Stocks, bonds and everything in between have been hard-hit this year as fears about high inflation have morphed into concerns about a potential U.S. recession.

But what does the sharp rout in stocks mean in dollar amounts? The S&P 500 index SPX, -3.88% officially closed in a bear market on Monday, marking a skid of at least 20% from its most Jan. 3, 2020 peak.

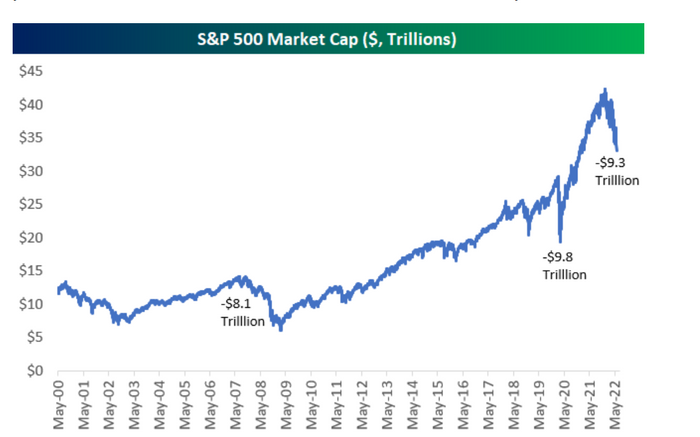

In dollars, that represents a $9.3 trillion drop in the S&P 500’s market capitalization to around $33 trillion (see chart), according to Bespoke Investment Group.

S&P 500 sheds $9.3 trillion, enters a bear market

Bespoke Investment Group

That’s less than the $9.8 trillion it shed in the aftermath of widespread COVID-19 lockdowns in 2020, but already was $1.2 trillion more than was lost during the Global Financial Crisis from 2007 to early 2009, according to Bespoke.

“Add in the 20%+ drop in Treasuries this year, and the wealth destruction we’ve seen has been absolutely massive,” the Bespoke team wrote in a Monday client note.

The 10-year Treasury rate TMUBMUSD10Y, 3.370% soared 21.5 basis points on Monday to 3.371%, an 11-year high, according to Dow Jones Market Data.

The selloff in markets intensified in recent days, including after May’s consumer-price index on Friday showed the cost of living — at a 40-year high — hasn’t been receding very fast, even as the Federal Reserve looks to quickly raise rates this summer and shrink its near $9 trillion balance sheet.

See: Stocks sink as inflation fears trigger shock waves: What investors need to know about stagflation

What’s more, the S&P 500’s top companies by market valuation shed more than $1 trillion in market cap in the past four days, when looking at companies that include Apple Inc. AAPL, -3.83%, Microsoft Corp. MSFT, -4.24%, Alphabet Inc. GOOG, -4.08%, Amazon.com Inc. AMZN, -5.45% and Tesla Inc. TSLA, -7.10%.

In other markets, bitcoin BTCUSD, -15.03% tumbled about 20% Monday, while crypto lending platform Celsius said it was pausing all withdrawals and transfers due to “extreme market conditions.”

Read: BlackRock isn’t buying the dip as volatility climbs in sinking stock market