(Bloomberg Opinion) — China has birthed some pretty impressive billion-dollar startups. Bytedance Inc.’s TikTok is so hip it makes Snap Inc. look like it’s for your parents.

Sensetime Group Ltd. and Beijing Megvii Co. are masters of creepily powerful AI used in facial recognition and surveillance. Even in boring old hardware, Bitmain Technologies Ltd. has a niche in bitcoin; SZ DJI Technology Co. dominates the market for drones; and UBTech Robotics Ltd. makes an IronMan robot. Bitcoin, drones and robots – that’s cool.

India’s four largest unicorns, by contrast, are in online payments, e-commerce, ride-hailing and education. No shame in meeting the simplest of human needs.

In fact, Indian startups can do well just by focusing on “meat and potatoes” consumer requirements, Sarbvir Singh, managing partner at Waterbridge Ventures, told me recently. As he sees it, the country’s future unicorns will remove friction in areas where people are already spending.

Chalo, one of Waterbridge’s recent investments, offers commuters real-time bus timetables and locations. You can’t get much more mundane than public transportation – yet hundreds of millions of users take buses round the clock, and consumers are likely to open that app multiples a day.

It’s not surprising, then, that nine of India’s top 10 unicorns by value are in the online-consumer space, according to data compiled by CB Insights. The outlier is ReNew Power, an independent wind and solar-energyproducer. In China, three of the top 10 are online consumer companies, two are bricks-and-mortar businesses, and the rest are a mix of hardware and B2B.

The latest Indian unicorn, however, could hint that a new sector is developing. Icertis Inc., which makes cloud-based contract-management software, just raised $115 million, propelling it into the unicorn league, Bloomberg News’s Saritha Rai reported this week. While it’s dual-headquartered in Bellevue, Washington and Pune, India, the company has more than two-thirds of its staff in India where the product is developed.

Based on its current trajectory, Icertis has every chance of breaking out of the outsourcing model that made India’s IT sector famous over the past two decades. That’s because it’s making real software for enterprises to use, rather than employing thousands of people to run software on behalf of Western clients at a fraction of the cost.

India is going to need more such companies, as big names in IT outsourcing, including Infosys Ltd. and Tata Consultancy Services Ltd., face pressure from cloud services, stricter U.S. visa rules, and a call to bring back Western jobs. If they weaken, then so too may India’s supply of foreign income. Of 30 soonicorns identified by Indian media outlet Inc42 as having the potential to fetch a $1-billion-plus valuation by 2020, five are in enterprise tech. One of them, Druva Software Pvt., is a cloud data-protection provider with a suite of global clients. A $130 million round of funding last month subsequently raised the company’s valuation above $1 billion, a spokesperson told Bloomberg Opinion. Another is Atlan, which makes data-management software.

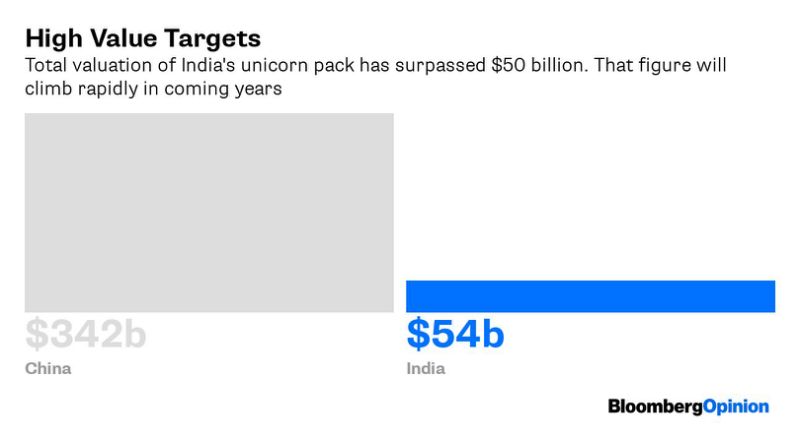

India’s startup scene is relatively new compared with China’s, and its economy is much smaller despite their populations being of similar size. That helps explain why there are 94 unicorns in China and 19 in India.

Still, I have no doubt that India’s tally will rise rapidly, hitting 50 by 2025, with a mix of companies that meet local consumer needs and businesses making crucial enterprise software for global clients. Contract management and food delivery may not be as chic as electric cars or artificial intelligence, but India is about to prove that you don’t need to be hip to be hot.

(Updates ninth paragraph to reflect Druva’s latest valuation. )

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Rachel Rosenthal at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”38″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.