Falling margins have PayPal trading on the low end of its valuation since its 2015 IPO.

A few short years ago, PayPal (PYPL -5.10%) was a red-hot stock as digital payment trends accelerated during the pandemic’s height. Its growth was staggering, hopes were high, and so was the stock’s valuation. Things have taken a turn in recent years, and slower growth and falling profit margins weigh on the fintech.

The company is transforming under its new CEO and is priced on the lower end of its valuation since it went public in 2015. The stock seems like a screaming bargain, but is it really? Let’s explore whether it’s a value trap or a good value today.

Why PayPal is a value trap

PayPal is a dominant player in the digital payments industry and has the most used digital wallet among U.S. adults, with a 71% penetration rate, according to Morning Consult. However, competition is heating up, and rivals like Block‘s Cash App, Apple Pay, Alphabet‘s Google Pay, and Shopify Payments have all emerged as real competitors in recent years.

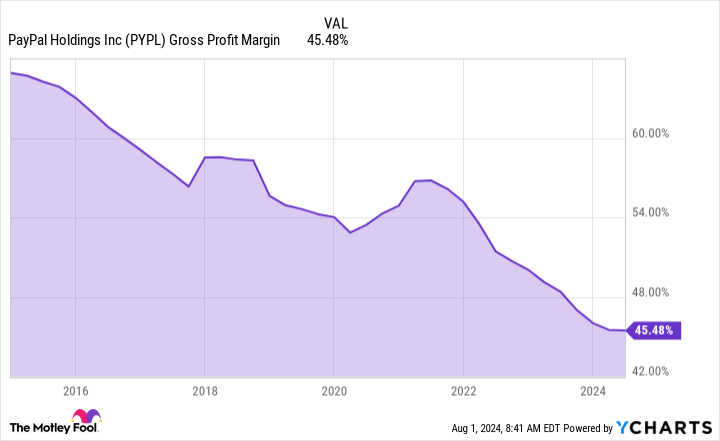

Rising competition has weighed on PayPal’s margins, as shown by its falling take rate over the years. Take rate is the percent of transaction revenue PayPal retains after sharing fees with its partners, and it has fallen every single year since its 2015 IPO. As a result, PayPal’s gross margin (sales minus transaction costs) has fallen from 65% to 45%.

PYPL Gross Profit Margin data by YCharts

Another concern is PayPal’s shifting focus. During the pandemic’s height, PayPal added customers at a staggering pace and believed this stellar growth would continue for years. Management expected to grow its number of active accounts to 750 million by 2025, doubling from its 2020 level of 377 million active accounts.

However, the hopes were too high, and PayPal shifted away from adding customers and focused on getting more from existing customers. eBay also ended its longtime relationship with PayPal and switched to Adyen to process its payments.

Because of its slower growth, PayPal doesn’t warrant the lofty valuation it sported in 2021, when it traded at 16.9 times sales and 109 times earnings. If you’re concerned about PayPal’s increasing competition and ongoing margin contraction, even its 15.9 price-to-earnings (P/E) ratio may still seem too high.

Why PayPal is a great value stock

On the other hand, perhaps you are hopeful that PayPal can turn things around under new CEO Alex Chriss, who took over for the company at the beginning of this year and has declared this a transition year for the fintech. Chriss will lean on his expertise from his time at Inuit, where he managed its small business and self-employed group.

Chriss will leverage this experience by enhancing its PayPal Complete Payments (PPCP) offering for small and medium-sized businesses. This product aims to improve merchants’ checkout experiences for customers, enabling one-click checkouts that Chriss hopes will improve conversion rates. During the company’s second-quarter earnings call, Chriss said volume through PPCP is up more than 40% during the first half of this year.

Another goal is to use its trove of customer spending data to help customers discover products and help merchants make sales. By leveraging data analysis and artificial intelligence (AI), PayPal will create targeted discounts and personalized customer recommendations based on their shopping experience.

Earlier this year, PayPal hired Mark Grether as Senior Vice President and General Manager of PayPal Ads. Grether’s expertise was instrumental in growing Uber Advertising into a $1 billion business. The opportunity for digital marketing could be huge, with some estimates showing digital marketing could grow by 13.6% annually through the next decade.

PYPL PE Ratio data by YCharts.

PayPal has disappointed with slower growth in recent years and could continue to face volatility amid its transition year as investors wait to see how it executes its plans. That said, the company has made good progress through two quarters this year and is relatively cheap, providing some margin of safety for investors buying today.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Courtney Carlsen has positions in Alphabet, Apple, Block, and PayPal. The Motley Fool has positions in and recommends Adyen, Alphabet, Apple, Block, Intuit, PayPal, and Uber Technologies. The Motley Fool recommends eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short September 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.