One of Wall Street’s trailblazers in enterprise software is growing up.

A company with a great product can make investors good money. Companies that can expand beyond that to launch new products and capture new markets can be life-changing investments. Enterprise software giant Salesforce (CRM 0.86%) is a prime example.

Salesforce has evolved from one product to many, and its stock has returned more than 5,800% over its lifetime. The company is now worth $249 billion, so its best growth days are probably over. So should investors still buy the stock today?

How Salesforce built its moat

Companies must continually execute well to sustain success. Building a systemic edge over the competition, often called a moat, takes many years. Moats are important because they give companies pricing power and help protect them from competition.

For example, Walmart didn’t roll out of bed with the size and buying power to acquire and sell products at the lowest prices. The company earned that with years of growth through strong management and company performance.

Salesforce grew for years on its customer relationship management (CRM) software. A CRM program helps companies manage their customer base. Knowing your customers helps companies advertise, plan products, and make strategic decisions.

Salesforce’s CRM software, its core product, has been ranked No. 1 for 11 consecutive years. That’s consistently strong execution.

That said, there are more software puzzle pieces to running a company than just a CRM. Salesforce has spent years building and acquiring new products to create Customer 360. That’s the name for Salesforce’s software ecosystem, which offers various tools and programs companies use to run their businesses. Outside of its CRM, Customer 360 provides software for marketing, sales, customer service, collaboration, and back-end software to collect data and analyze it for insights.

Salesforce can cross-sell its other software to its CRM users. The more companies buy into Salesforce’s ecosystem, the stickier it is because it’s harder to rip it all out and replace it. That’s a moat.

Driving long-term growth

The software enterprise market is both enormous and fragmented. There are millions of companies worldwide, but even an industry giant like Salesforce only does business with roughly 150,000 of them.

Salesforce has growth opportunities in several directions. Growing businesses want to adopt software and technology to reach the next level. There are opportunities in new industries and geographic markets. Management believes its total addressable market will grow at a double-digit rate over the next several years and surpass $290 billion by 2026.

The company wants to hit $50 billion in annual revenue by then; it did roughly $35 billion in 2023. Customer 360 has become Salesforce’s best tool for achieving that goal and beyond. Cross-selling Customer 360 to existing customers now contributes the majority of the incremental revenue that Salesforce adds to its business. That’s the moat in action.

The engine seems to be chugging along, making analysts optimistic for the future. Estimates call for high-single-digit revenue growth and double-digit earnings growth for the next four to five years.

But is Salesforce a buy right now?

Despite a healthy growth outlook, Salesforce has become large and mature enough that investors must be careful not to overpay for the stock.

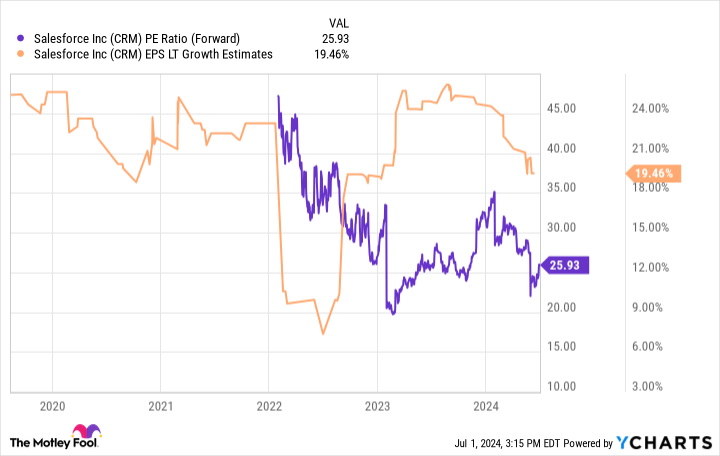

CRM PE Ratio (Forward) data by YCharts

Fortunately, the stock’s P/E ratio has drifted lower for the better part of the past two years. The company has continued growing earnings, and shares have slipped from their 52-week high. Valuations can change quickly when earnings go up and prices go down.

The shares look attractive now at a forward P/E ratio of 26 due to anticipated earnings growth averaging over 19% annually for the next three to five years. Investors can use the PEG ratio to confirm how good of a deal the stock is for that growth.

Generally, as a long-term investor, I like buying quality companies when their PEG ratio is below 1.5. Doing the math above, Salesforce’s current PEG ratio of 1.3 indeed signals an opportunity here.

It can take time, but great companies do occasionally go on sale. Salesforce took a couple of years, but long-term investors should green-light it as a blue chip technology stock worth stashing away in their portfolios today.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Salesforce and Walmart. The Motley Fool has a disclosure policy.