When hedge-fund billionaire Ray Dalio asked a crowded ballroom at a Milken Institute conference earlier this year whether they agreed that the current economic system needs to be renovated, most hands were raised.

“If we don’t agree, we’ll have some form of revolution; that could be to abandon capitalism or to go to another extreme,” said the co-founder of Bridgewater Associates. There may not be a revolution as of yet, but the chasm between the rich and the poor continues to grow.

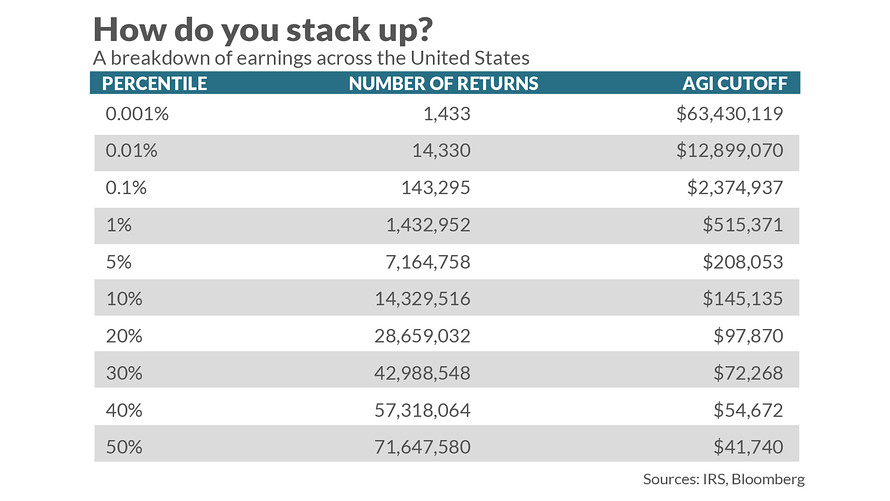

According to the most recent data from the Internal Revenue Service cited by Bloomberg, it took earnings of $515,371 in 2017 to crack into the top 1%. That is a rise of 7.2% from the year prior, even after adjusting for inflation. Since 2011, when the Occupy Wall Street protests were raging, the threshold to break out of the 99% has risen by an inflation-adjusted 33%.

This chart breaks down the various percentiles:

As you can see, to push into the rarefied air of the 0.1% of U.S. earners, you’d need to have been paid $2.4 million in 2017, a jump of 38% from the year before. To hit the even-loftier air of 0.001%, reserved for only the gilded 1,433 taxpayers, you would have to have earned $63.4 million, up 51% from the 2016.

Numbers like these explain why income inequality and the wealth tax are such hot-button topics ahead of the 2020 election. Presidential-hopeful Elizabeth Warren, with her proposal for a wealth tax of 2% on all assets above $50 million, is at the forefront of the battle.

“Look I don’t have a beef with billionaires,” the Massachusetts senator said during Tuesday’s Democratic debate. “My problem is you made a fortune in America — you had a great idea, you got out there and worked for it – good for you. But, you built it in part using workers all of us helped educate. You built it getting your goods to market on roads and bridges all of us helped pay for. You built it, at least in part, protected by police and firefighters all of us help pay the salaries for.”

Talk of wealth and poverty divides expanding in America come as the Dow Jones Industrial Average DJIA, -0.95%, the S&P 500 SPX, -0.39% and the Nasdaq Composite indexes COMP, -0.83% have been clambering toward all-time highs, even as global economies are seen weakening.