The last time a housing bubble popped in the United States, it took four years to play out. But things are moving fast during this pandemic — just look at the record-breaking action in the stock market — and if Wolf Richter has it right, pent-up supply could soon ravage home prices.

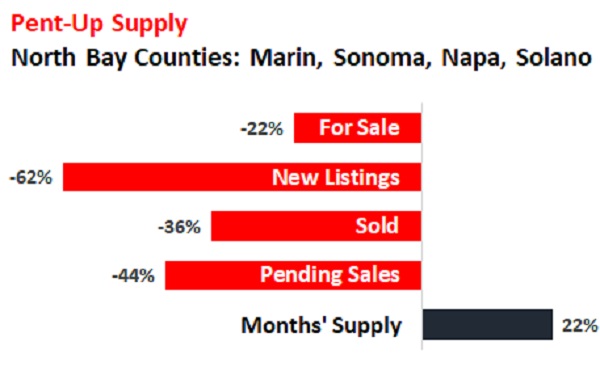

He used this chart to show how the typically red-hot Bay Area housing market, including Marin, Sonoma, Napa and Solano counties, has been grinding to a halt.

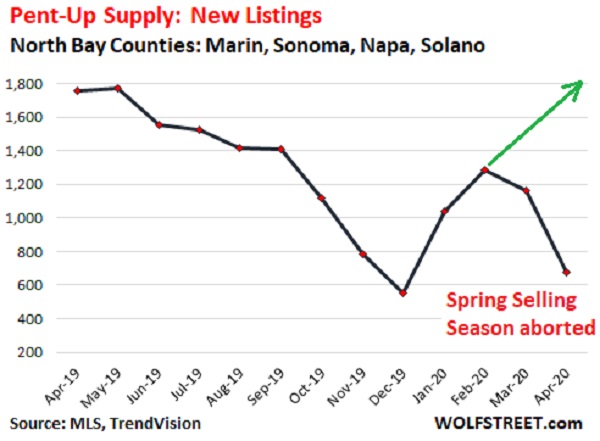

“This is supposed to be the spring selling season, and new listings are supposed to surge,” Richter explained in a post. “But sellers aren’t interested in having potentially infected people traipsing through their home; and they know that buyers are woefully absent, and it doesn’t make that much sense to list the home because previously listed homes are still languishing on the market.”

Here’s a chart of what the trend typically looks like vs. the current reality:

According to Thomas Stone, a Sonoma Country realtor quoted on the Wolf Street blog, there’s a very rough road ahead in the housing sector due to falling appraisals, a trickier loan market and a glut of vacation rentals that owners need to shed.

“The next big shoe to drop will be when appraisers call a declining market, probably in August but perhaps as early as July,” he said. “And this bleeds into the difficulties of getting a mortgage.”

A new report from Oxford Economics estimates that 15% of homeowners will fall behind on their monthly mortgage payments, which would mean delinquencies caused by the coronavirus pandemic would exceed the number seen during the Great Recession.

“The uncertainty in the mortgage market has contributed to a significant tightening of lending standards that may persist even once a recovery is underway,” Oxford Economics wrote.

Then there’s the big number of vacation rental houses in a completely dead Wine Country market — who’s planning trips this summer? — that may also provide a stiff headwind to the recovery.

“So there you have it,” Richter said, putting an exclamation point on his dire forecast. “A most splendid housing bubble and an equally splendid vacation-rental boom that were both caught at the peak in their most vulnerable state by The Virus that upended everything.”

The stock market has certainly been upended, with Dow Jones Industrial Average DJIA, -2.17% losing another 517 points in Wednesday’s session. The S&P 500 SPX, -1.74% and Nasdaq Composite COMP, -1.54% were also firmly lower.