The Federal Reserve and its free-flowing river of cash is at the heart of just about any bearish Wall Street argument calling for the popping of this stock-market bubble.

And there are lots of them.

Howard Wang of Convoy Investments, for instance, put it simply: “The bull market of our life time is explained by two words, money printing.” In other words, more money getting printed means more dollars in the system to chase assets and push prices higher.

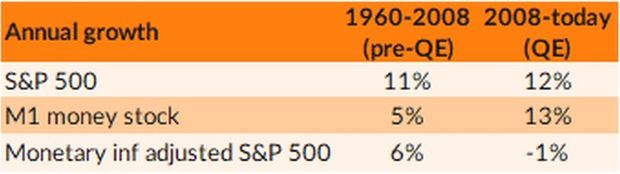

“In a vacuum, the S&P 500 going up 20% this year seems great,” he said in a note. “But then you realize that money supply has gone up an incredible 51% this year. So on a monetary inflation adjusted basis, the S&P 500 is sitting at a miserable -30% for the year.”

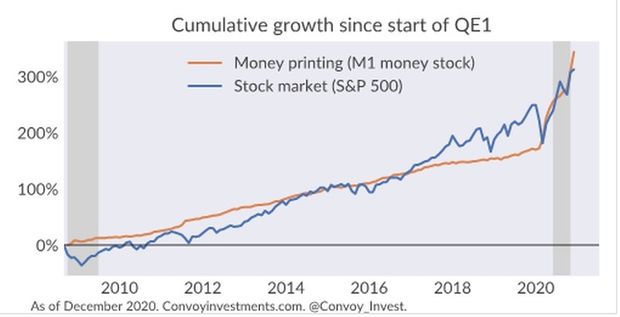

He used this chart to show how critical the flow of cash has been for stocks in recent years:

“The S&P 500 has had an incredible run during the QE era started in 2008, clocking in at over 12% annualized return for over a decade,” Wang wrote. “However, this seems much less impressive when we see that money supply in our system has been growing at 13% a year over the same time. On a monetary inflation adjusted basis, S&P 500 actually lost -1% per year since 2008!”

Of course, money printing hasn’t always been the primary driver of equity rallies, as Wang used this chart to illustrate what happened before “markets became hooked on QE”:

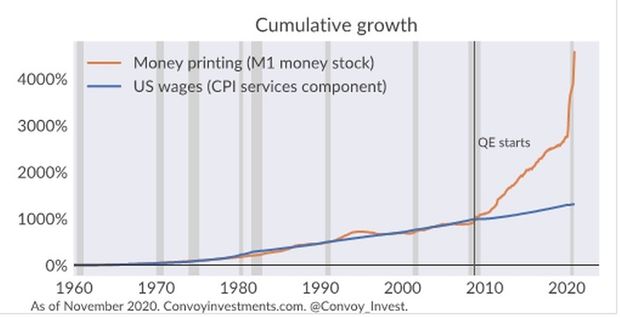

“Stocks and other financial assets have come to be completely dependent on money printing like drug addicts, while the money has largely bypassed the real economy,” Wang wrote.

He then pointed to this “extreme divergence between financial conditions and real economic conditions” for context on how money printing has split from the real economy:

So what happens next in a post-pandemic world?

“Central banks will lose the political support to keep up the maniacal pace of money printing,” Wang said. “Markets may have to remember how to stand up and function by itself again. Will central banks have the resolve to let the markets go through the nasty withdrawal and rehab ahead?”

Meanwhile, money flowed into stocks on Tuesday, with the Dow Jones Industrial Average DJIA, +0.71%, S&P 500 SPX, +0.78% and Nasdaq Composite COMP, +0.67% all moving higher.