How bad can a bubble get for investors? Look at Japan.

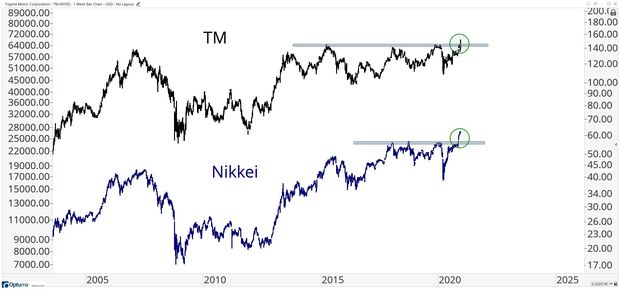

The last time the Nikkei NIK, +0.30% traded near the 27,000 level, the Dow Jones Industrial Average DJIA, -0.54% was bouncing around 2,600. Fast forward nearly three decades and the blue chips just broke the 30,000 market, while, as you can see from this chart, Japanese stocks are still recovering from the historic selloff that begin in 1989.

The Nikkei has another 40% yet to go before finally breaking into uncharted territory. “That’s how long it takes a bubble of that magnitude to correct itself,” J.C. Parets of the All Star Charts blog wrote in a post on Monday highlighting the chart.

“Let’s remember, at its peak in 1989, the real estate value of just one single park in Tokyo was worth more than all of the real estate in the state of California combined,” he continued. “I’ve been to that park. It’s ok I guess. But not worth more than all of Cali, quite obviously.”

Parets pointed to two heavyweight stocks, in particular, that he believes are setting up for a bullish run along with the Nikkei, according to his reading of the charts.

“When you think Japan, it’s hard not to check out what Toyota Motor Corp. TM, +1.77% is doing. And in fact, it’s actually breaking out of a decade+ long base to new all-time highs,” he wrote, pointing to his upside target of $200+ for the shares.

Parets is also bullish Sony Corp. SNE, -1.34%, which he believes could get back to the record highs of long ago and topple $142 if the technical stars align.

“This is just another example of yet another country around the world participating to the upside,” Parets concluded. “We’re not seeing fewer countries participating. We’re seeing more of them.”