Shares of Inovio Pharmaceuticals Inc. rallied another 12% Wednesday, a day after the company said it’s accelerating the timeline for development of a vaccine to treat the coronavirus COVID-19 and expects to start human trials in the U.S. next month.

The stock INO, +22.11% has gained more than 2505 in three months as expectations for the company’s vaccine, called INO-4800, have grown, and as the virus has spread to more than 93,000 people and caused more than 3,100 deaths.

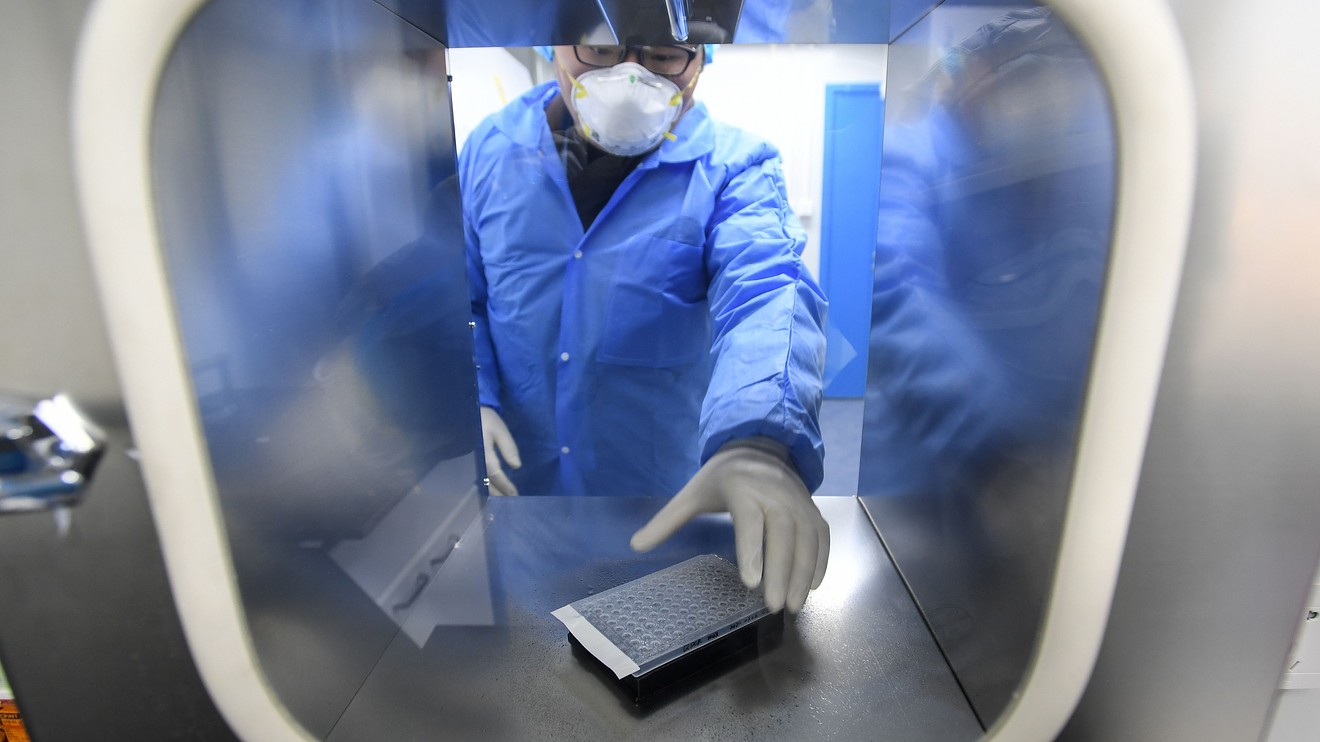

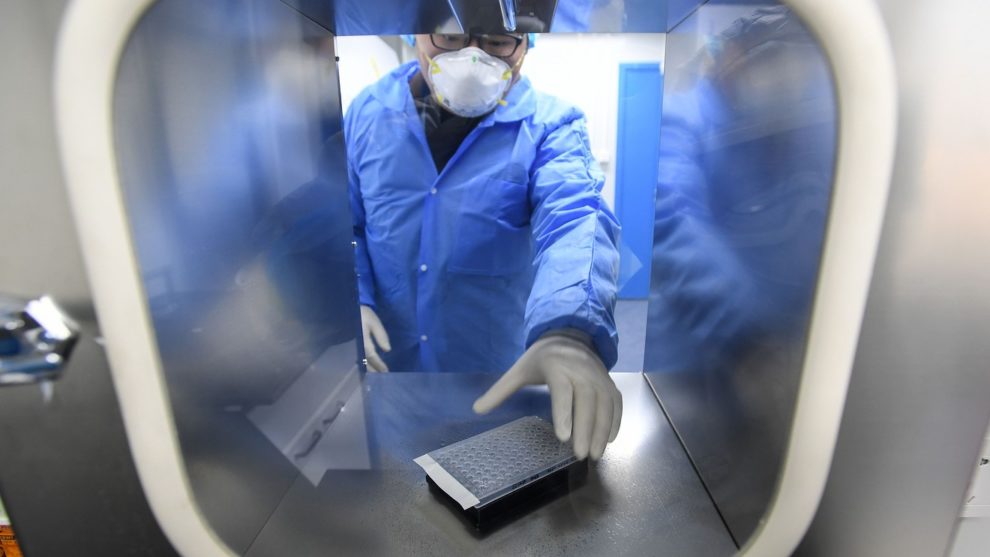

Plymouth Meeting, Pennsylvania-based Inovio specializes in developing DNA vaccines and has created products to treat 15 indications. It is the only company to have a phase 2 vaccine for the coronavirus that caused Middle East respiratory syndrome, or MERS. The company was called on to help during the 2016 Zika outbreak and the Ebola outbreak in 2014.

Inovio Chief Executive Dr. J. Joseph Kim told the U.S. Coronavirus Task Force meeting at the White House on Monday that the company designed INO-4800 on Jan. 10 in three hours after the publication of the genetic sequence of the virus.

For daily coverage of COVID-19: Coronavirus update: 92,314 cases, 3,131 deaths, at least 107 sickened in the U.S.

“We immediately began preclinical testing and small-scale manufacture and have already shared robust preclinical data with our public and private partners,” Kim said in a statement. “We plan to begin human clinical trials in the U.S. in April and soon thereafter in China and South Korea, where the outbreak is impacting the most people.”

Maxim analyst Jason McCarthy, Ph.D., said Inovio likely has the best vaccine option for the new illness. The speed with which it developed INO-4800 “is demonstration of the versatility and speed with which Inovio can respond to an ‘emergency’ situation.”

Read also: What Apple, Microsoft, Nike and other U.S. companies are saying about the coronavirus outbreak

The company “is consistently the recipient of non-dilutive grant funding for its infectious diseases vaccines from the Coalition for Epidemic Preparedness Innovations (CEPI),” he wrote in a note to clients. In February, it was awarded up to $9 million for a COVID-19 vaccine. It has previously received up to $56 million in CEPI grants for MERS and Zika.

Inovio is expecting to deliver 1 million doses of vaccine by year-end, using its existing resources, but will need additional resources to scale up to provide further amounts.

The company has finalized the designs for human clinical trials and has developed large-scale manufacturing plans. It is planning to launch trials in the U.S. in 30 healthy volunteers and expects to publish the first results by fall.

Stifel analysts said they caught up with Inovio management late Tuesday and are confident the company is in a good position to work on the virus.

“We believe Inovio’s ongoing clinical development of a MERS-targeting vaccine (a related coronavirus) provides leverageable experience and believe the company’s nucleic acid based vaccine technology – while still unproven in larger outcomes studies (only P1 safety/immunogenicity data has been generated for any infectious disease vaccine candidate) – provides meaningful advantages on the manufacturing/production fronts (the timing of which likely represents a rate-limiting step for traditional vaccine technologies),” analysts led by Stephen Willey wrote in a note Wednesday. Stifel rates the stock a buy.

In November, Inovio posted a net loss of $23.1 million, or 25 cents a share in the third quarter of 2019, after a net loss of $25 million, or 27 cents a share, in the year-earlier period. Revenue came to $867,000, down from $2.0 million in the year-earlier period.

Shares of four other companies seeking to develop a COVID-19 vaccine were mixed Wednesday, after prior-day losses. Moderna Inc. shares MRNA, +1.89% were down less than 1%, AIM ImmunoTech Inc. AIM, -2.94% was up 40%, Vir Biotechnology Inc. VIR, -2.49% was up 4.5% and Gilead Sciences Inc. GILD, +0.15% was up 1.9%.

The S&P 500 SPX, -3.39% was up 2.9% and the Dow Jones Industrial Average DJIA, -3.57% was up 3.2%.

These airlines are waiving flight change fees because of the coronavirus outbreak

Add Comment