The tech giant is now a source of passive income, adding to its many compelling qualities.

Dividend-paying tech stocks were once a rare breed. But this year big names in tech have suddenly started offering dividends. For example, Salesforce and Facebook parent Meta Platforms both initiated dividends in February.

Joining them is Google owner Alphabet (GOOGL 0.83%) (GOOG 0.72%), which implemented a dividend for the first time in April. As one of the largest companies in the world, with a market cap over $2 trillion, Alphabet possesses the ability to make this move, especially in light of its smaller tech brethren doing so.

Now that it’s paying dividends, does Alphabet make a good income stock? Considering an investment in the tech giant based on its dividend requires taking a deeper look into the company.

Alphabet’s free cash flow potency

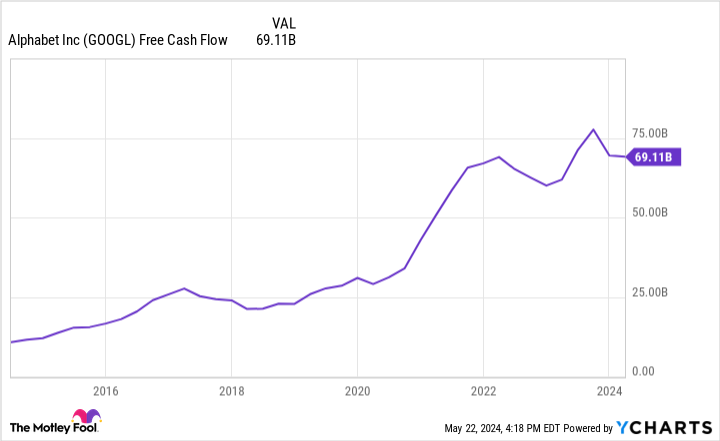

One reason why Alphabet can afford to pay a dividend is its remarkable ability to generate free cash flow (FCF). A company uses FCF for activities such as investing in its business, paying debt, performing share buybacks, and funding a dividend.

In the first quarter, Alphabet produced FCF of $16.8 billion. To get a sense of how much this is, let’s contrast Alphabet against tech veteran IBM, which paid dividends since 1916.

IBM’s Q1 FCF was $1.9 billion, and it produced a total of $11.8 billion over the trailing 12 months. This is dwarfed by Alphabet’s massive FCF in Q1 alone.

Not only that, Alphabet’s impressive FCF generation has only grown stronger in recent years.

Data by YCharts.

This is thanks to the company’s slew of successful businesses fueled primarily by advertising dollars. In Q1, ad sales accounted for $61.7 billion of Alphabet’s $80.5 billion in total revenue.

Alphabet’s many other strengths

Alphabet’s FCF generation is likely to remain strong, helping to ensure its dividend remains in place. After all, it owns Google, but the corporation also has a potent streaming service in YouTube, and a thriving cloud computing business in Google Cloud.

YouTube achieved revenue of $8.1 billion from advertising in Q1, an increase over the previous year’s $6.7 billion. It also generates an undisclosed sum from subscription fees to services such as YouTube Music.

Google Cloud is one of the top three cloud computing vendors in the world, and its market share has steadily risen in recent years. It pulled in $9.6 billion in Q1 sales, up from $7.5 billion in 2023.

With ownership of several multi-billion dollar businesses, Alphabet’s financials are strong. It exited Q1 with $402.4 billion in total assets on its balance sheet versus $119 billion in total liabilities. Cash, cash equivalents, and marketable securities were $110.9 billion.

Other considerations regarding Alphabet’s dividend

Alphabet’s financial strength means its dividend is reliable, but there’s another component to consider with an income investment: the dividend yield.

Alphabet initiated a $0.20-per-share dividend, currently yielding 0.5%. For comparison, IBM pays $1.67 per share with a yield of 3.8%. So in comparison, Alphabet’s dividend is lacking.

In addition, because Alphabet only began dividend payments this year, there’s no history to gauge whether those payments will increase in the future, or how often. Typically, companies raise dividends annually, but every business is different.

Right now, all that’s known about how the firm will approach its dividend is Alphabet stating, “The company intends to pay quarterly cash dividends in the future.”

That said, its dividend isn’t the only consideration for an investment in Alphabet stock. Factors such as its growth prospects and competitive strength should also play a role in a decision to invest.

For instance, IBM possesses the superior dividend payout compared to Alphabet, but this rival to Google Cloud has a 2% share of the cloud computing market. Meanwhile, Google Cloud holds a far greater 11% share.

Adding to the strength of its products, Alphabet is now investing in artificial intelligence. It included AI in its search engine. YouTube uses AI to check its vast video catalog for policy violations. Google Cloud serves as a distribution mechanism for Alphabet’s AI products, allowing customers to use the technology for their own businesses.

So while Alphabet is not among the best dividend stocks, with many other choices serving as superior sources of passive income, it is still a good overall investment. Its strong suite of products, fantastic financials and FCF generation, and rising revenue make Alphabet an excellent growth stock.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Robert Izquierdo has positions in Alphabet, International Business Machines, Meta Platforms, and Salesforce. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Salesforce. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.