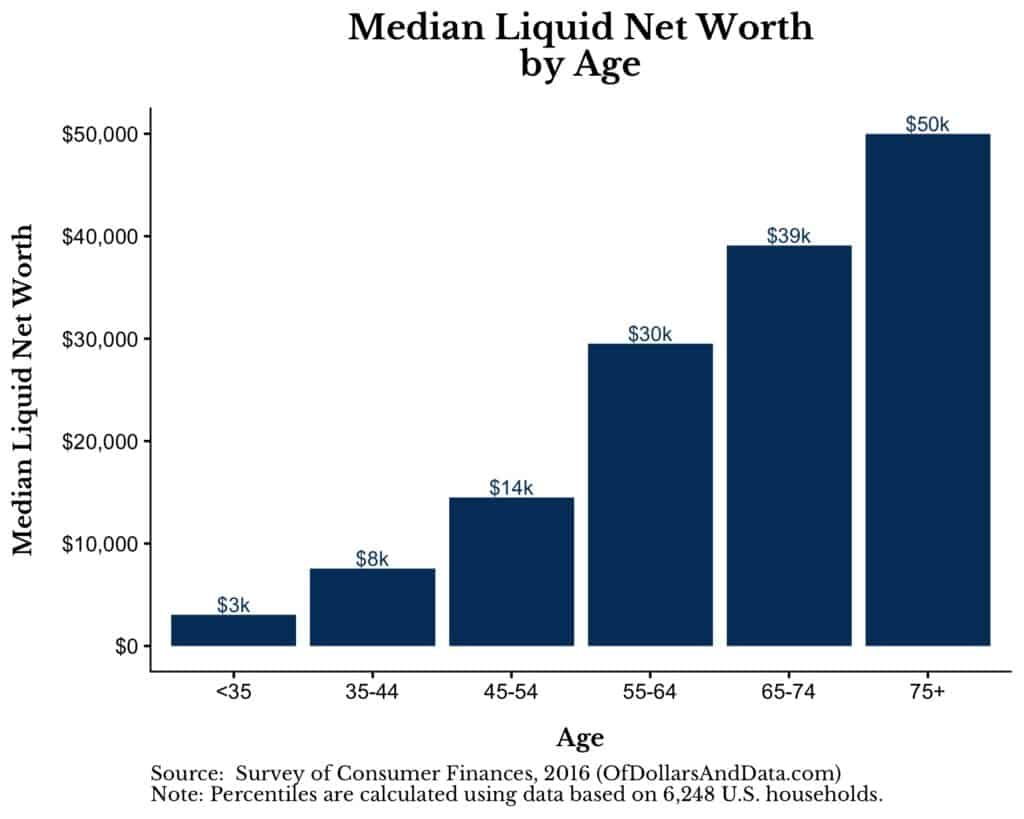

Here’s what liquid net worth looks like across the country:

The idea of having liquid assets on hand takes on even greater import at times like these, when millions of Americans are facing job losses and all sorts of financial uncertainty. And the median figure of $12,050 doesn’t bode well for families desperately scraping for cash.

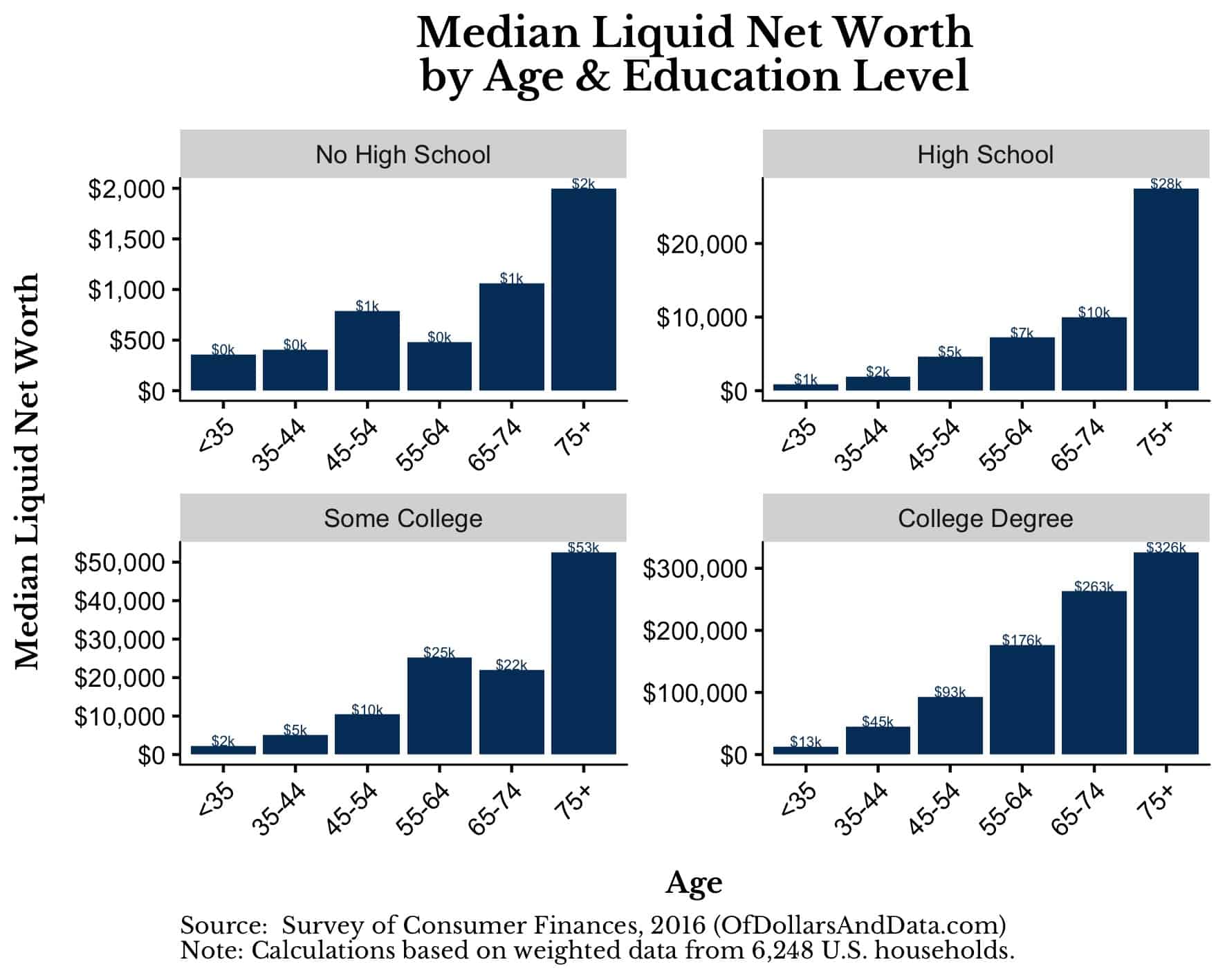

Stay in school, kids? Maggiulli used this telling chart, which takes into account education and age, to give more depth to the data. As you can see, the differences are quite vast:

Maggiulli said he’s not surprised by the fact that college-educated households amassed the most liquid net worth. “What does surprise me is how little liquid net worth households without a high school diploma have,” he said. “Even with increased age, the median household without a high school education barely has any wiggle room in case of emergencies.”

He pointed to the troubling statistic that most Americans couldn’t manage to cover a $1,000 emergency bill, which seems about right when looking at that chart.

Add Comment