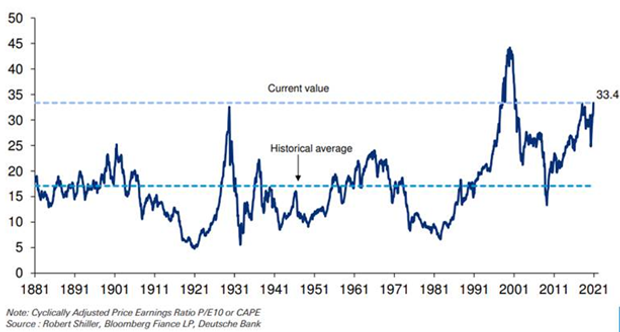

How richly priced are equity markets in the era of the pandemic? According to Deutsche Bank strategist Jim Reid, the recent run-up in U.S. stocks has taken markets “above the level seen on the eve of the 1929 stock market crash and the recent peak in January 2018,” citing the CAPE ratio of price-to-earnings created in part by Robert Shiller.

The cyclically adjusted price-to-earnings (CAPE) ratio captures the ratio of the real (inflation-adjusted) share price to the 10-year average of real earnings per share, and is used by some as one measure, outside of traditional P/Es, to assess how pricey stocks have become.

Reid cautions that the CAPE ratio isn’t a perfect tool if considered as a market-timing tool because values can persists at elevated heights for longer than one can predict.

“The CAPE ratio is not perfect for many reasons and note we’ve been above the long-term average of 17 since early 1991 outside of 10 months during the [2008 financial crisis],” he wrote in a research note on Wednesday.

The Deutsche Bank strategist says that one reason for pricey stocks is the extremely low levels of government bond yields.

“The most used justification for current structural higher CAPE than long-term averages is the four decade decline in yields to what are now close to all time multi-century lows,” he added.

It is a point also made by Shiller himself.

Shiller’s thoughts in PROJECT SYNDICATE

WE CANNOT KNOW HOW THE COVID-19 PANDEMIC WILL END, AND IT MAY WELL END SOON WITH THE ADVENT OF EFFECTIVE VACCINES. BUT A KEY TAKEAWAY…IS THAT IT CONFIRMS THE RELATIVE ATTRACTIVENESS OF EQUITIES, PARTICULARLY GIVEN A POTENTIALLY PROTRACTED PERIOD OF LOW INTEREST RATES.

Shiller added that it may justify the FOMO (Fear Of Missing Out) narrative and go some way toward explaining the strong investor preference for equities since March.

On Wednesday, markets were pulling back from record gains put in the day before, with the S&P 500 index SPX, -0.06% was off 0.3% lower, while the Nasdaq Composite Index COMP, -0.29% was off 0.8% and the Dow Jones Industrial Average DJIA, -0.09% was trading 0.4% lower.