MarketWatch readers frequently search for news on Chinese electric vehicle upstart Nio Inc. — and for good reason. The dynamic company has been volatile in the last year or so, and each day seems to bring a new set of headlines that have potential to move the stock.

This quarterly review of Nio NIO, +0.71%Inc.’s stock aims to look beyond the latest headlines. We will show comparisons of key metrics to watch and a summary of the company’s most important issues to help investors make better decisions.

These updates will also include comparisons of results to competitors. Keep in mind that no two companies are alike — even rivals don’t compete in every space. Any investor needs to do their own research to make informed long-term decisions.

Where Nio fits in

It’s undeniable that Nio is red hot lately, with a share price that has surged to almost $40 from $3 in early 2020. However, share price is only one reflection of a company’s health.

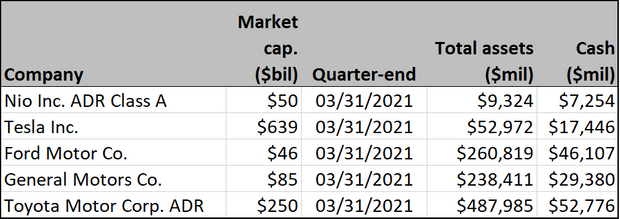

When you look at the landscape of the most widely traded automaker stocks right now, including traditional manufacturers such as General Motors Co. GM, +0.46% and the EV icon Tesla Inc. TSLA, +1.33%, Nio is decidedly smaller as an actual business. Though its nearly $70 billion in market value puts its stock on par with legacy companies like GM, balance-sheet statistics show the two companies aren’t even close.

This is the fundamental challenge for investors trying to value Nio’s shares. Do you place your emphasis on metrics such as revenue, manufacturing assets and total vehicles sold? Or are you betting on the future state of this dynamic company rather than cold statistics from last quarter that may already be out of date?

Key metrics

Growth is important for Nio investors, and it’s undeniable that the company is seeing an impressive expansion. That’s particularly true over the last year in what was otherwise a fairly hostile environment for car sales.

First, let’s look at operational metrics before we get to the much-followed growth rate in vehicles sold to illustrate how much smaller Nio is than legacy automakers that may be similarly valued by market cap.

Assets and cash

Consider that GM had $238 billion in assets at the end of 2020. Nio didn’t even have $10 billion! What’s more, lest you think this is all attributed to its extensive manufacturing facilities, over $29 billion of GM’s assets were cold, hard cash.

Sales growth

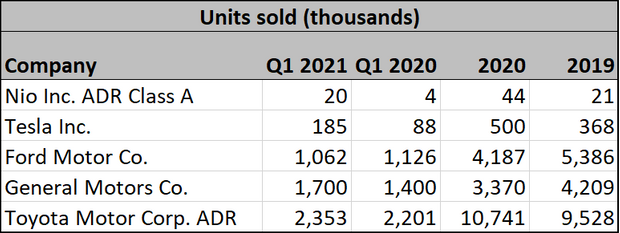

Similarly, the numbers of vehicles Nio has been selling haven’t even been close to those of larger rivals. The company sold just under 44,000 vehicles last year. That compares with nearly 3.4 million vehicles sold for GM and 10.7 million for Toyota Motor Corp. TM, +0.45% across all its brands.

Of course, this lower base means more potential to many investors rather than a reason to be scared away from Nio’s stock. During the first quarter, Nio sold five times as many cars as it did in the same period a year earlier. That growth rate blows the doors off everyone, even Tesla.

And just as the total number of vehicles increased dramatically, so naturally did Nio’s top line. But as we will see, that uptick in revenue has yet to translate to significant profits.

Pricing power and profitability

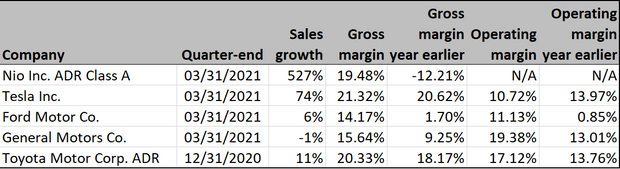

The rapid expansion of vehicle sales naturally has resulted in soaring revenue. However, the Chinese EV upstart continues to operate at a loss.

Gross margins have admittedly improved, but profit forecasts for fiscal 2022 are still negative for Nio. And more importantly, when you look at peers including legacy automakers, it doesn’t appear realistic that Nio could see outsized improvement from its current gross margins that are in-line with the rest of the industry. That means as it continues to invest heavily in future growth, investors may have to make their peace with the fact that the company is trading current profit potential for that vision.

Free cash flow

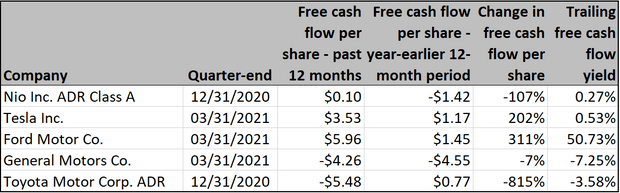

Free cash flow is another area where Nio has a bit of work to do, particularly if it wants to win over investors who care about this metric, which measures how much money is on hand at a company after it pays the bills for regular operations. Based on the last 12 months, free cash flow has firmed up but is still barely out of the red.

However, as a smaller company that is scaling up rapidly, it is reasonable to expect this kind of gap between Nio and its more mature peers as it comes into its own. By contrast, established firms like GM and Toyota that saw serious cash flow concerns over the last year don’t have the same excuse. Rather, these automakers seem to be burdened by structural challenges — including the specific costs associated with scaling up EV operations to evolve and meet the challenges and opportunities of a modern auto marketplace.

Stock valuation and performance

As you’ve no doubt determined on your own, there are really two different ways to value momentum stocks such as Nio. One involves a reliance on traditional metrics like sales and profitability, while the other is a more aspirational look at where the company could be headed in the future.

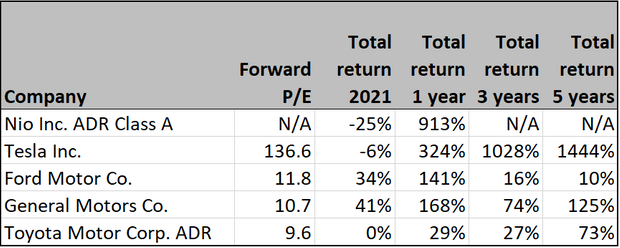

From a traditional perspective, Nio is worrisome because it has no profits to speak of. It’s also not exactly a hot stock lately, as shares have drawn back in recent months and are negative for the year so far. However, the shares have gains of more than 900% in the last 12 months.

In fact, for those who call Nio “the next Tesla,” it’s not an entirely unreasonable comparison — and considering Tesla’s three-year and five-year returns despite only recently moving into profitability, that could be music to investors’ ears.

Wall Street’s opinion

The million-dollar question is whether Nio can keep up both its growth trends and its long-term appeal to investors who aren’t concerned with near-term numbers. Based on its most recent numbers, that trend could still be intact — but it is far from certain.

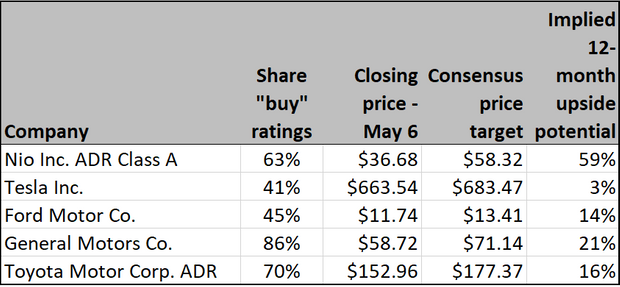

Analysts aren’t exactly bearish on Nio, with 63% of Wall Street experts rating the stock a buy and the implied 12-month upside on shares a juicy 59% based on consensus price targets.

However, it’s interesting to see that legacy automakers as a group are generally thought of better, with more “buy” ratings even if the upside isn’t as dramatic. Excluding Ford Motor Co. F, +0.68%, both GM and Toyota have better support among the analyst community.

The question for Nio investors is pretty simple: Do you want to bank on the less dynamic but more established automakers, or do you want to take on more risk in this Chinese upstart in pursuit of bigger potential gains?

With reporting by Philip van Doorn.