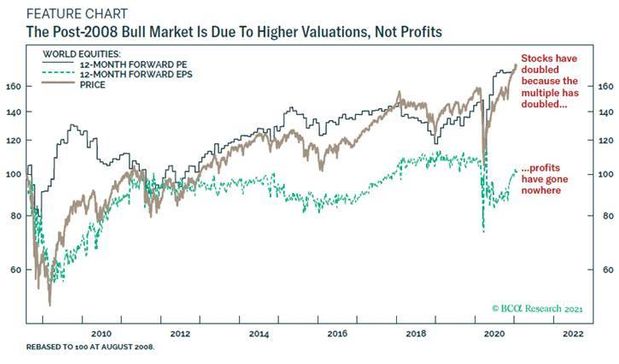

As the debate between the discrepancy between the stock market and the real economy continues to play out with U.S. stocks at record highs, one chart really drives home the difference.

It’s a chart looking at global stocks and global earnings per share. EPS here is measured on a forward 12-month basis, and analysts are assuming a nearly full recovery from the COVID-19 pandemic.

The chart shows global earnings per share flat from 2008 levels. Put in a different way — not only are stocks divorced from the performance of the economy, they are even divorced from the profits of the companies they seemingly represent.

“This remarkable observation leads to a salutary conclusion. The global stock market has nearly doubled since 2008 because the multiple paid for unchanged profits has nearly doubled,” said Dhaval Joshi, chief European investment strategist at BCA Research.

The reason the multiple has surged is because the global bond yield has collapsed, making the relative valuation for equities stronger. Joshi took a simple average of the U.S. 10-year Treasury TMUBMUSD10Y, 1.090%, the bedrock of global markets, and, as a proxy for more risky countries, the Italian 10-year Treasury TMBMKIT-10Y, 0.622%.

He said the global rally can continue until the yield on the U.S. and Italian 10-year reach zero. On Thursday, the U.S. 10-year yielded 1.09% and the Italian 10-year yielded 0.62%.

While profits globally are flat, that isn’t the case on a sector and country basis. Buoyed by the technology sector, U.S. profits have climbed 55% and South Korean profits have gained 25%. Denmark, reliant on health, has seen profits grow by 40%. By contrast, Spain, Italy and Austria have seen profits drop by 45% to 55% due to their exposure to banks.

“One important message for long-term investors is that when a sector’s profits go into structural decline, it is terminal. It is almost unheard of for these sectors to return to structural growth. Furthermore, the support to the sector price from falling bond yields is not enough to offset the weight of collapsing profits. In any case, bond yields cannot fall forever,” said Joshi.

Both the S&P 500 SPX, +1.39% and Nasdaq Composite COMP, +1.97% ended on records on Wednesday, and the Nikkei 225 NIK, +0.82% closed at a 30-year high in Tokyo.