U.S. companies have been on a borrowing blitz for the past decade, especially in the past two years of the pandemic amid ultralow borrowing rates.

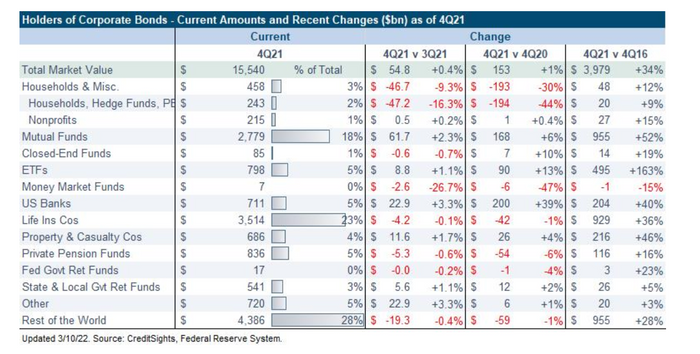

Who owns all those bonds? Foreign accounts own the biggest slice of the roughly $15.5 trillion market, or a 28% share as of the fourth quarter of 2021 (see chart below), according to a report Thursday from CreditSights, a research firm closely tracking the sector.

That makes sense, given a world awash in negative bond yields until recently. Bond yields, including the 10-year Treasury TMUBMUSD10Y, 2.153% rate, have been rising as central banks look to raise benchmark rates to help battle hot inflation.

Fixed-rate bonds that offer low returns can lose value as rates rise, particularly when the cost of living in the U.S. has been climbing, last pegged near 8%, or a 40-year high.

Foreign accounts have largest exposure to U.S. corporate bonds

CreditSights, Federal Reserve System

Returns on investment-grade corporate bonds were negative-5.4% on the year to in early March, while at minus-4.1% for high-yield, according to Mizuho Securities.

Life insurance companies represent the second-largest group of U.S. corporate bondholders with a 23% stake, followed by mutual funds at 18% and private pension funds at 5%, according to CreditSights.

As rates rise, many bond managers replace lower yielding bonds that pay off with new debt issued at higher yields. Bonds also can help limit losses in recently tough markets, with the S&P 500 index SPX, +1.17% down about 7.8% on the year through Thursday and the Nasdaq Composite COMP, +2.05% off 13.3%, according to FactSet.

The Federal Reserve on Wednesday pulled the trigger on its first rate increase since 2018, while penciling in more to come.

High-yield corporate borrowers have been largely put issuing new bonds on pause since Russia’s invasion of Ukraine added to market turmoil, with spreads touching their widest levels of the year.

Add Comment