Here’s a look at MicroStrategy stock after its 10-for-1 stock split.

MicroStrategy (MSTR 1.74%) began acquiring Bitcoin (BTC 3.47%) four years ago, and since then, its stock has outperformed every company in the S&P 500 except Nvidia with an impressive 863% return. The company’s Bitcoin holdings have grown to 226,500 coins, currently valued at $13.1 billion, leading to a recent 10-for-1 stock split.

Now that the dust has settled on the stock split, let’s explore how and why MicroStrategy is hoarding Bitcoin and its future prospects to see whether MicroStrategy stock is a buy, sell, or hold.

Why did MicroStrategy start buying Bitcoin?

Until 2020, MicroStrategy focused primarily on its core business as a business-to-business enterprise software provider. However, facing slow revenue growth and excess cash, Michael Saylor, former CEO and now the executive chairman, decided to invest $250 million of the company’s cash in Bitcoin, making MicroStrategy the first publicly traded company to do so.

In 2020, Saylor viewed Bitcoin as a “dependable store of value and an attractive investment asset, with more long-term appreciation potential than holding cash.”

The decision has paid off handsomely for MicroStrategy, considering the company has acquired 226,500 Bitcoins at an average price of $36,821, and the current price of Bitcoin is approximately $58,000. Expanding on the math, if MicroStrategy were to liquidate its entire Bitcoin holdings, it would result in a profit of roughly $4.8 billion.

Here are the risks of MicroStrategy’s Bitcoin bet

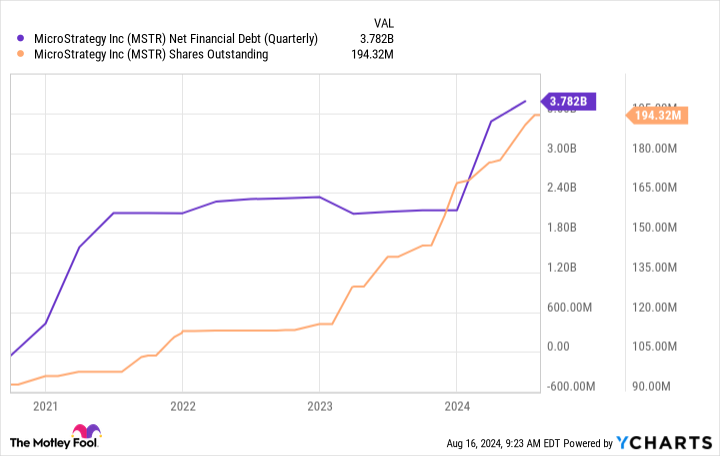

While MicroStrategy’s bet has worked so far, that doesn’t mean it will continue to pay off for investors. Namely, the company has been funding further purchases with debt and equity after MicroStrategy’s initial acquisition of Bitcoin with cash on hand. As a result, the company’s cash reserves have sharply declined, and its outstanding shares have significantly increased.

Regarding its balance sheet, MicroStrategy had approximately $531 million in net cash before its Bitcoin spending spree, which has worsened to $3.8 billion in net debt as of Q2 2024. Despite having the option to sell its Bitcoin and clear the debt, Saylor has made it clear that the company won’t part with its cryptocurrency. Given this position and the fact that the company generated only $5.2 million in cash from operations for the first half of 2024, the company will likely continue to find creative ways to raise capital.

Recently, MicroStrategy has been utilizing convertible notes — loans that allow the noteholder to convert their loan into an equity stake in the company — to fund Bitcoin purchases. As a result, MicroStrategy’s outstanding shares have surged 110% over the past four years. In other words, if you were a MicroStrategy shareholder four years ago, your ownership stake has been cut in half.

Currently, MicroStrategy has five different convertible notes with strike dates ranging from 2025 to 2032 that could dilute an additional 18.2 million outstanding shares to its current total of 194.3 million.

MSTR Net Financial Debt (Quarterly) data by YCharts

While the share dilution frustrates shareholders, the more significant risk to MicroStrategy is if the price of Bitcoin craters. In this scenario, the good news is that MicroStrategy claimed 175,721 of its Bitcoins, or 78%, were “unencumbered” by its loans as of June 30, 2024.

The bad news lies with the company’s reliance on convertible notes. In the scenario of a Bitcoin crash, the loan issuer may not be interested in converting the debt into MicroStrategy stock, and the company will be forced to repay the loan in cash. Without the backing of a strong Bitcoin price, MicroStrategy’s debt could snowball quickly.

Is MicroStrategy a buy, hold, or sell?

MicroStrategy’s leveraged nature creates an incredibly high-risk, high-reward stock. Unsurprisingly, the stock performs more as a leveraged exchange-traded fund than the price of Bitcoin, as its stock amplifies Bitcoin’s gains and losses. This has played out in 2024, with MicroStrategy delivering a 111% price appreciation compared to Bitcoin’s return of 37%.

While MicroStrategy offers an enticing opportunity, there is one simple reason why even the most enthusiastic Bitcoin investors should stay away: Its market capitalization is significantly higher than its Bitcoin holdings. As of this writing, MicroStrategy trades at a market capitalization of $25.3 billion with only $13.1 billion worth of Bitcoins. And while the company is likely to purchase more Bitcoin in the future, it will come at the cost of further shareholder dilution, considering its core business is unlikely to provide meaningful gains.

Alternatively, investors looking to gain exposure to Bitcoin should consider buying the cryptocurrency directly or through one of the recently approved Bitcoin ETFs.