Nvidia has been a top performer in 2024.

Nvidia (NVDA 4.07%) has been one of the best stocks to own over the past two years, returning 239% in 2023, 169% so far in 2024, and over 800% since the start of 2023. That’s quite the run, and many investors might wonder if year three of its run will also be profitable.

While the stock doubling or tripling isn’t likely to occur, a modest gain, like crossing the $200 price per share mark, may be in the cards. So, could Nvidia do this? After all, a $200 stock price at the end of 2025 would represent a 50% rise from today’s price.

Nvidia has AI to thank for its massive run

Understanding why Nvidia has been a successful stock is critical, as it will clue investors in on whether these trends are sustainable. Artificial intelligence (AI) has been a huge driver across the entire stock market, and few companies (if any) have benefited as much as Nvidia.

Nvidia makes graphics processing units (GPUs), which are used to train and run AI models. Because they can process calculations in parallel, they can process information much faster than a standard CPU on a laptop or phone can. Furthermore, multiple GPUs can be connected in clusters to create unreal processing speeds.

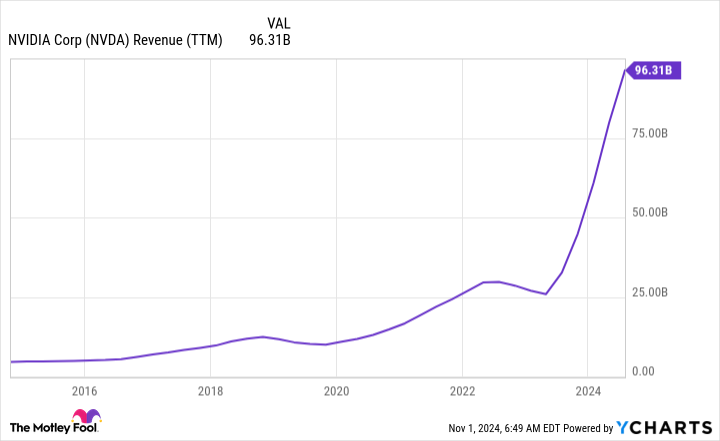

Over the past two years, nearly all of the big tech players have purchased thousands (if not hundreds of thousands) of GPUs from Nvidia, which is why its revenue has skyrocketed.

NVDA Revenue (TTM) data by YCharts

Nvidia’s margins also expanded during this run, as its profit margin rose from about 30% to more than 55%. These two factors caused Nvidia’s profits to soar, which increased the stock price.

The question is, how long will those catalysts last? After all, no company can sustain its revenue doubling year over year forever.

Nvidia has a tough road ahead

As Nvidia’s results reach tough year-over-year comparisons, its growth rate will naturally slow down, which is what we’re seeing now. In Q2 FY 2025 (ending July 28), Nvidia’s revenue rose 122% year over year. That’s down from the 262% growth it achieved in Q1. Q3 looks to bring about more of the same, as management expects $32.5 billion in revenue, up 80% from last year.

Make no mistake; these are incredible growth figures, but they are slowing down from the rapid growth investors became accustomed to in 2023 and 2024.

According to Wall Street analysts, 2025 will continue the growth moderation trend. For FY 2026 (ending January 2026), Wall Street analysts expect about 43% growth, which is still quite impressive for Nvidia’s size. They also expect earnings per share growth to match revenue growth, rising 43% next year.

While market sentiment and valuation can steer stock performance in the short term, stock prices tend to follow earnings growth over the long term. So, with our threshold for Nvidia crossing $200 per share in 2025 being 50% growth, it’s looking like the cards may be stacked against Nvidia to achieve that level.

Furthermore, Nvidia also carries a premium valuation.

NVDA PE Ratio data by YCharts

Nvidia’s stock trades for an expensive 62 times trailing earnings and 33 times FY 2026 earnings. Both levels represent premium valuations, and they are likely to come down throughout 2025 as growth slows.

So, Nvidia won’t have a valuation expansion working in its favor, and its growth isn’t at the level necessary to achieve a $200 per share stock price. However, 50% is a lofty goal to meet. If you shift the expectation to “can Nvidia beat the market going forward?” then the whole analysis will change.

I believe Nvidia has the growth to produce market-beating returns (above 10% per year), which makes it a solid stock to own. Just don’t expect the stock to double (or reach $200) anytime soon.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.