Santa still on his way?

Odd Andersen/Agence France-Presse/Getty Images

Don’t worry about Santa Claus. Despite fears to the contrary, the stock market’s historic November rally doesn’t signal a lackluster December, according to analysts at Jefferies.

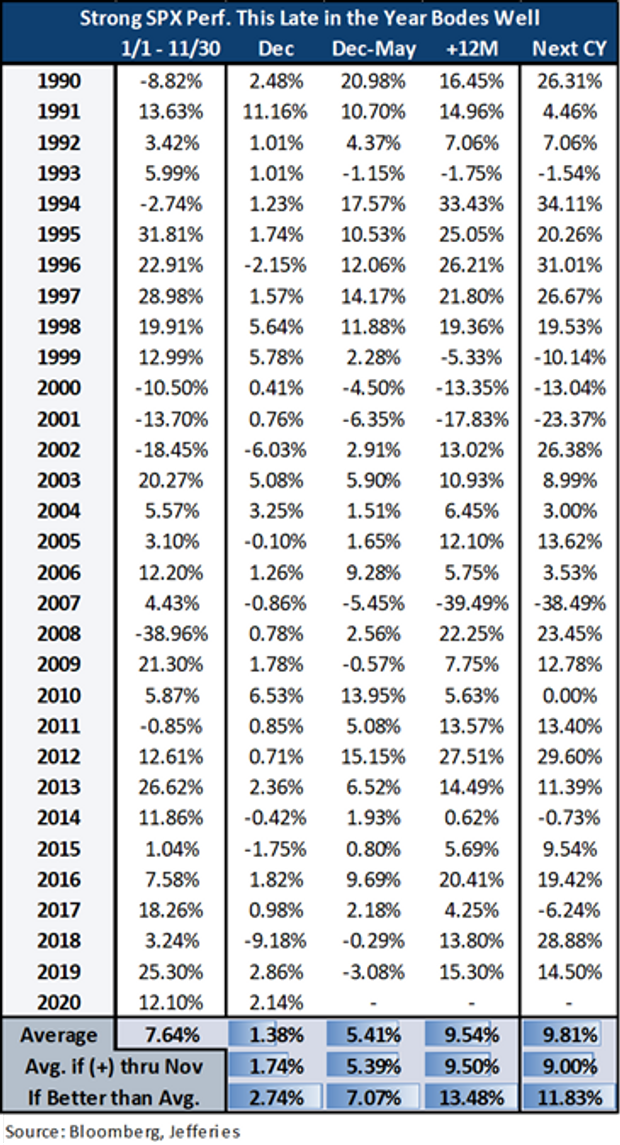

“While markets had an incredibly strong November, our analysis of the past 30 years shows that when you have had a better-than-typical year, you tend to see a better-than-typical December, and an even better [next 12 months] as well,” they said, in a Saturday note, illustrating the point in the table below:

They noted that when the January-to-November performance of the S&P 500 SPX, -0.41% performs better than the average 7.6% gain December averages a return of 2.74%, compared with an average rise of 1.38% for all years and 1.74% in years when the index is positive through November.

The S&P 500 rallied 10.5% in November, its biggest monthly gain since April and its strongest November since 1928. That put the large-cap benchmark up 12.1% year-to-date through the end of November. The Dow Jones Industrial Average DJIA, -0.69% soared 11.8% last month — its strongest monthly gain since January 1987 and its strongest November since 1928.

That doesn’t mean a note of caution isn’t in order, however. Sam Stovall, chief investment strategist at CFRA, noted that there have been 11 times since WWII that any month of the year rose by 10% or more. While the following month was higher by an average of 0.70%, in line with the average return for all months since 1945, it advanced in price just 45% of the time versus the traditional 60% frequency for all months, he observed, in a note last week.

That suggests, but doesn’t guarantee, a subdued December for equites, Stovall warned last week.

The Jefferies analysts were upbeat. “We expect that an improving cycle will continue to blaze the path forward, and despite the small downtick in ISM PMI in November, see continued strength in orders and still depleted inventories providing plenty of runway,” they wrote, referring to last week’s weaker-than-expected reading for the Institute for Supply Management’s index.

Stocks were putting in a mixed performance Monday as investors weighed a continued surge in COVID-19 cases versus prospects for a vaccine rollout and additional aid spending by the government. They have built on November gains so far this month, with the S&P 500, Dow, Nasdaq Composite COMP, +0.28% and the small-cap Russell 2000 RUT, -0.07% all logging record closes on Thursday and Friday.