The radio disc jockeys got it right — this month would more accurately be known as Rocktober, particularly for stock-market investors.

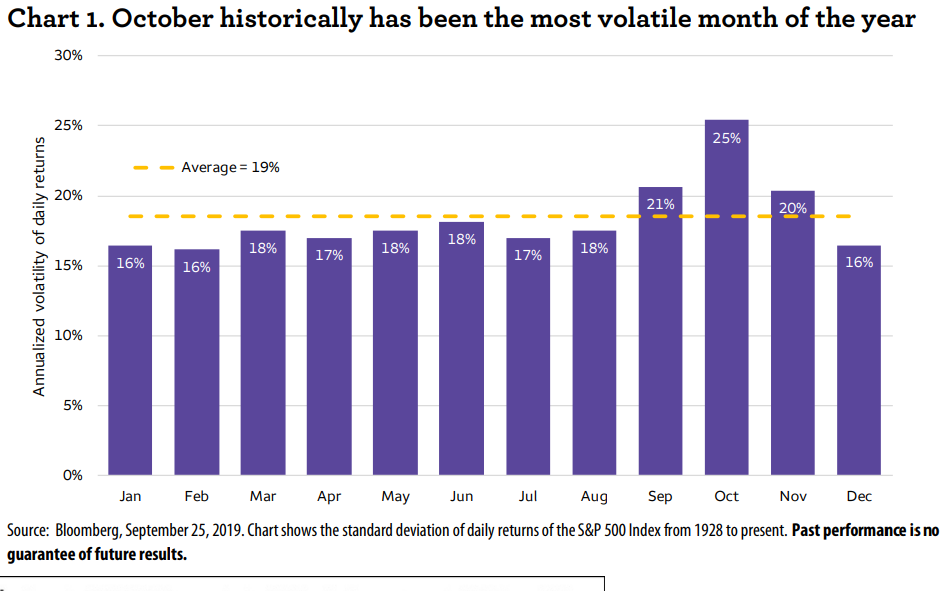

As shown in the chart below from Wells Fargo Investment Institute, which tracks the standard deviation of daily returns of the S&P 500 index SPX, -1.23% dating back to 1928, October has historically been the most volatile month for U.S. equity markets.

Wells Fargo Investment Institute

Wells Fargo Investment Institute October certainly got off to a rocky start. The S&P 500 SPX, -1.23% gave up early gains Tuesday after a weaker-than-expected reading on manufacturing activity to end 1.2% lower, while the Dow Jones Industrial Average DJIA, -1.28% shed 1.3%, wiping out their gains for the third quarter.

This year, October offers “more than its fair share of market worries,” wrote Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute. That includes weighing a number of potential geopolitical flash points and trade talks against a backdrop of weakening U.S. consumer confidence and slowing global economic growth, McMillion said.

Read: Blackstone’s billionaire co-founder says investors should worry about these 5 market dilemmas

U.S.-China trade talks will continue in mid-October, the Federal Reserve meets again in late October, and the U.K. will face an end-of-the month deadline that could see it exit the European Union without a withdrawal agreement, she noted.

It was the Institute for Supply Management’s September manufacturing index that ensured stocks started October on a volatile note. Equities gave up early gains to post heavy losses after the index fell further into contraction territory.

The CBOE Volatility Index VIX, +14.29% , which uses options on the S&P 500 to gauge investor expectations for volatility over the next 30 days, jumped 13% to 18.35, though that remains below the gauge’s long-term average around 19.

But if worries about volatility weren’t enough, some analysts argue that October has also developed a reputation as a “jinx month” for stocks, though that may be a result of historic market crashes in 1929, 1987 and 2008. Those not-so-minor hiccups aside, October historically is fairly average.

So if nothing else, investors might want to buckle up in anticipation of a potentially rough ride. But how?

McMillion proposed investors follow a three-pronged strategy: rebalance portfolios to match strategic allocation targets, increase asset quality to reduce risk by cutting allocations to small-cap stocks and both corporate and municipal high-yield fixed income, and modestly increase cash holdings.