‘People will hunker down and see what happens. You’re probably going to have to grind it out next year. That’s just the way it is.

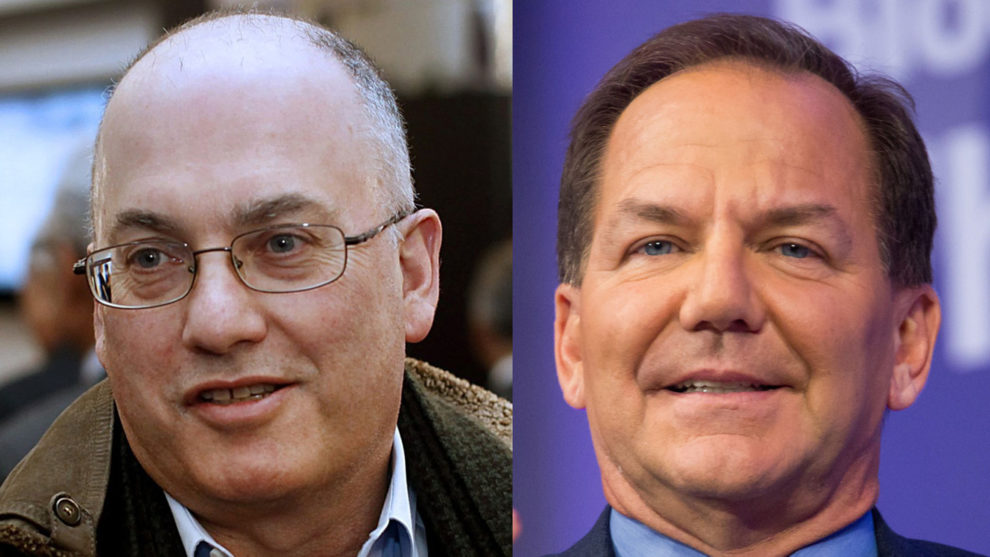

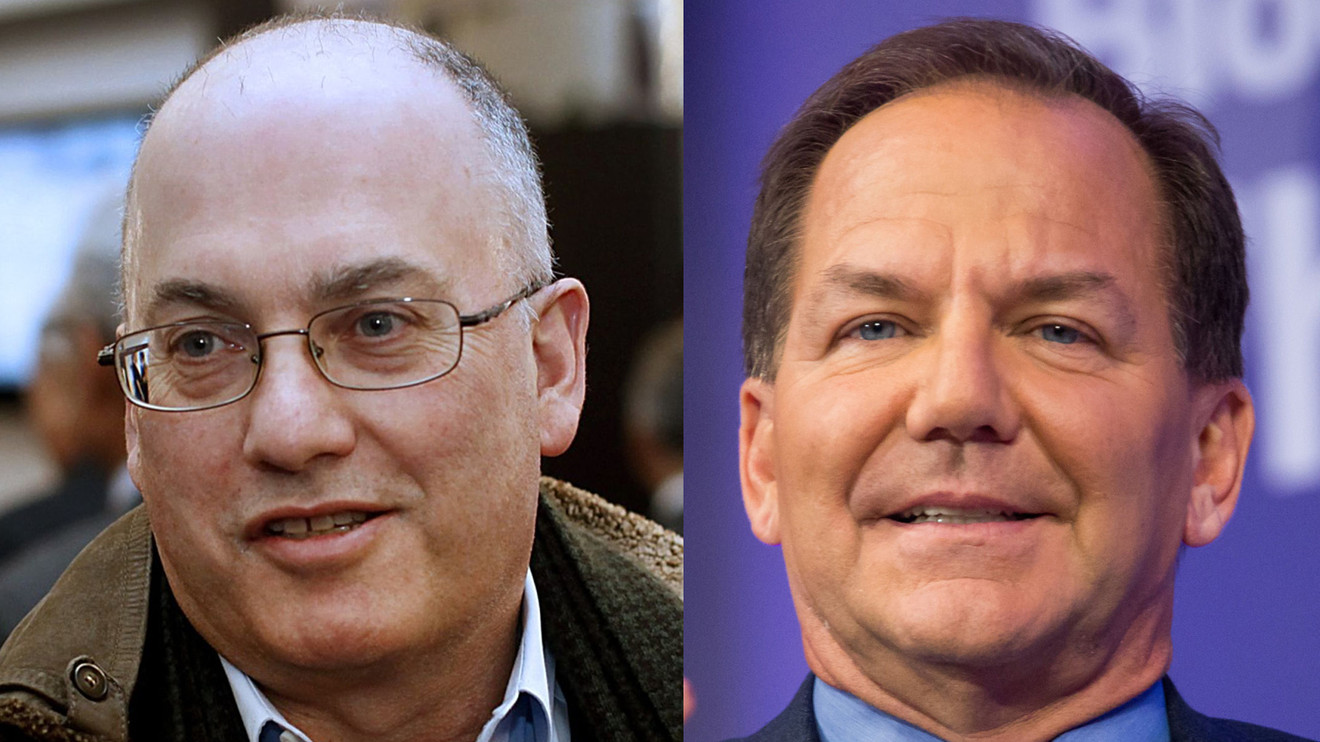

That’s how Steve Cohen, the man behind the$15 billion hedge fund Point72 Asset Management, sees the run-up to the 2020 election playing out for investors.

Cohen was speaking at the Robin Hood Investors Conference in New York on Monday, according to Bloomberg. He was joined by fellow hedge-fund billionaire Paul Tudor Jones, who agreed the market is careening toward a volatile future.

For his part, Jones said that if Elizabeth Warren were to win the election, the S&P 500 SPX, -0.02% would drop by about 25% and economic growth in the U.S. would slip to 1% from estimates of more than 2% this year.

Cohen predicted Warren only need win the Democratic nomination for a double-digit drop in the stock market to take place, according to Bloomberg’s report.

The views of Cohen and Jones echo those of fellow Wall Street billionaires Rob Citrone and Leon Cooperman, in making bearish market forecasts should Warren’s rise toward the White House continue.

Read: Billionaire investor says market might not open if Warren wins

Jones told the audience that Warren’s more centrist opponents, like Joe Biden and Pete Buttigieg, would also be a drag on the market, just not as severe.

Trump, on the other hand, would boost the S&P 500 to 3,600, Jones estimated, which would be an 18% surge from the close of trading on Monday.

At last check, the Dow Jones Industrial Average DJIA, -0.04% and the S&P 500 were mostly flat in Tuesday’s session while the Nasdaq Composite Index COMP, -0.45% was trading in negative territory.