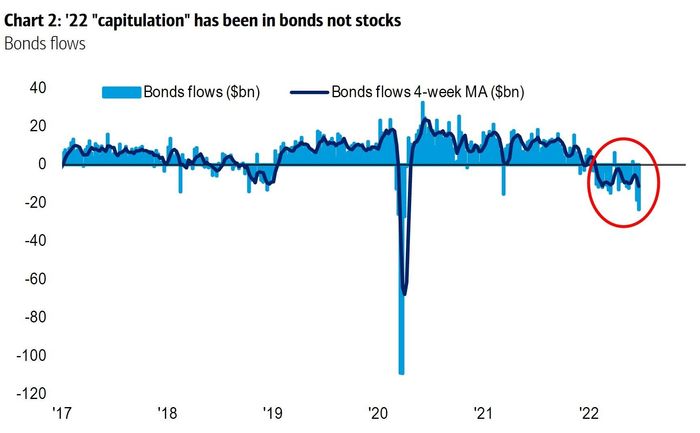

An incredible symmetry has played out in markets this year — investors have put into stocks almost exactly what they have withdrawn from bonds.

The latest “flow show” report from Bank of America finds investors have bought $195 billion in stocks and sold $193 billion of bonds this year.

“Capitulation has been in bonds, not stocks,” said Michael Hartnett, chief investment strategist of Bank of America Securities. The weekly outflows from investment grade bonds, of $16.6 billion, were the largest since April 2020, the bank said, citing data from EPFR Global.

Analysts often look for signs of capitulation, as a signal for when performance has bottomed out. The S&P 500 SPX, +0.95% has climbed for three of the last four sessions, but has dropped 20% this year. The S&P U.S. government bond index has dropped 8% this year, as the yield on the benchmark 10-year Treasury TMUBMUSD10Y, 3.106% has climbed as high as 3.48%.

That said, the bank’s bull and bear indicator, based on investor positioning, remained at “maximum bearish” levels. The three-month returns are very strong at that level exception when there’s a two standard deviation event, like the 2002 double-dip recession, or the 2008 and 2011 crises.

Read: History says the next bull market is just months away

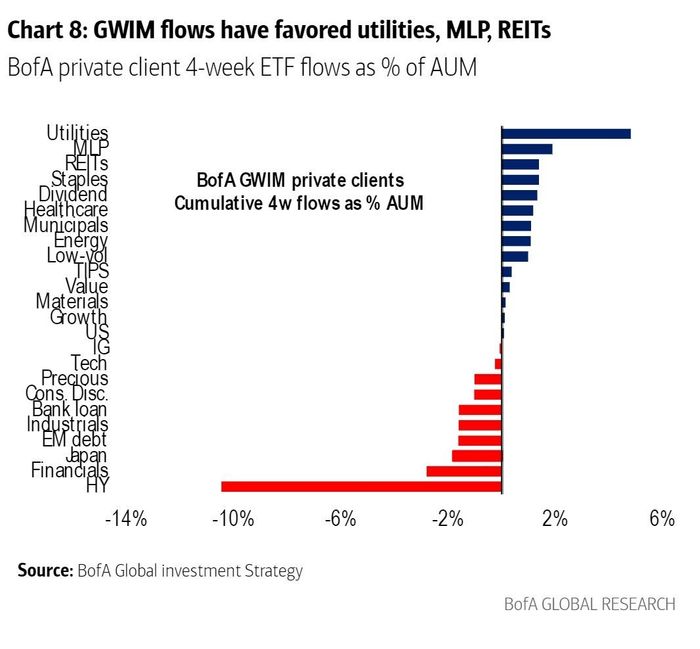

Among Bank of America’s private clients, the 61.2% in stocks is the lowest since November 2020, and the 18.9% in bonds is the largest since February 2021. These clients, with $2.8 trillion in assets, are showing a preference for yield and defense over the past four weeks.