(Bloomberg) — Israel’s most valuable private technology company is in talks to buy a U.S.-based business to establish a foothold in the world’s biggest economy ahead of an initial public offering.

Most Read from Bloomberg

Breaking into the U.S. is part of plans by payments startup Rapyd, last valued at $10 billion in August, to increase its attractiveness to American investors for a potential listing in two to three years, according to Chief Executive Officer Arik Shtilman.

It’s a move that would put the company up against the likes of Stripe Inc., the digital payments company worth $95 billion and among the most valuable startups in the world. Rapyd wants the U.S. to account for 20% of its revenue to address the risk that investors will have a home bias when looking to participate in the company’s eventual share sale, Shtilman said.

“I don’t want to explain to a pension fund looking to invest in my IPO what I’m doing in Brazil,” Shtilman, 42, said in an interview. “Just explaining to Americans where Brazil is on the map is complicated enough.”

Founded in 2015 by Shtilman, Arkady Karpman and Omer Priel, the company’s platform facilitates digital cross-border transactions. It also built a payment network that allows businesses to choose from 900 locally preferred methods in more than 100 countries.

Rapyd raised $600 million in less than a year to fuel its growth, a standout during what was a banner year for Israel’s tech industry.

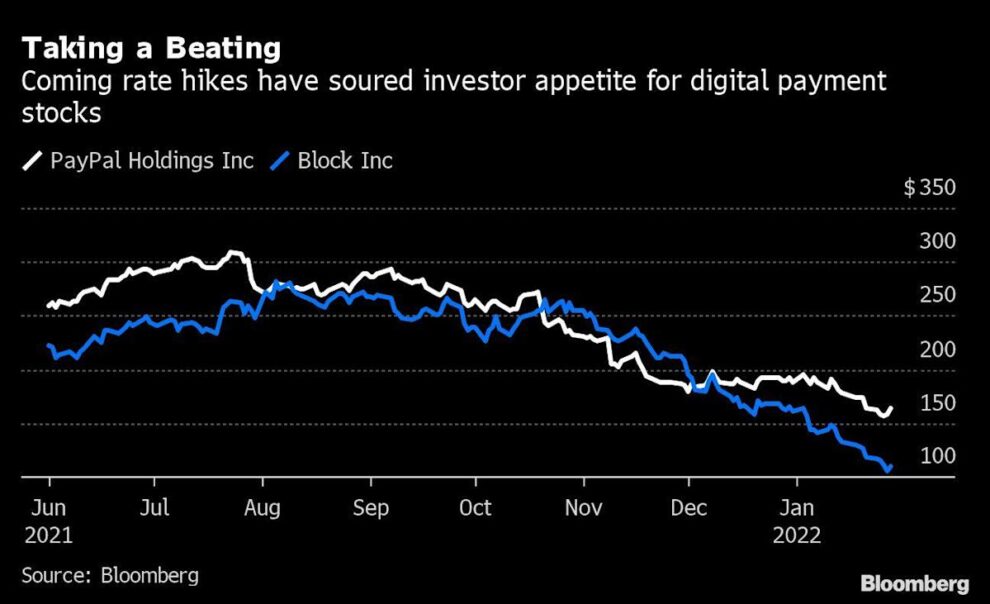

But the outlook for the sector has become more challenging amid a broader slump in tech shares by investors spooked by the looming rise in U.S. interest rates.

The value of companies like PayPal Holdings Inc., Robinhood Markets Inc., and Block Inc., which surged as businesses and consumers increasingly adopted e-commerce during the pandemic, has taken a beating the past few months.

Undeterred, Rapyd is exploring M&A opportunities to bolster sales in Brazil, Shtilman said.

Backed by funds including BlackRock and Fidelity in its last financing round, the Tel Aviv-based company was already on the cusp of an agreement with a U.S. business until it halted negotiations just before the new year, arguing that the recent equity selloff made the price no longer relevant, Shtilman said, without disclosing the name of the target.

The deal was supposed to be Rapyd’s biggest, “well north” of the $100 million it spent on the Icelandic company Valitor last year, he said. Talks restarted earlier this month, whereby Shtilman said the price will ultimately be “cut in half.”

The company it’s looking to acquire clocked in about $100 million in U.S.-based revenue last year, part of the drive to push sales to between $550 million and $620 million this year, he said. That would be four to five times what Rapyd generated in 2021 when excluding contributions of businesses it acquired, according to Shtilman.

War for Talent

One of the flashiest and most aggressive startups in Israel, Rapyd has also spent big in order to attract tech talent that is in short supply.

In October, Rapyd flew in some of the world’s most renowned DJs for a private party of 1,400 people on its roof deck in Tel Aviv, garnering some criticism for the event’s lavishness.

Read more: Dubai Is Bait in War for Coder Talent Fought by Israel Firms

The buzz around the party created so much interest that Rapyd hired 102 engineers in Israel in one quarter, boosting the workforce by 20%, Shtilman said.

The company is planning another large event in March on Purim, a Jewish holiday that features costumes among other traditions.

To mark the occasion, Rapyd is planning a bash that “will make the last event look like a kindergarten party,” Shtilman said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.