CFRA Research Senior Equity Analyst Angelo Zino joins Yahoo Finance Live to discuss the rise in Intel stock after the company says its new chips are arriving early.

Video Transcript

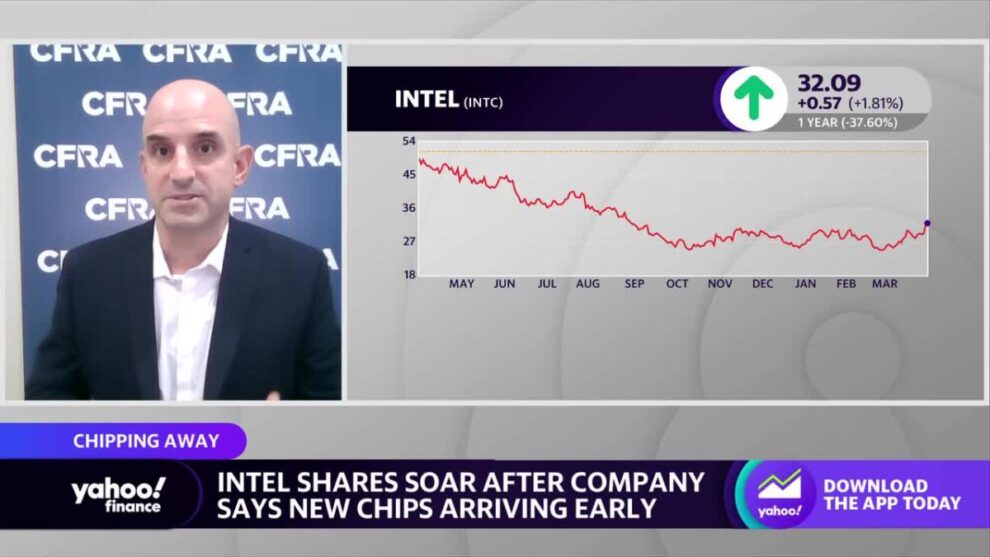

SEANA SMITH: All right, let’s move on to Intel because Intel stock climbing once again today, a move higher of just about 2%. Over the last two days, though, you’re looking at gains of nearly 10%. Now, that move came after the company said that its new server chips are going to arrive sooner than expected. Investors seem to be excited about this.

Well, let’s talk about all of what this means here for the company going forward. For that, I want to bring in Angelo Zino here of CFRA. Angelo, it’s great to have you here. So we saw a pop in the stock today. And Intel, it’s really been going gangbusters over the last month, on track for its best month here in just over, what, 20 years. Enough to think that this momentum is going to continue?

ANGELO ZINO: I mean, it’s tough to say. We wouldn’t necessarily wouldn’t be kind of chasing the stock here, but listen, you kind of saw the news yesterday in terms of them announcing a new CPU server in terms of, you know, proposed in 2025, that being their Clearwater Forest CPU. And I think what’s most important here are what we got indications of yesterday, is that execution wise, everything is kind of going on as planned. And that was really kind of the problem with Intel’s story over the last five years. It’s the fact that execution has continued to be an issue with the company with the prior management team. And that really kind of allowed them to lose significant share.

And now that we’re actually seeing execution actually on par here, that, at the very least, is an incremental positive. Now, you need to continue to see that execution play out here over the next two years. And I wouldn’t necessarily say it’s clear sailing from here. And thus– and this is a company that continues to burn cash, will burn cash through the rest of this year, likely next year, because of some of their expansion initiatives out there. So, personally, we wouldn’t be chasing the stock here, but definitely good news from what we’ve seen here in recent days.

DAVE BRIGGS: Of course, so much of the oxygen, Angelo, has been taken up by Nvidia and their progress in AI and links to ChatGPT. How significant is the gap between Intel and Nvidia and others in the AI space?

ANGELO ZINO: Yeah, I mean, listen. I mean, clearly, these companies all specialize in different areas of the market. And on Nvidia’s side of things, it’s all about GPUs. And our view and what we’ve told investors out there is the wallet share will go to the accelerators out there. And clearly, the accelerators are the companies, the GPU providers, the FPGAs, the Asic chips out there. But Nvidia is really the only pure play to do it out there.

In terms of Intel, their kind of bread and butter out there is really on the CPU side of things. And our view is CPUs are going to be a much slower type of business out there. As far as Intel is concerned at least, if you are getting into the stock here, at least you’re getting into it at the trough of a cycle, or at least, we think we’re at the trough of a cycle here. And again, they do have some, you know, great chipsets coming out here over the next two years. And as long as they execute there, it should be a positive for them. But as far as we’re concerned, we continue to favor the more accelerator type of names, so an Nvidia out there, to a lesser extent, AMD.

SEANA SMITH: All right, so Angelo, that’s your take on semis on the chip sector.