It’s been quite a run for Robinhood Markets Inc., the no-fee trading app targeting millennials that became the trading app for nearly everyone when the retail investing boom hit in 2020 and exploded in 2021.

Now, we will get to see what Wall Street actually thinks of the app where many of its younger participants invest.

Robinhood HOOD, priced its initial public offering at $38 a share Wednesday evening, after filing for the IPO and setting proposed terms earlier in the month. Robinhood had targeted a price from $38 to $42 a share, and the bottom of that range put an initial market capitalization on the company of $26.7 billion, which make the registered broker-dealer more valuable than the actual Nasdaq exchange NDAQ, -0.09% or the financial-services giant State Street STT, +0.63%. Shares are expected to begin trading Thursday morning in the Nasdaq exchange under the ticker symbol HOOD.

More: Robinhood prices IPO at bottom of range, valuing trading app at $26.7 billion

Like most big contemporary IPOs, Robinhood’s IPO is being underwritten by all the big banks —Morgan Stanley excluded, in this case — and the numbers are even bigger, profits are theoretical for now, and the company’s founders will retain a massive amount of control, thanks to the proposed structuring of share offerings.

Here are five disclosures from the original IPO filing that really gave our eyeballs a workout, plus one more that showed up later.

Robinhood’s recent growth is staggering, especially for a company selling more growth

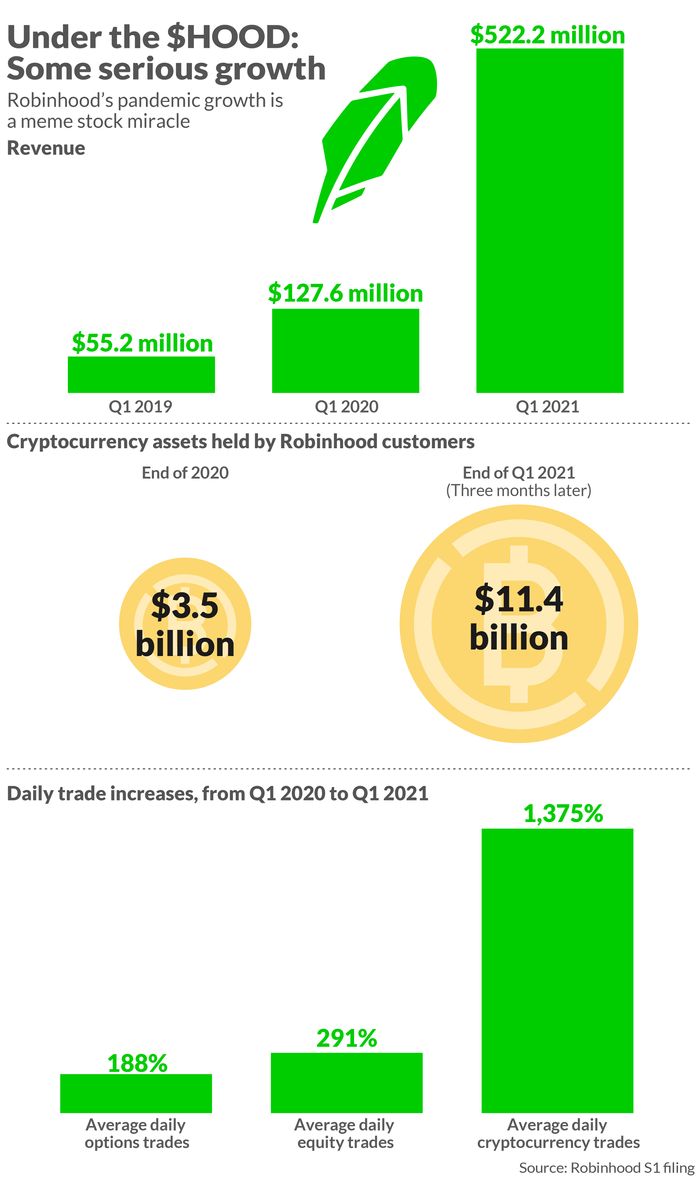

The word “growth” is mentioned 217 times in Robinhood’s S-1 filing, which makes sense considering that it had almost 18 million users at the end of March, a 107% year-over-year increase, which was echoed by its ballooning revenue, which grew more than 311% over the same period.

Take a look at some of that growth:

More on the crypto surge later, but for now just revel in the breadth of what appears to be Robinhood’s monetization of the retail trading boom that was sparked by hundreds of millions of people trapped inside during a once-in-a-century global pandemic as the stock market made an unprecedented, parabolic recovery between March 2020 and March 2021.

And take into account that what we’re looking at includes a January short squeeze on stocks like GameStop GME, -5.28% and AMC Entertainment AMC, +2.34% that saw retail investors become key players, typically using apps like Robinhood, and cementing what we now know as the “meme stock” boom in the public consciousness.

Multiple-quote data page: Keep tabs on all the so-called meme stocks in one place

But Robinhood’s filing is unequivocal in its pitch that the best is yet to come — and that even more growth can be found in a world where people are finally leaving their houses after 16 months of terrified boredom and the froth around retail trading is already subsiding.

Expansion into Asia and Europe are explicit parts of this plan, as is a belief that more widespread adoption of individual investing is an organic next step in personal finance. But it has to be mentioned that some of Robinhood’s diehard retail investors abandoned the platform after it had to halt trading in some meme stocks at the height of January’s squeeze.

While that stock-market phase made Robinhood a household name, it also made the company’s co-founder, Vlad Tenev, a witness in a congressional hearing and gave a clear sense to many retail traders that the app was not for them. The company is setting aside 20% to 35% of its shares for retail investors to buy, but it might not be an easy sell in the current climate.

On Reddit forum WallStreetBets, one discussion of Thursday’s offering prompted users to discuss how they can short Robinhood’s IPO, with many still angry about January.

And speaking of anger …

A lot of people are suing Robinhood. Like, a lot.

One doesn’t usually see six pages of pending lawsuit disclosures in an IPO offering, but that’s the case with Robinhood.

In addition to disclosing last month that it will pay out almost $70 million to settle claims by the Financial Industry Regulatory Authority that it distributed false and misleading information to its customers, failed due diligence on its approval of options accounts for novice traders, and did not provide complete market data to users, Robinhood also admitted Thursday that its lawyers are very busy.

More than 50 class-action lawsuits have been filed against the company regarding January’s trading restrictions, with three individual actions also on the books for good measure. There are also apparently some issues with the Securities and Exchange Commission’s antitrust division and the U.S. attorney’s office in Northern California, which have subpoenaed the company and executed a warrant on Tenev’s cellphone.

Then there are allegations from a state regulator in Massachusetts that the company has broken three state securities laws; from New York’s poking into possible money laundering and cybersecurity infractions; from 2,000 users in a class-action suit who say their accounts were hacked; in 15 class actions about server outages in March 2020 that made national headlines and froze users out of their trading accounts during a market crash; in six class actions by users who claim that Robinhood’s controversial payment-for-order-flow model cheats them out of best executions of their trades; a Finra probe into the same issue; and in disclosure of a settlement in a civil suit over the suicide of 20-year-old Robinhood user Alex Kearns, who killed himself after seeing an unsettled options trade on his account had him at a loss of more than $700,000.

But that’s mostly it for Robinhood’s legal troubles headed into the IPO … other than a few SEC issues — and some other lawsuits.

Robinhood’s future is all about not repeating its past

One major takeaway for anyone reading the offering document is that Robinhood is learning a lesson from all that legal mishegas, so “safety,” “oversight” and “education” are the sexy new keywords at a company once known for tossing virtual confetti every time a user made a trade on a phone.

And while the company still makes 81% of its revenue via payment for order flow, it clearly wants to give a narrative of evolution to prospective investors. From the S-1:

At Robinhood, our values are in service of our customers. The following values describe the company that we aspire to become.

• Safety First. Robinhood is a safety-first company.

• Participation Is Power. At Robinhood, the rich don’t get a better deal.

• Radical Customer Focus. We exist to make our customers happy.

• First-Principles Thinking. We make bold bets and challenge the status quo.

After spending the past year fending off criticism of its business model, shoring up its tech in the face of huge user growth, moving to better inform and support customers who appeared to be in over their heads, and paying fines to multiple regulators, Robinhood is not being shy about wanting people to know that it’s learned its lesson about playing it safe, or at least safer.

Well, outside of one key thing …

Forget Elon; the true ‘dogefather’ is Vlad Tenev

According to Robinhood’s filing, trading of dogecoin DOGEUSD, -0.98% accounted for 34% of the company’s entire cryptocurrency transaction revenue in the first quarter of 2021, a rather sizable jump from the 4% it accounted for in 2020’s fourth quarter.

Taking into account that Robinhood also disclosed that it’s holding almost $12 billion in crypto on its books, it looks like the company could be sitting on almost $4 billion in doge, or about 7% of all the coins currently in circulation.

But while some would point to the volatility of a cryptocurrency created as a joke about a dog meme, we prefer to mention that this huge holding makes Elon Musk’s doge tweets almost irrelevant, because why listen to a guy who makes electric cars and space rockets when Robinhood might just be, as MarketWatch’s Mark DeCambre expertly speculates, the dogecoin whale that was promised?

The average Robinhood user was born in the ’90s

From the S-1:

As of March 31, 2021, approximately 70% of our AUC came from customers on our platform aged 18 to 40, and the median age of customers on our platform was 31.

So the people whom this company is relying on for the kind of financial avarice that will power a multibillion-dollar trading platform were born after “Dallas” went off the air?

Bold.

Bonus: Even Robinhood thinks the retail trading boom might be over

In a subsequent filing on July 19, the company warned potential investors that it is already seeing some de-frothing of the retail trading frenzy and went as far as to say explicitly that it expects “our revenue for the three months ending September 30, 2021 to be lower, as compared to the three months ended June 30, 2021, as a result of decreased levels of trading activity.”

That’s a stunning admission from a company that, to reiterate, is selling a growth story on top of a growth story.

Forgot about that? Well, start over and read again … we’ll wait.

Add Comment