American Airlines Co.’s Chief Executive Doug Parker says his shareholders shouldn’t shoulder losses for the protracted grounding of Boeings 737 MAX.

“So we are working to ensure that Boeing shareholders bear the cost of Boeing’s failures, not American Airlines shareholders.”

Shares of American Airlines AAL, +3.89% rallied 3.9% in afternoon trading Thursday, after the air carrier beat profit expectations, despite headwinds related to the grounding of the Boeing’s 737 MAX fleet in March and a separate labor dispute.

CEO Parker acknowledged that results “should have been better,” as business continued to suffer as from the 737 MAX groundings. The company said it canceled 9,475 flights during the third quarter as a result, reducing earnings by about $140 million. Since the company has removed all MAX flights through Jan. 15, 2020, American expects a combined $540 million hit to 2019 earnings.

Don’t miss: Boeing stock at its lowest in two months after report jet maker may have misled FAA.

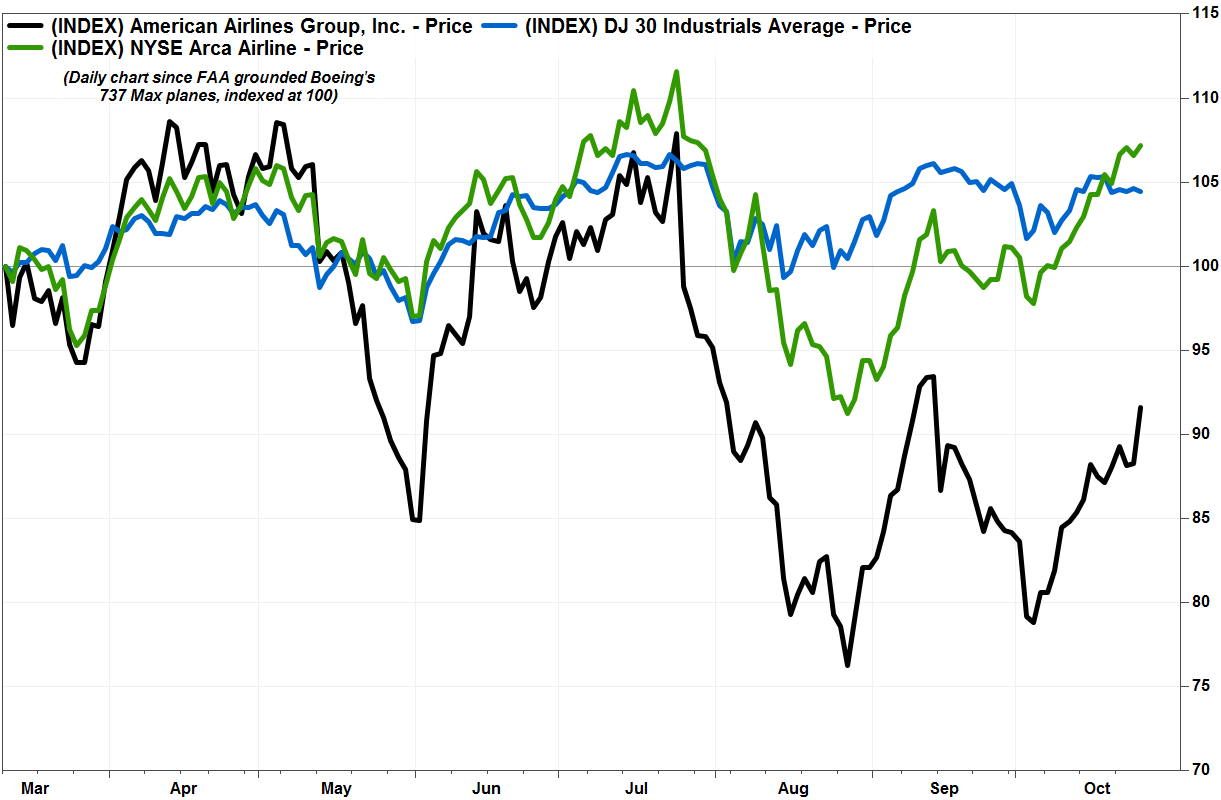

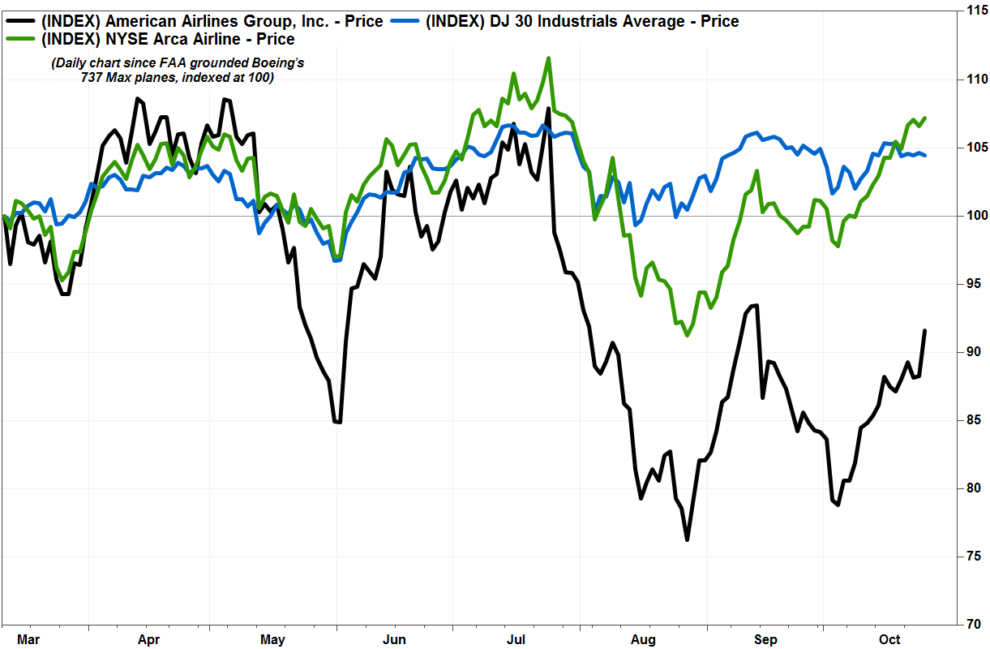

Since March 13, when the Federal Aviation Administration directed the grounding of all U.S.-registered Boeing 737 MAX aircraft following two deadly crashes, American’s stock has lost 4.9%, to wipe out roughly $665.8 million in market value.

Over the same time, the Boeing shares BA, +1.39% have lost 8.2%, representing a roughly $17.2 billion loss of market capitalization, while the NYSE Arca Airline Index XAL, +0.38% has rallied 8.0% and the Dow Jones Industrial Average DJIA, -0.05% has gained 4.9%.

FactSet, MarketWatch

FactSet, MarketWatch Parker said he had two goals for the 737 MAX:

1) Boeing to complete the FAA’s required recertification process and ensure the aircraft’s safety.

2) Ensure American is compensated for the loss of revenue from the planes groundings.

“We missed deadlines and extended groundings for our customers, our team members and our shareholders,” Parker said in the post-earnings conference call with analysts. “So we are working to ensure that Boeing shareholders bear the cost of Boeing’s failures, not American Airlines shareholders.”

Earlier Thursday, American reported third-quarter net income that rose to $425 million, or 96 cents a share, from $372 million, or 81 cents a share, in the year-ago period. Excluding nonrecurring items, adjusted earnings per share came to $1.42, above the FactSet consensus of $1.40.

Revenue grew 3.0% to $11.91 billion, compared with the FactSet consensus of $11.94 billion. So-called load factor improved by 3.4 percentage points to 86.6%, to match the FactSet consensus, and total revenue per available seat mile, or TRASM, rose 2% to 15.71 cents. Load factor is one measure of how efficiently an air carrier, or any public transport, can generate revenue from selling seats.

The company expects fourth-quarter TRASM to be flat to up 2% from last year, and 2019 adjusted EPS of $4.50 to $5.50, which surrounds the FactSet consensus of $4.99.

Add Comment