Let’s just say sympathy is in short supply.

In a clear example of extreme American consumerism, one profligate man, using the online handle Slavikfill, claimed to be seeking tips on how to stretch his household income of $500,000 a year when he posted his monthly budget on Reddit.

“My wife and I are in our early thirties. We live in Kansas. I’m a CTO of well known startup, and she’s a model,” he wrote. “As you can see, each year we have a large deficit. Currently, we add that to our mortgage each year. We’ve been doing this for 2 years. I’d appreciate any advice on how to reign our situation in.”

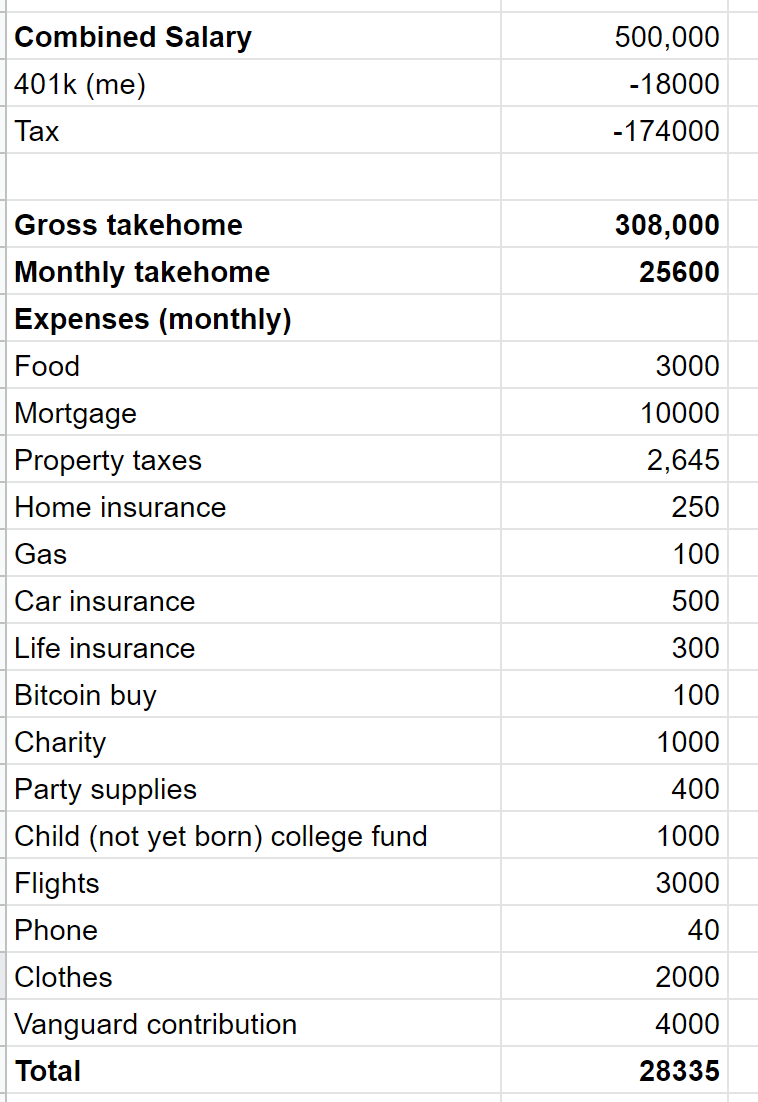

Here’s what his self-reported financial mess looks like:

First of all, the median household income in Kansas comes in at $56,422 — add to that the fact that the median home value in the state, according to Zillow, is down around $140,000 (though prices would be expected to run higher in more urbanized areas such as the Kansas City suburbs or Lawrence). So, as you might expect, not a lot of tears being shed there.

The gist of the feedback — besides questions over whether it could possibly be true — is that nearly all the expenses could be slashed dramatically. Specifically, critics called out the $3,000 spent on food and the $2,000 on clothes.

“You just don’t want to compromise your current lifestyle,” writes HollowestOfHalos in the most upvoted comment in the thread.

LordOverThis drilled down into the numbers: “$36,000 a year on food; $30,000 on property taxes; $120,000 on a mortgage; $24,000 on clothing,” he wrote. “I mean … it’s kind of obvious. Everything you do is to be ostentatious. Your food budget alone is a livable salary in the Midwest.”

Yes, $100 a day spent on food seems way over the top, even if the couple lived in New York City — but in Kansas?

As for clothing costs, Slavikfill blames his wife’s job as an “influencer.”

But, as with many homeowners across the country these days, it’s the mortgage that does the most damage. In this case, Slavikfill spends $10,000 every month, and that doesn’t even include the taxes. His explanation: He bought the house for about $1.3 million on a 10-year term, hence the high monthlies.

“Refi into a 30-year like a normal person. That mortgage is just absurd,” says Bbekks. “Why would you enter that mortgage and then complain about not pocketing enough cash?! You are literally doing this to yourself.” Outlawsix put it even more bluntly: “A 10-year term is stupid if you can’t manage your money.”

Basically, a 10-year mortgage offers lower lifetime interest but higher monthly payments that build equity much faster than a 30-year. If Slavikfill switched to a 30-year, he’d take far longer to pay off his home but would cut his monthlies.

Then there’s an item that stands out as perhaps completely unnecessary even for a couple of across-the-board overspenders: $100 a month on bitcoin BTCUSD, +1.43% — but, considering the crypto’s performance lately, he’s probably not in a hurry to remove that budget line.

One parting tip from RicoRodimusPrime: “Honestly the only and best advice I can give you is don’t care what others think of you,” he wrote. “You could cut your lifestyle down to [$10,000] a month and still live better than 95% of the population. … When you stop caring about being flashy or having the newest car, latest style etc you will find you can control your money better.”

Have advice for Slavikfill? Leave it in the comments.