Even with another part of the U.S. Treasury yield curve flashing recession signals, U.S. stocks aren’t necessarily doomed to fall in 2023, according to James Paulsen, chief investment strategist at the Leuthold Group.

A usually reliable recession indicator in the near $24 trillion U.S. Treasury market appeared about a month ago, when the 10-year Treasury yield TMUBMUSD10Y, 3.494% fell below the 3-month bill TMUBMUSD03M, 4.306% rate. The “inversion” of that part of the Treasury yield curve highlighted growing skittishness among investors about the outlook for the economy.

As of Friday, the 10-year yield was near 3.55%, while the 3-year was pegged closer to 4.34%.

“Ouch!,” wrote Paulsen, in a Friday client note, adding that since the 1960s, “an inverted yield curve has a nearly perfect record in forecasting a recession within two years. And everyone knows the stock market does not react well to pending recessions.”

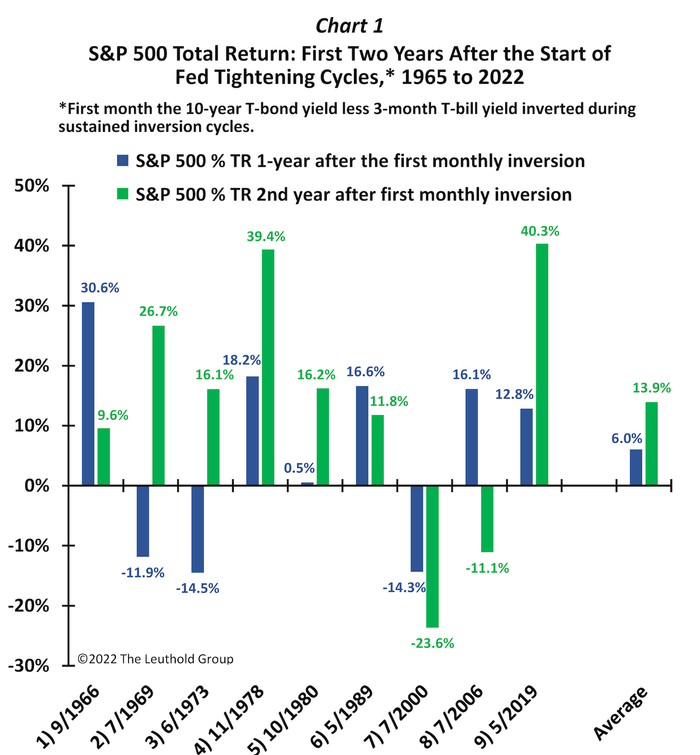

However, he also put together this chart showing the S&P 500’s SPX, -0.12% total return as mostly positive one-year and two-years after the first month of a 10-year/3-month yield curve inversion since 1965.

Yield curve inversions don’t always means stocks are lower a year, or two years later.

Leuthold Group

To be sure, the average return a year after each inversion was 6%, while it was at 13.9% on average two years later.

“That is, overall, while yield-curve inversions have customarily unleashed havoc on the economy, job creation, and even profits, they are not nearly as bad for the stock market as commonly advertised,” Paulsen wrote.

A departure from the trend occurred when investors weren’t skittish enough about stocks heading into a recession, particularly in 2000 when stock-market investors were caught off guard by the dotcom crash, which saw the S&P 500 post back-to-back annual declines of 14.3% and 23.6%, respectively.

Although, the S&P 500 already had tumbled about 25% from its peak this year when this key part of the yield curve inverted in October.

“Accordingly, because investors are especially anxious about the recent inversion, and the stock market has already adjusted lower, any further pain may be much less than expected,” according to Paulsen, who also said, “it is highly likely that the stock market will perform agreeably over the next couple of years.”

A key caveat, however, for this monetary tightening cycle has been a Federal Reserve using a series of jumbo interest rate hikes this year in its fight against stubbornly high inflation, but while also aiming to avoid sparking a recession.

And Friday’s surprisingly strong jobs November report could derail tentative Fed plans to start raising rates at a slower pace later this month.

See: U.S. jobs data puts jumbo interest rate hike back on table at Fed’s December meeting

The Dow Jones Industrial Average DJIA, +0.10% was down about 100 points Friday, or 0.3%, while the S&P 500 was off 0.6% and the Nasdaq Composite Index COMP, -0.18% was 0.8% lower.