The chipmaker could be a reliable stock amid rising tensions between the U.S. and China.

Intel‘s (INTC -5.42%) stock popped 1% in mid-day trading on July 17, hitting as high as $37.16 per share before ending the day at $34.46. That growth alone isn’t particularly noteworthy. However, what is significant is that while Intel’s shares were rising, Nvidia‘s and AMD’s stock prices tumbled 7% and 10%, respectively.

These three companies are in steep competition in the chip market, each unveiling new artificial intelligence (AI) accelerators this year. Nvidia and AMD have far outperformed Intel in stock growth since last July. However, this shift in market results from rising tensions between the U.S. and China, which could threaten access to Taiwan Semiconductor Manufacturing Company‘s foundry services.

Nvidia and AMD are heavily reliant on TSMC’s manufacturing plants. Intel similarly uses the Taiwan-based company’s services. However, it is also building chip fabs throughout the U.S., which could mitigate issues with China in the coming years and make it the world’s leading chip manufacturer.

Here’s why Intel is a no-brainer buy this year.

An attractive investment amid rising tensions with China

A Bloomberg report on July 17 revealed that the Biden administration is considering more stringent trade restrictions on China as it continues its attempts to limit access to high-powered chips. The potential heightened crackdown would likely impose more severe restrictions on Tokyo Electron Ltd. and ASML Holding NV in an effort to curb their ability to give China access to advanced technology. Their stocks fell 11% and 12% respectively when the news broke.

As a result, Intel has come out smelling like a rose amid strained relations with China after the company’s heavy investment in building chip plants in the U.S. Last year, Intel announced a fundamental change in its operations, which would see it transition to a foundry model.

The company is a leading recipient of President Biden’s CHIPS Act, an initiative meant to expand the U.S.’s chip manufacturing capacity. Intel is slated to receive $8.5 billion from the U.S. government to help fund its foundry expansion. The tech giant has plans to build at least four chip plants in the U.S. and has already started construction on its Ohio location, which the company plans to be the world’s largest AI chip factory.

Chip demand has skyrocketed over the past year amid a boom in AI. High-performance hardware like graphics processing units (GPUs) are critical in training AI models. Meanwhile, many other tech sectors, such as cloud computing, virtual/augmented reality, gaming, and self-driving cars, increasingly need powerful chips to take their products to the next level.

So, if Intel can steal manufacturing market share from TSMC with its U.S.-based factories, the company could enjoy major financial and stock gains over the long term.

A better value than its chip market rivals

Shares in Nvidia and AMD have climbed 706% and 146%, respectively, since the start of 2023, receiving a healthy boost from AI hype. While the growth has made many current stockholders rich, it has also made it more challenging for new investors to buy in. By contrast, Intel’s more moderate stock rise of 30% in that period has kept its valuation at a more attractive price point.

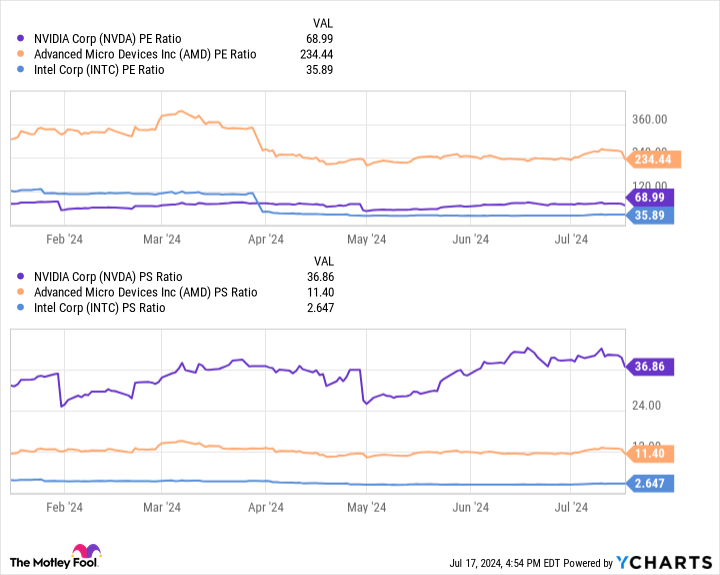

Data by YCharts.

According to the data above, Intel has by far the lowest price-to-earnings (P/E) and price-to-sales (P/S) ratio among its top AI rivals. These figures make Intel stock look like a bargain compared to Nvidia and AMD.

P/E and P/S multiples are helpful metrics for determining a stock’s value. The P/E is calculated by dividing a company’s stock price by its earnings per share. P/S multiple divides a company’s total market capitalization by its trailing 12-month revenue. For both metrics, the lower the figure, the better the bargain.

As a result, the chart suggests Nvidia’s and AMD’s earnings haven’t quite caught up with their share prices, with Intel’s stock more in line with its current financial position. With its expanding role in the foundry market and AI, Intel stock is a must-buy right now.

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.