Snap Inc. (NYSE:SNAP) shareholders will doubtless be very grateful to see the share price up 31% in the last quarter. But that doesn’t change the fact that the returns over the last three years have been stomach churning. In that time the share price has melted like a snowball in the desert, down 76%. Arguably, the recent bounce is to be expected after such a bad drop. But the more important question is whether the underlying business can justify a higher price still.

It’s worthwhile assessing if the company’s economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let’s do just that.

Check out our latest analysis for Snap

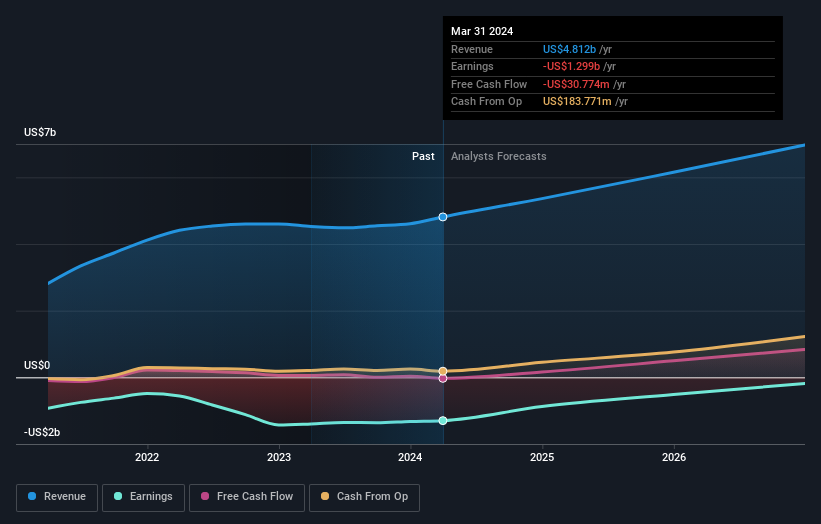

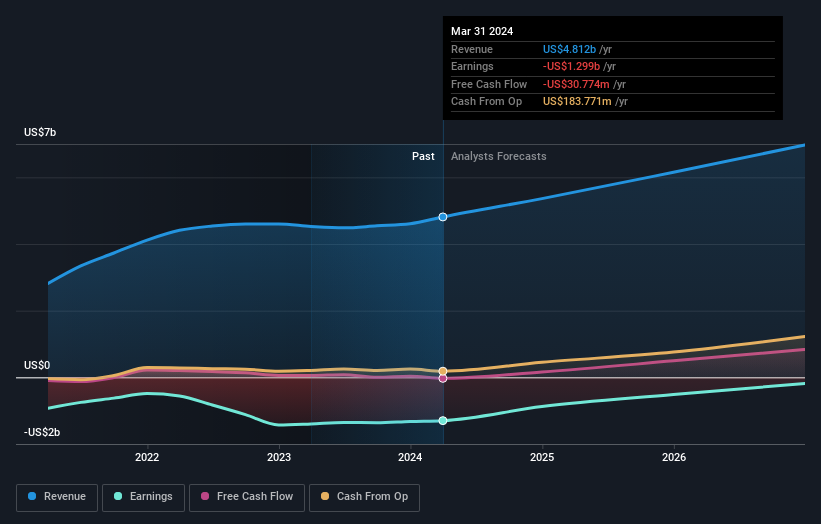

Because Snap made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn’t make profits, we’d generally hope to see good revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Snap grew revenue at 12% per year. That’s a pretty good rate of top-line growth. So it seems unlikely the 21% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify – even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It’s probably worth noting that the CEO is paid less than the median at similar sized companies. It’s always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Snap will earn in the future (free profit forecasts).

A Different Perspective

We’re pleased to report that Snap shareholders have received a total shareholder return of 43% over one year. That gain is better than the annual TSR over five years, which is 1.8%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We’ve spotted 3 warning signs for Snap you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.