Buy or sell?

Getty Images

The 33rd anniversary of the “Black Monday” stock-market meltdown is upon us, and if hedge-fund managers are scared of history repeating itself, you certainly wouldn’t know it from the massive overhaul in their positions they’ve undertaken over the past week.

Read: This is the last chart investors need to see right now

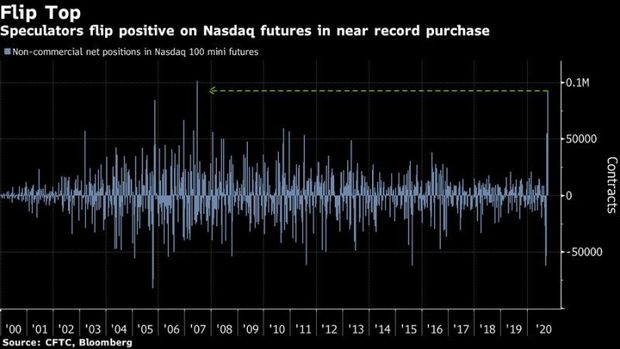

After establishing one of their biggest short positions in U.S. tech stocks in more than a decade earlier this month, hedge-fund managers poured their money into Nasdaq futures at a near-record rate, according to Commodity Futures Trading Commission data cited by Bloomberg.

Here’s what that breakneck reversal looks like:

The reversal left speculators net long technology stocks for the first time since the beginning of September, when traders began loading up on short positions in a move that grew to the most bearish levels since before the financial crisis, Bloomberg reported.

The S&P 500 SPX, +0.01% and blue-chip Dow Jones Industrial Average DJIA, +0.39% are coming off a week that saw three straight days of declines. The tech-heavy Nasdaq Composite COMP, -0.36% posted its first four-day losing streak since September.

But the bulls certainly appear to have the upper hand heading in to a new week, with futures on the Dow YM00, +0.59%, Nasdaq NQ00, +0.83% and S&P ES00, +0.65% all pointing to a strong start.