Growing up, you were probably that told nothing good ever happens after 10 p.m. Whoever gave you that advice clearly wasn’t talking about investing in the stock market.

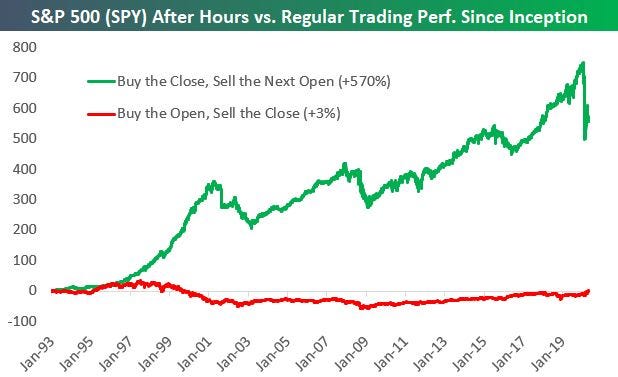

That’s because buying the S&P 500 SPX, +1.48% at the close, holding it overnight, and then selling it at the opening bell has proven to be one of the most lucrative trades since the index’s ETF hit the market back in 1993, according to Bespoke Investment Group data posted on Business Insider.

In fact, a trader executing that move every day since then through 2019 would be up about 570%, while buying at the open and selling at the close would have delivered a paltry 3%.

Check out the chart:

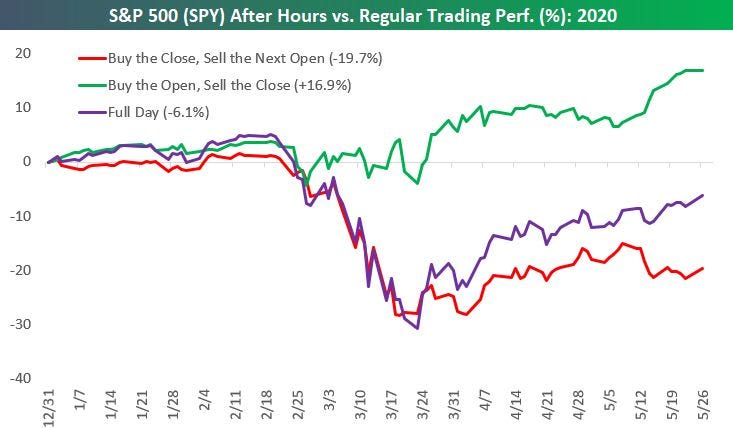

But what a difference a pandemic makes.

So far this year, the trend has completely flip-flopped. Buying the open and selling the close has gained about 17% since the start of the year, while holding overnight would have lost traders almost 20%. That’s quite a reversal, as this chart clearly shows:

“There has never been a 100-trading day period like this where the intraday action has been more positive than the after-hours action to this degree,” Bespoke said in the note.

The new trend continued again on Wednesday, with the Dow Jones Industrial Average DJIA, +2.21% closing around session highs, up 553 points to 25,548.

Add Comment