The cybersecurity specialist is in red-hot form on the stock market these days, but should you buy it?

Share prices of CrowdStrike Holdings (CRWD -1.18%) surged after the June 4 release of its fiscal 2025 first-quarter results (for the three months ended April 30) thanks to robust growth in the company’s top and bottom lines that allowed the cybersecurity specialist to coast past consensus expectations.

Another big reason why investors cheered CrowdStrike’s results and sent its stock up was because of its improved full-year outlook. Additionally, the news that the company is set to join the S&P 500 index gave its stock price another boost.

While fellow cybersecurity specialists, such as Palo Alto Networks, struggle to win a bigger share of their customers’ wallets, CrowdStrike managed to buck the trend. Let’s see why that was the case and check if the stock is worth buying following the recent developments.

CrowdStrike’s cybersecurity platform is in solid demand

CrowdStrike’s fiscal 2025 Q1 revenue increased 33% year over year to $921 million, well ahead of the $905 million consensus estimate. Meanwhile, the company’s non-GAAP net income shot up 63% year over year to $0.93 per share, beating the consensus estimate by four cents. CrowdStrike management attributed this impressive growth to the improving adoption of its artificial intelligence (AI)-equipped cybersecurity platform.

CEO George Kurtz remarked on the latest earnings conference call that the company’s “AI-native platform wins at scale every geography, every market segment, and every solution area.” This is evident from the impressive growth in the adoption of the company’s cybersecurity modules by its customers.

Last quarter, 65% of CrowdStrike’s subscription customers were using five or more of the company’s modules. Meanwhile, the number of customers using six or more modules stood at 44%, and those using seven or more of its solutions were at 28%. The company also reported a 95% year-over-year increase in the number of deals involving sales of eight or more modules.

This healthy growth in the adoption of CrowdStrike’s cybersecurity platform is allowing it to build a healthy revenue pipeline. This is evident from the $4.7 billion worth of remaining performance obligations (RPO) the company reported last quarter, an increase of 42% from the year-ago period. A company’s RPO refers to the amount of future-contracted revenue, which will be recognized on the income statement once it delivers its products or services to those customers.

The fact that CrowdStrike’s RPO increased at a faster pace than its revenue indicates that its growth could accelerate in the future. Even better, CrowdStrike points out that its total addressable market (TAM) could increase from $100 billion in 2024 to $225 billion by 2028. That isn’t surprising as CrowdStrike points out that the AI revolution is leading to greater utilization of cloud-based cybersecurity products.

CrowdStrike has already launched AI-focused solutions to help customers leverage this technology by integrating AI tools into its Falcon cloud-security platform. It is also worth noting that the company has struck a partnership with Nvidia to help customers train large language models (LLMs) and build AI applications powered by the semiconductor giant’s hardware on its Falcon cybersecurity platform.

Such moves explain why CrowdStrike is gaining more business from customers, leading to an improved outlook for the year.

Stronger growth could translate into more upside

CrowdStrike increased its fiscal 2025 revenue guidance to a range of $3.98 billion to $4.01 billion from the earlier forecast of $3.92 billion to $3.99 billion. The midpoint of the updated guidance would translate into a 30% increase in revenue from fiscal 2024. However, as the discussion above points out, CrowdStrike may continue to revise its guidance upward thanks to the robust revenue pipeline it is building.

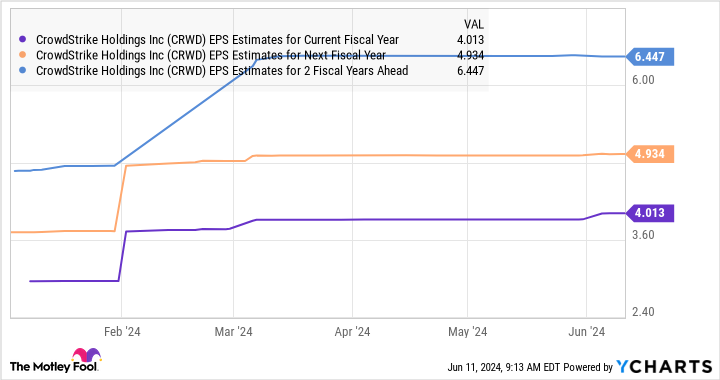

This is probably why analysts expect an acceleration in CrowdStrike’s bottom-line growth in the future.

CRWD EPS Estimates for Current Fiscal Year data by YCharts.

A stronger growth in CrowdStrike’s earnings could help this cybersecurity stock sustain its momentum. The company’s improving-growth prospects thanks to catalysts such as AI could translate into a better bottom-line performance in the future and help it deliver more upside, which is why investors looking to add a growth stock to their portfolios can consider buying it before it jumps higher.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, and Palo Alto Networks. The Motley Fool has a disclosure policy.