Here’s a look at Microsoft stock as the company goes all-in on artificial intelligence.

Microsoft (MSFT -0.78%) investors have been rewarded handsomely over the past five years with an impressive total return of 225%, outpacing the market benchmark S&P 500 by approximately 120%. Any time a company as large as Microsoft surges in a relatively short period, investors are reasonable to ask how much larger the company can get.

So, let’s examine the tech giant’s recent financial results, capital allocation strategy, and artificial intelligence opportunity to determine whether Microsoft’s stock has room to run or has reached its ceiling.

Here’s the reason Microsoft stock soared

Given Microsoft’s massive market capitalization of $3.2 trillion, it should come as no surprise that the company is setting records for its top and bottom lines. In its fiscal 2024, Microsoft reported $245.1 billion in revenue and $88.1 billion in net income. By contrast, in its fiscal 2023, it earned $211.9 billion in revenue and $72.4 billion in net income, reflecting year-over-year growth of 15.7% and 21.8%, respectively.

A portion of that growth was partly due to Microsoft’s purchase of gaming leader Activision Blizzard for $69 billion in late 2023. However, even with that large acquisition, Microsoft’s balance sheet remains healthy, with $29.3 billion in net cash.

Microsoft prioritizes dividends and share repurchases

Companies use two methods to return capital to shareholders: dividends and share repurchases. Microsoft participates in both.

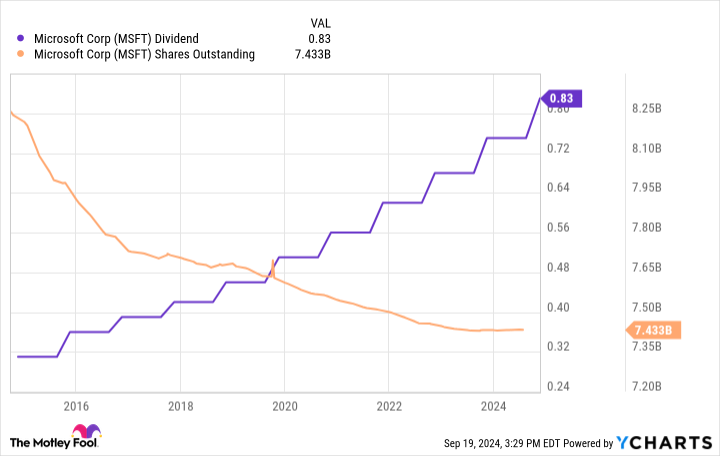

Management recently announced it would raise its quarterly dividend by 10% from $0.75 to $0.83 per share. Including the new increase, Microsoft will have paid and raised its dividend for 20 consecutive years. The new dividend will represent a forward annual yield of 0.76%.

For any dividend-paying stock, investors should monitor its payout ratio, which compares the percentage of a company’s earnings paid out as dividends. According to research from S&P Global, stocks with a payout ratio below 75% are considered safe and have a history of outperformance when coupled with annual raises. Microsoft’s trailing-12-month payout ratio is 24.7%, so investors can reasonably expect dividend raises in the future, especially given management’s consistent track record of increasing them.

Microsoft also announced that it authorized a new share repurchase program worth up to $60 billion in addition to its current program, which had $10.3 remaining as of June 30. Reducing the number of outstanding shares boosts the ownership stakes of existing shareholders and is a more tax-efficient way of returning capital than dividends. Microsoft has reduced its outstanding share count by 10% over the past decade.

MSFT Dividend data by YCharts

Microsoft is at the forefront of the AI revolution

Given the size of Microsoft, any significant growth may need to come from new avenues. For Microsoft, that comes in the form of artificial intelligence (AI), which the company has poured billions into recently. Microsoft invested a reported $13 billion in OpenAI, the company behind the transformative generative AI product ChatGPT. In return, Microsoft will receive “preferential treatment when it comes to OpenAI profits,” according to Fortune. More recently, Microsoft announced a new $30 billion fund in partnership with BlackRock to invest in artificial intelligence infrastructure to build data centers and energy projects.

Microsoft is also scaling its AI infrastructure with data centers and servers to meet its customers’ needs across its product offerings. The company spent a quarterly high-water mark of $19 billion in capital expenditures for its fiscal year Q4 to fund its new developments, and it appears it’s only the beginning. On the company’s most recent earnings call, CEO Satya Nadella added, “To meet the growing demand signal for our AI and cloud products, we will scale our infrastructure investments with FY ’25 capital expenditures expected to be higher than FY ’24.” For reference, Microsoft spent $55.7 billion in capital expenditures for its fiscal year 2024, which was 75% higher than its fiscal year 2023.

While Microsoft’s AI bet is still in its early stages, the gamble is showing early signs of a payoff. Notably, Microsoft now has 60,000 Azure AI customers, up 60% year over year; 14,000 paid customers for its next-generation data platform, Microsoft Fabric; and 48 million monthly active users of its Power Platform, up 40% year over year.

Is Microsoft a buy?

Microsoft’s stock is trading at 37.2 times earnings, higher than its five-year median price-to-earnings ratio of 33.7, indicating a relatively expensive valuation.

Still, given the company’s position as a market leader and the possibilities regarding the AI revolution, investors should consider adding Microsoft to their portfolio. For those worried about the valuation, consider dollar-cost-averaging your position to ease concerns about Microsoft’s lofty stock price in the short term.

Collin Brantmeyer has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.