This high-flying Vanguard ETF might be the growth engine your portfolio needs.

Exchange-traded funds (ETFs) have revolutionized investing, offering investors easy access to diversified portfolios at low costs. Among ETF providers, Vanguard has built a reputation for investor-friendly practices and rock-bottom fees. The company’s broad range of funds covers nearly every corner of the market, from total stock market indexes to sector-specific offerings.

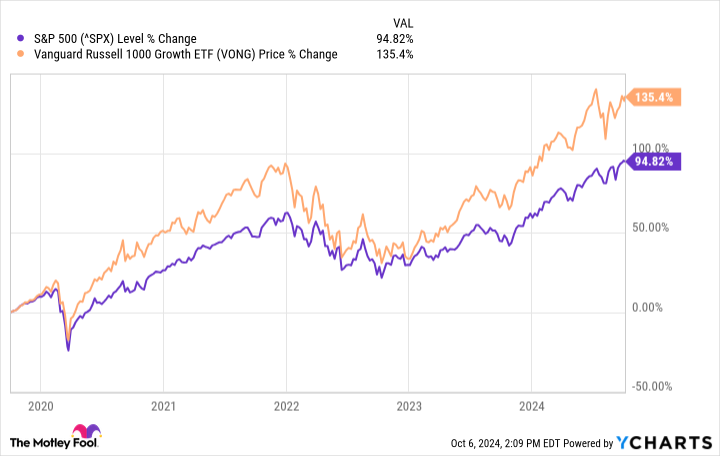

One Vanguard ETF that has caught the attention of growth-oriented investors is the Vanguard Russell 1000 Growth ETF (VONG -1.07%). This fund has delivered impressive returns in recent years, even outperforming the red-hot S&P 500.

However, with valuations stretched and economic uncertainties looming, investors might wonder if the Vanguard Russell 1000 Growth ETF can continue its market-beating ways. Let’s take a closer look at this high-flying fund to see if it still deserves a place in your portfolio.

Image Source: Getty Images.

A growth powerhouse

The Vanguard Russell 1000 Growth ETF tracks the Russell 1000 Growth Index, which consists of large-cap U.S. growth stocks. This index represents about 93% of the total market cap of all listed stocks in the U.S. equity market. The fund aims to closely track the index’s return, offering investors exposure to some of the fastest-growing large companies in America.

The Vanguard Russell 1000 Growth ETF has delivered a stellar performance, with a year-to-date return of 23.6% as of Oct. 4, 2024. This return outperforms the S&P 500 over the same period, with the benchmark index up by approximately 20.5% this year. Even more remarkably, the fund has generated a total return of 357.6% over the past 10 years, assuming dividend reinvestment, making it one of Vanguard’s top-performing growth funds over this period.

Tech-heavy portfolio

The Vanguard Russell 1000 Growth ETF’s top holdings read like a who’s who of tech giants. Apple, Microsoft, and Nvidia make up the top three positions, collectively accounting for over 34% of the portfolio. Other major holdings include Amazon, Meta Platforms, and Alphabet. This tech concentration has been a key driver of the ETF’s outperformance in recent years.

However, this tech focus also introduces some concentration risk. Technology stocks comprise nearly 60% of the fund’s assets. While this has boosted returns during tech bull markets, it could lead to underperformance if the sector faces headwinds. Fortunately for investors, a slowdown in this sector seems unlikely in the near term, given the rapid progress in advanced artificial intelligence, robotics, and autonomous vehicles.

Low costs boost returns

One of the Vanguard Russell 1000 Growth ETF’s key advantages is its rock-bottom expense ratio of just 0.08%. The fund’s expense ratio is significantly lower than the average of 0.94% for similar funds. These low fees mean more of the fund’s returns flow through to investors, enhancing long-term performance.

The ETF’s efficient, index-based approach also leads to low turnover. The Vanguard Russell 1000 Growth ETF had a turnover rate of just 14.4% in the most recent fiscal year. The low turnover rate helps minimize trading costs and tax implications for shareholders.

Is the Vanguard Russell 1000 Growth ETF still a buy?

The Vanguard Russell 1000 Growth ETF offers investors exposure to some of the most innovative and fastest-growing large companies in the United States. Its strong past performance and low fees make it an attractive option for growth-oriented investors. However, the fund’s heavy tech concentration and relatively high valuation metrics (e.g., price-to-earnings ratio of 36.8) introduce important risk factors to consider.

The Vanguard Russell 1000 Growth ETF has the potential to continue outperforming, but it may experience higher volatility than a broader market index fund like the Vanguard Total Stock Market ETF. This potential for increased volatility is due to its heavy tech concentration and premium valuation. Nevertheless, for investors comfortable with these specific risk factors, this ETF remains a compelling option to capture the growth potential of America’s leading companies.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. George Budwell has positions in Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.