There’s a case to be made for buying this long-term under-performer but it may require too big of a leap of faith.

Known best for its Snapchat app, Snap (SNAP 1.30%) is a company that’s failed to consistently produce a profit and the stock price is down nearly 90% from its all-time high. Could there actually be a case for buying shares of a business like this?

Before dismissing it, investors should consider the things in Snap’s favor. In my opinion, the company’s strengths start with its impressive user base. Its app now has more than 430 million people who use it every single day and over 850 million that use it at least once a month, as of the second quarter of 2024. And over 80% of users are adults, which is attractive from an advertiser’s perspective.

Indeed, apart from a small but growing subscription revenue stream, Snap primarily generates revenue from advertising. And here the trends are promising. Much of Snap’s advertising revenue comes from direct-response ads — ads that produce an immediate response from consumers. In Q2, direct-response advertisers more than doubled compared to the same quarter of 2023. In other words, advertisers are flocking to Snapchat to market their products to its impressive user base.

With the new features it keeps launching, Snap’s management thinks it can eventually attract 1 billion monthly active users. And with advertisers jumping on the platform at a strong rate, it’s not hard to imagine impressive revenue growth for this company in coming years.

Snap stock is trading at one of its cheapest valuations ever with a price-to-sales (P/S) ratio of about 3. That’s a bargain for a company with the potential for high revenue growth. So there is a case that can be made for buying Snap stock. But as you might have guessed, there’s another side of the argument that needs to be acknowledged.

Here’s what could hold Snap stock back

I would say Snap’s lack of profitability is the biggest reason why it’s been a losing investment since going public. To be clear, companies can have net losses for extended time periods and still be winning investments. But among profitless businesses, investors often analyze cash flows to determine which can potentially be winners.

Over the last 12 months, Snap has a nearly $1.2 billion net loss but it generated positive free cash flow of $15 million over this time. The difference between these two profitability metrics is largely stock-based compensation. When a company pays workers with stock, the expense must be accounted for, leading to net losses. But stock isn’t the same as cash, meaning cash flows can differ from accounting profits.

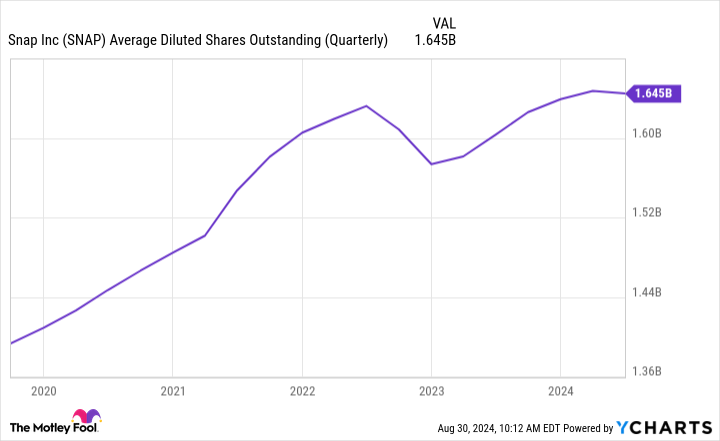

The problem for Snap’s shareholders is two-fold. First, it pays workers with stock to boost cash flow but this dilutes shareholder value. Second, to avoid dilution, management repurchases shares, which uses the cash it preserved in the first place.

Snap’s management boasted in the Q2 earnings call that it’s repurchased 8.4% of shares over the last two years. But this is misleading because it’s share count is still rising due to stock-based compensation.

SNAP Average Diluted Shares Outstanding (Quarterly) data by YCharts

It’s a matter of perspective. From one vantage point Snap is losing a lot of money whereas from the other vantage point it’s diluting shareholders. Neither is good and it’s kept Snap stock down. And unless this changes, it could keep holding Snap stock down.

Will it change? Investors can’t say for sure but there’s reason for doubt. When highlighting its free cash flow of $15 million, Snap’s management said it was balancing cash flow with investing for top-line growth. To me, this signals that investors shouldn’t expect drastic cash-flow improvements anytime soon — growth is the focus.

So should investors buy Snap stock?

As mentioned, Snap seems to have great growth potential and management says it’s investing for growth. However, the company’s growth rate has slowed pretty dramatically in recent years, as the chart below shows.

SNAP Revenue (Quarterly YoY Growth) data by YCharts

Moreover, further deceleration is expected with Snap’s growth rate. In Q2, revenue was up 16% year over year. But in the upcoming third quarter, management expects 12% to 16% growth.

In my opinion, there is a lot of promise with an investment in Snap stock today. But looking at the long-term trends and management’s nearer-term guidance, investors would have to take a leap of faith when investing in Snap. For this reason, I’d personally wait to see if the company can start living up to its potential a little better before buying shares, rather than just trusting that things are different this time.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.