Don’t call it a “melt-up,” but the June stock-market rebound could soon begin to foster the same sort of “fear of missing out” that prevailed in April if speculators come off the sidelines, says one analyst.

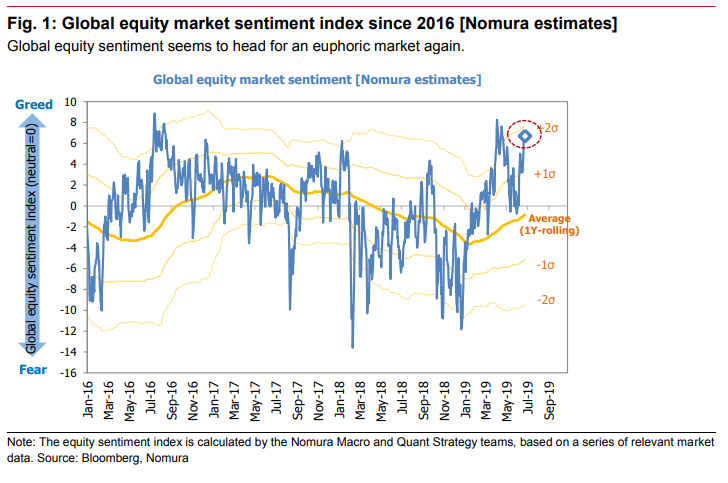

“Although markets have been calm, it appears that the appetite for risk is alive and well,” said Masanari Takada, quantitative analyst at Nomura, in a Tuesday note. “The key issue now is whether sentiment rises to more than two standard deviations above its rolling average (into the euphoric zone) this week, as it did in April.” (See chart below).

Nomura

Nomura

While Nomura’s proprietary gauge of the global mood around equities is on the upswing, the narrative around market sentiment has generally been downbeat.

For example, the share of individual investors who expect U.S. stocks to rise over the next six months rose last week but remains at just 29.5%, according to the weekly survey by the American Association of Individual Investors. Bearish sentiment, expectations that stocks will fall over the next six months, fell 2.1 percentage points to 32.1% — above its historical average of 30.5% for the sixth consecutive week.

See: We’re already in recession, here’s what to do, says economist who called last bubble

At the moment, most categories of trader appear to be awaiting the outcome of a meeting between President Donald Trump and Chinese leader Xi Jinping that’s expected to take place this weekend on the sidelines of the Group of 20 summit in Osaka, Japan, Takada said.

Read: How the Trump-Xi trade meeting could set the stock-market tone for the summer

Major U.S. stock indexes lost ground Tuesday, with the S&P 500 SPX, -0.95% ending with a loss of around 0.9% and the Dow Jones Industrial Average DJIA, -0.67% declining nearly 180 points, or 0.7%. For the month, however, the S&P 500 has rallied 6% and hit an all-time high last week. The Dow is up 7% in June and remains a little more than 1% shy of its all-time closing high set in October.

Also see: Trump touts best June for the stock market in years — but charts show 5 areas flashing warnings

That comes after a May selloff that many investors tied to an unexpected escalation in the U.S.-China trade fight. Stocks in June have bounced back on growing expectations the Federal Reserve will move as early as next month to begin cutting interest rates, though analysts said much may also depend on the outcome of the Trump-Xi meeting amid hopes the two sides will agree to a renewed cease-fire that would at least temporarily avert further tariff increases, including the imposition of levies on another $300 billion of Chinese imports.

Mark Hulbert: Chances are the U.S. stock market will be higher by year-end, but there’s a catch

If sentiment between now and the start of the summit on June 28 swiftly improves along a trajectory similar to the pattern seen when it hit Nomura’s definition of “euphoric” back in April, it’s likely that momentum would “carry through into a ‘melt-up’ risk rally,” Takada said.

A melt-up is often defined as a sharp and unexpected rise in the price of an asset, driven largely by a stampede of investors who are more concerned about missing out on a big rally than by improving market fundamentals. Melt-ups are often followed by significant market setbacks.

Takada said commodity trading advisors, who use trend-following algorithms to find trading opportunities across a range of markets, have started to accumulate long positions — bets that prices will rise —on U.S. and Chinese equity futures “in earnest,” Takada said, getting ahead of other market players. It’s still too soon to declare that other speculators have missed the boat on the rally, he said, but reiterated that a sustained global equity rally “could soon foster the sort of fear of missing out (FOMO) that motivated investors back in April.”