Talk of a commodity boom, or even a “supercycle”, is a red-hot theme in 2021, feeding fears that rising input prices could dent corporate profit margins. But research shows that investors looking at the big picture should probably relax, according to Credit Suisse’s Jonathan Golub.

Read: How a weaker dollar could help fuel a commodities boom in 2021

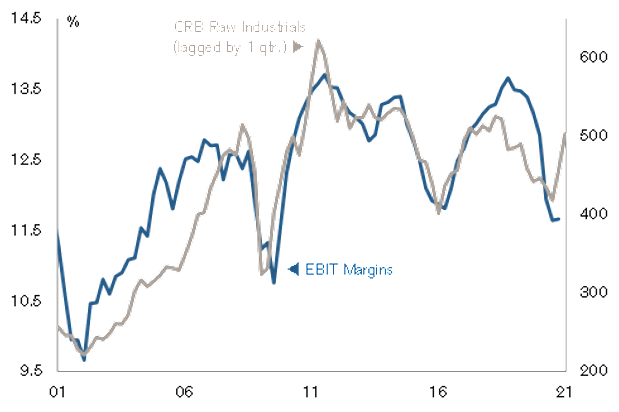

In a Wednesday note, Golub, the bank’s chief U.S. equity strategist and head of quantitative research, took a look back at past commodity rallies and found a positive relationship between raw material prices and EBIT (earnings before interest and taxes) margins. Commodity prices lead margins by three months, he noted.

“Put differently, higher materials costs mean higher operating margins,” Golub wrote. It’s laid out in the chart below:

Note: S&P 500 ex-Financials & REITs; CRB Raw Industrials Index is lagged by 1 quarter

Credit Suisse

Referring to the chart, Golub said the fit is driven by “(1) the relationship between commodity prices and broad-based economic growth, (2) the amortization of fixed expenses over greater sales, and (3) the ability of companies to pass on higher costs (pricing power) in key industries. The recent increase in raw materials prices points to margin upside in 2021.”

In keeping with that pricing power, inflation expectations have risen as commodity prices rallied. West Texas Intermediate crude CL00, -0.78% is up 23% from pre-pandemic levels, while copper HG00, +0.50% has rallied 54% and lumber LB00, +1.02% is up 116%, Golub noted.

Overall U.S. inflation fears appeared to moderate Wednesday after the February consumer price index rose in line with expectations. But investors are bracing for a pickup in coming months due to a combination of comparisons with pandemic-hit prices from last year, as well as supply-chain snags and pent-up demand amplified by aggressive fiscal spending.

That has helped drive up Treasury yields in recent weeks, in turn sparking a heavy rotation away from growth-oriented stocks that were the biggest winners in the pandemic toward more cyclical, value-oriented names seen as likely to benefit most from a wider reopening of the economy.

Stocks were higher Wednesday, with the Dow Jones Industrial Average DJIA, +1.28% up nealry 400 points, or 1.2%, while the S&P 500 SPX, +0.82% rose 0.7%. The Nasdaq Composite COMP, +0.60%, which tumbled into correction territory as the rotation accelerated this month, was up 0.5%.

The Bloomberg Commodity Index BCOM, -0.32% is up 9% so far this year.