The top-heavy valuations of the FANGs — Facebook FB, +0.14% Amazon AMZN, +0.63% Netflix NFLX, -0.22% and Google GOOG, +0.41% — has been a steady theme as the bull market continues to prove resilient.

But longtime investor Jesse Felder of the popular Felder Report says there’s another, oft-overlooked angle illustrating just how expensive stocks have become and how the rampant equity euphoria isn’t confined only to a select group of high-profile tech names that steal the headlines.

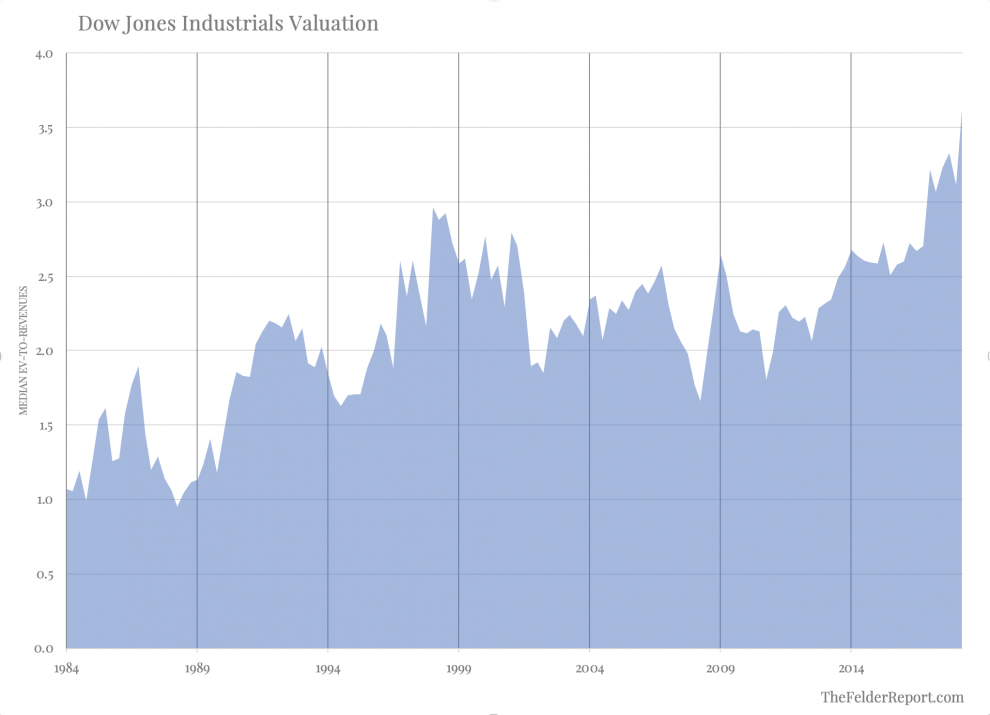

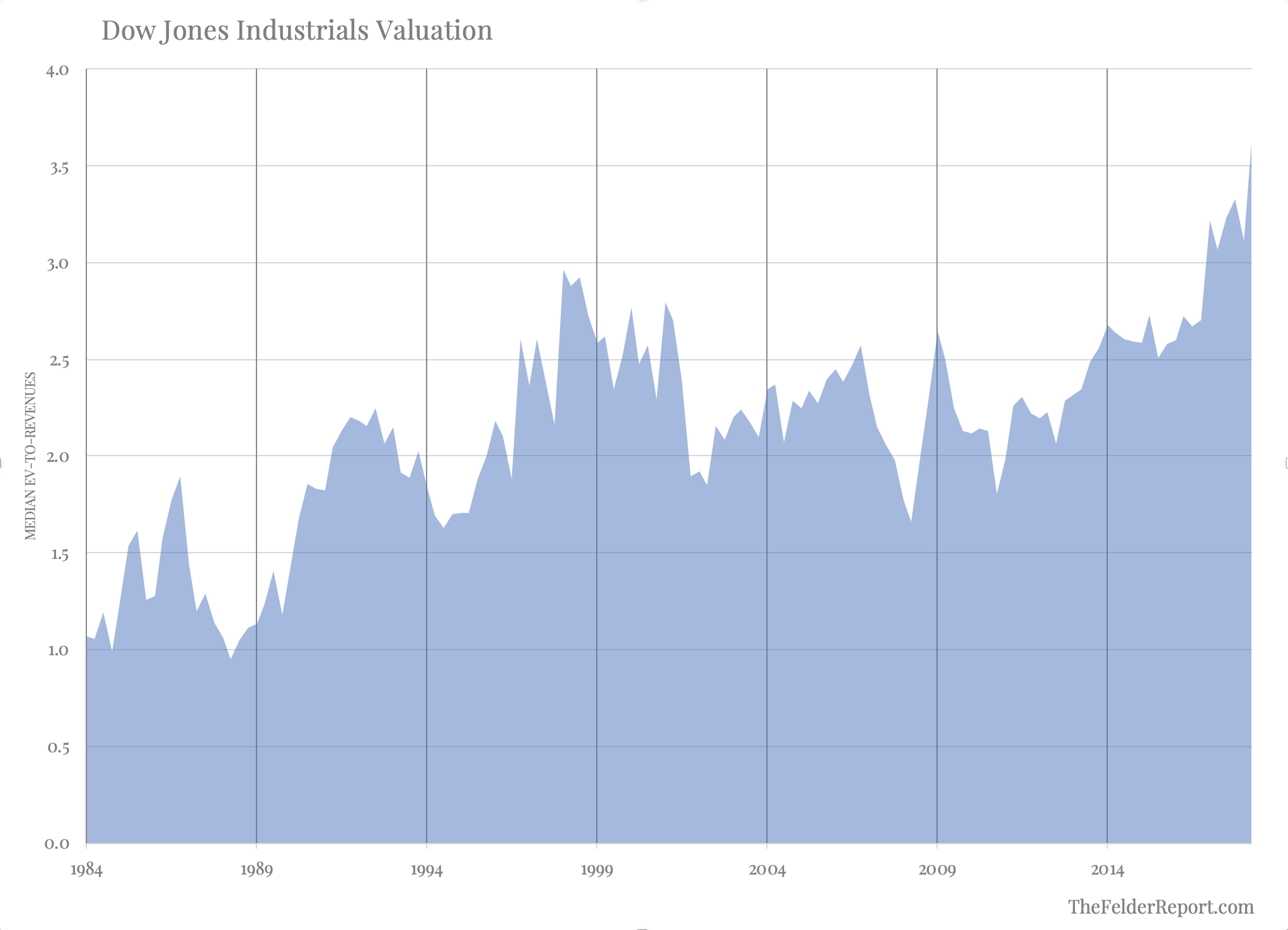

“The median valuation of all the stocks currently among the Dow industrials has recently soared to a record high,” he explained, pointing to the chart below. “In fact, it’s now more than 20% higher than it was at the peak of the dot-com mania.”

Felder, who once ran a multibillion-dollar hedge fund, says valuation extremes across the broader equity universe are more pervasive than ever. The obvious concern is that this won’t last forever, and the more valuations get stretched in one direction, the more violent the potential reversal.

“It’s clearly the result of the greatest volume of price-insensitive buying we have ever seen before, namely stock buybacks and the widespread adoption of passive investing,” Felder warned. “At some point, however, price-insensitive buying will become price-insensitive selling. It always does.

Read: If ‘relentless bid’ dries up, investors could face ‘gruesome nightmare’

No major pullback on Wednesday, with the Dow DJIA, +0.03% S&P SPX, +0.35% and Nasdaq COMP, +0.69% all closing with gains.